Employee Stock Purchase Plans (ESPPs) offer a valuable opportunity for employees to purchase company shares at a discounted price, often through payroll deductions. Participating in an ESPP can enhance your investment portfolio and align your financial growth with the company's success. Explore the rest of this article to understand how to maximize the benefits of your ESPP.

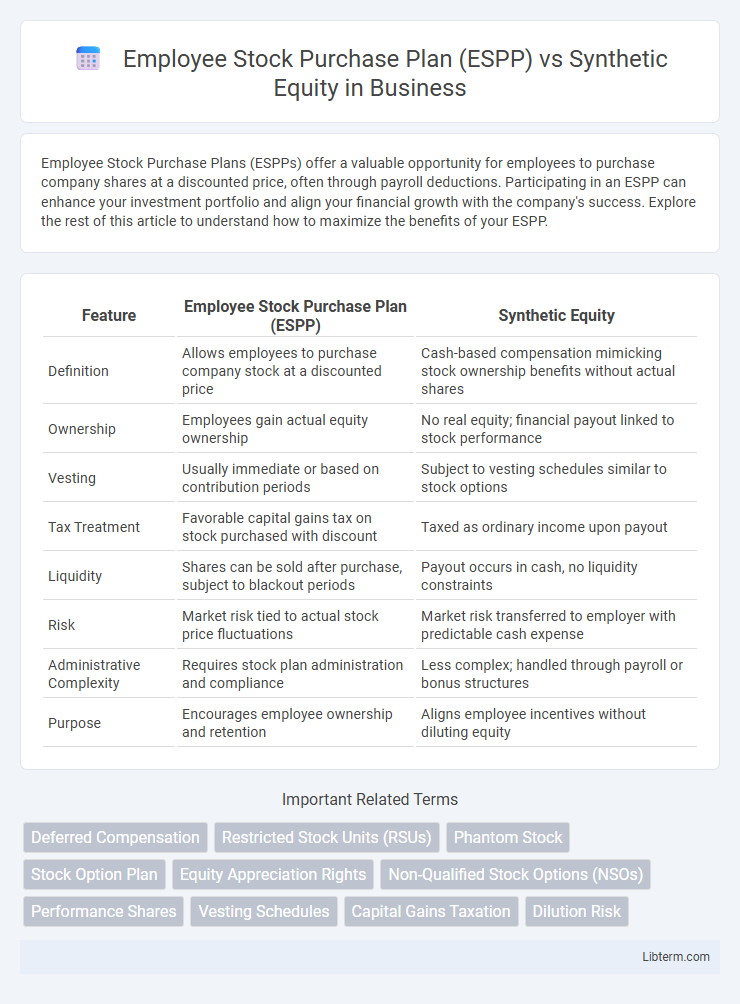

Table of Comparison

| Feature | Employee Stock Purchase Plan (ESPP) | Synthetic Equity |

|---|---|---|

| Definition | Allows employees to purchase company stock at a discounted price | Cash-based compensation mimicking stock ownership benefits without actual shares |

| Ownership | Employees gain actual equity ownership | No real equity; financial payout linked to stock performance |

| Vesting | Usually immediate or based on contribution periods | Subject to vesting schedules similar to stock options |

| Tax Treatment | Favorable capital gains tax on stock purchased with discount | Taxed as ordinary income upon payout |

| Liquidity | Shares can be sold after purchase, subject to blackout periods | Payout occurs in cash, no liquidity constraints |

| Risk | Market risk tied to actual stock price fluctuations | Market risk transferred to employer with predictable cash expense |

| Administrative Complexity | Requires stock plan administration and compliance | Less complex; handled through payroll or bonus structures |

| Purpose | Encourages employee ownership and retention | Aligns employee incentives without diluting equity |

Overview: Understanding ESPP and Synthetic Equity

Employee Stock Purchase Plans (ESPP) allow employees to buy company shares at a discounted price, often through payroll deductions, fostering ownership and aligning employee interests with company performance. Synthetic equity provides employees with financial benefits similar to stock ownership without granting actual shares, using instruments like stock appreciation rights or phantom shares to mirror stock value changes. Comparing ESPP and synthetic equity involves evaluating factors such as tax implications, stock dilution, employee motivation, and administrative complexity.

