Protecting voting rights is crucial to ensuring fair representation and maintaining democratic integrity. Efforts to safeguard these rights combat disenfranchisement caused by restrictive laws and practices. Explore the rest of the article to learn how you can support and uphold your voting rights.

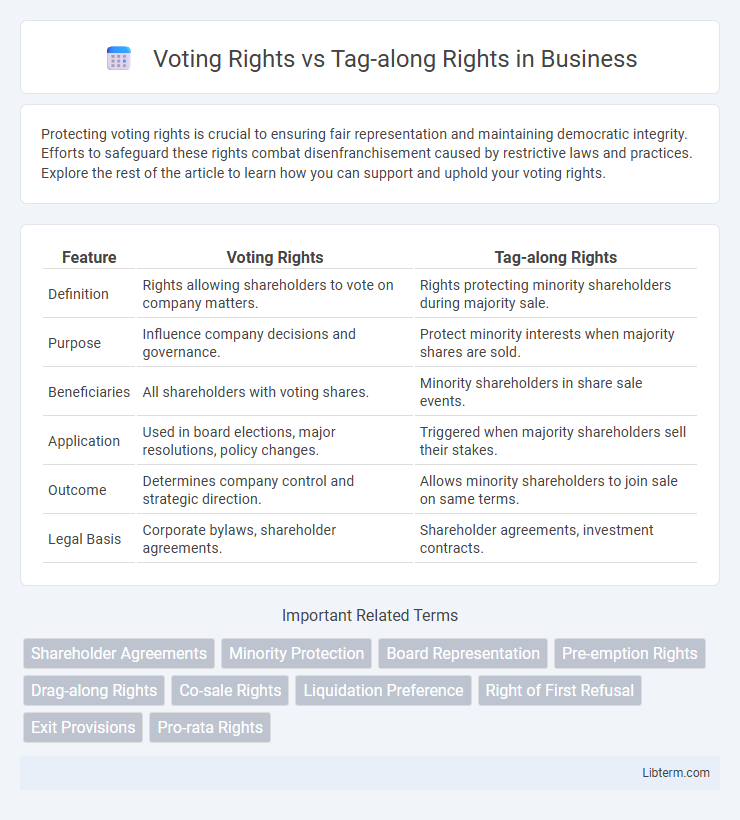

Table of Comparison

| Feature | Voting Rights | Tag-along Rights |

|---|---|---|

| Definition | Rights allowing shareholders to vote on company matters. | Rights protecting minority shareholders during majority sale. |

| Purpose | Influence company decisions and governance. | Protect minority interests when majority shares are sold. |

| Beneficiaries | All shareholders with voting shares. | Minority shareholders in share sale events. |

| Application | Used in board elections, major resolutions, policy changes. | Triggered when majority shareholders sell their stakes. |

| Outcome | Determines company control and strategic direction. | Allows minority shareholders to join sale on same terms. |

| Legal Basis | Corporate bylaws, shareholder agreements. | Shareholder agreements, investment contracts. |

Introduction to Voting Rights and Tag-along Rights

Voting rights grant shareholders the ability to influence corporate decisions through voting on key matters such as board elections, mergers, and amendments to corporate policies, typically proportional to their shareholdings. Tag-along rights protect minority shareholders by allowing them to join a majority shareholder in selling their shares, ensuring they receive equivalent terms and preventing exclusion from profitable exit opportunities. Both rights are crucial in maintaining balance between control and protection within corporate governance frameworks.

Defining Voting Rights: Scope and Importance

Voting rights grant shareholders the authority to influence corporate decisions, such as electing board members and approving major transactions, ensuring active participation in governance. These rights are fundamental in maintaining accountability and protecting investors' interests by allowing shareholders to voice opinions on critical company matters. The scope of voting rights varies based on share class and corporate bylaws, directly impacting control dynamics within a company.

Understanding Tag-along Rights: Key Features

Tag-along rights protect minority shareholders by allowing them to join in the sale of shares by majority owners, ensuring they receive equivalent terms and preventing their shares from being sold to undesired third parties. These rights are common in private equity and venture capital agreements, providing a safeguard against forced exclusion from lucrative exit opportunities. Unlike voting rights, which grant influence over corporate decisions, tag-along rights specifically secure financial protections during ownership transfers.

Legal Foundations of Voting Rights

Voting rights are legally established through corporate charters, shareholder agreements, and statutory laws, granting shareholders the power to influence key decisions such as electing the board of directors and approving major corporate actions. These rights are protected under securities regulations and jurisdiction-specific corporate governance frameworks designed to uphold transparency and equitable treatment among shareholders. In contrast, tag-along rights primarily serve as contractual safeguards for minority shareholders during a sale of controlling stakes, without directly affecting governance or decision-making authority.

Legal Basis for Tag-along Rights

Tag-along rights are primarily grounded in shareholder agreements and corporate law provisions that protect minority investors by allowing them to sell their shares alongside majority stakeholders during a sale. Unlike voting rights, which arise from the ownership of shares and confer decision-making power in corporate governance, tag-along rights provide a contractual mechanism to secure financial interests in exit scenarios. The legal basis for tag-along rights varies by jurisdiction, often requiring explicit inclusion in shareholder contracts to be enforceable.

Comparing Voting Rights vs Tag-along Rights

Voting rights grant shareholders the power to influence corporate decisions through voting on matters such as board elections and mergers, directly impacting company control. Tag-along rights protect minority shareholders by ensuring they can join a majority shareholder in selling shares, securing fair exit opportunities. Comparing these, voting rights focus on governance participation, while tag-along rights emphasize protection during share transfers.

Impact on Shareholder Decision-Making

Voting rights grant shareholders the power to influence corporate governance through decisions on board elections and major company policies, directly affecting the strategic direction of the company. Tag-along rights protect minority shareholders by allowing them to join in the sale of shares if a majority shareholder sells their stake, ensuring equitable exit opportunities without influencing daily corporate decisions. The presence of voting rights drives active participation in shareholder meetings, while tag-along rights provide a safeguard against disproportionate control shifts, shaping shareholder decision-making dynamics distinctly.

Protecting Minority Shareholders: Which Right Matters More?

Protecting minority shareholders hinges crucially on understanding the distinction between voting rights and tag-along rights, as voting rights empower minority investors to influence corporate decisions proportional to their shareholding, ensuring a voice in governance. Tag-along rights safeguard minority shareholders by allowing them to join in any sale of shares by majority stakeholders, preventing exclusion from liquidity events and potential undervaluation. While voting rights affect strategic control, tag-along rights provide critical protection against exit disadvantages, making tag-along rights often more impactful in preserving minority shareholder value during ownership transitions.

Common Scenarios: When Each Right Is Invoked

Voting rights are typically invoked during shareholder meetings to influence key corporate decisions such as electing the board of directors or approving mergers. Tag-along rights come into play when majority shareholders sell their stakes, giving minority shareholders the option to join the sale and protect their ownership interests. Common scenarios for voting rights include governance issues, while tag-along rights are triggered in merger, acquisition, or major share transfer events.

Conclusion: Navigating Governance with Voting and Tag-along Rights

Voting rights empower shareholders to influence company decisions directly, ensuring active participation in governance, while tag-along rights provide minority investors protection by allowing them to join major shareholders in selling stakes, safeguarding their investments from potential exclusion. Balancing these rights is essential for equitable corporate governance, promoting both control and investor security. Effective navigation of voting and tag-along rights enhances shareholder value and aligns interests between majority and minority stakeholders.

Voting Rights Infographic

libterm.com

libterm.com