Key Features of Employee Stock Purchase Plans

Employee Stock Purchase Plans (ESPP) enable employees to buy company shares at a discounted price, typically through payroll deductions, fostering employee ownership and loyalty. These plans often include a look-back provision allowing purchase at the lower of the stock price at the beginning or end of the offering period, maximizing employee gain. Unlike synthetic equity, ESPPs provide actual stock ownership, which can lead to long-term capital appreciation and voting rights.

Defining Synthetic Equity: What Is It?

Synthetic equity represents a form of compensation that mimics traditional equity ownership without granting actual stock, often structured through financial instruments like stock appreciation rights or phantom shares. It aligns employee incentives with company performance by providing benefits tied to stock value increase without diluting shareholder equity. Unlike Employee Stock Purchase Plans (ESPP), which require employees to purchase shares at discounted prices, synthetic equity offers value appreciation potential sans ownership transfer.

Eligibility and Participation Criteria

Employee Stock Purchase Plans (ESPPs) typically require employees to meet specific employment tenure and job classification criteria to participate, often limiting enrollment to full-time employees after a probationary period. Synthetic equity, in contrast, offers greater flexibility by allowing companies to grant equity-like benefits to a broader range of participants, including contractors and consultants, without requiring actual stock ownership. Participation in synthetic equity plans usually depends on customized contractual agreements rather than standardized eligibility rules, enabling tailored incentive structures aligned with company objectives.

Tax Implications: ESPP vs Synthetic Equity

Employee Stock Purchase Plans (ESPP) typically offer favorable tax treatment where employees may benefit from capital gains tax rates if shares are held for specified periods, while disqualifying dispositions trigger ordinary income tax on the discount. Synthetic equity, such as stock appreciation rights or phantom shares, usually results in ordinary income tax upon vesting or exercise since no actual shares are transferred, affecting payroll tax liabilities as well. Understanding these distinct tax implications helps employees and employers optimize compensation strategies for tax efficiency and cash flow management.

Benefits for Employees: Comparing Value Propositions

Employee Stock Purchase Plans (ESPP) provide employees the opportunity to purchase company stock at a discounted price, often 10-15% below market value, offering immediate financial gain and long-term wealth building. Synthetic equity grants simulate stock ownership by providing cash or stock bonuses tied to company valuation, granting employees economic benefits without dilution or actual stock issuance. ESPPs typically foster employee ownership and motivation through actual equity stakes, while synthetic equity offers flexible compensation with reduced regulatory complexity and risk exposure.

Risks and Drawbacks Associated with Each Option

Employee Stock Purchase Plans (ESPP) risk includes potential stock price decline after purchase, leading to financial loss despite discounted buy-in rates; tax implications can be complex depending on holding periods and plan specifics. Synthetic equity poses risks such as lack of actual ownership, which limits shareholder rights and potential dividend benefits, and valuation challenges that might affect the payout's fairness and timing. Both options carry liquidity risks, with ESPP shares often subject to market fluctuation, while synthetic equity payouts depend heavily on company performance and contract terms.

Accounting and Compliance Considerations

Employee Stock Purchase Plans (ESPP) typically require careful accounting for discounts and offering periods, with compliance governed by IRS Section 423 and FASB ASC Topic 718 to ensure proper recognition of compensation expense and tax benefits. Synthetic equity, such as stock appreciation rights or phantom shares, demands tracking of fair value changes under ASC Topic 718 and may trigger complex liability classification and incremental expense recognition. Both plans necessitate rigorous documentation, accurate fair value measurement, and adherence to securities regulations and tax rules to maintain compliance and transparency.

Best-Fit Scenarios: Which Plan Suits Your Organization?

Employee Stock Purchase Plans (ESPP) best suit established companies seeking to enhance employee ownership with straightforward tax benefits and predictable dilution, appealing to a wide workforce. Synthetic Equity plans are ideal for startups or high-growth firms aiming to provide equity-like incentives without issuing actual shares, thus avoiding immediate dilution and complex compliance. Organizations prioritizing cost-effective motivation with minimal administrative burden often favor synthetic equity, while firms valuing transparent stock ownership prefer ESPPs.

Strategic Recommendations for Employers

Employers should consider implementing an Employee Stock Purchase Plan (ESPP) to enhance employee ownership and motivation by offering stock at a discount, which aligns workforce interests with company performance and boosts long-term retention. Synthetic equity grants, such as stock appreciation rights or phantom shares, provide a flexible alternative without diluting equity or triggering complex tax events, making them ideal for private companies or those seeking less administrative burden. Strategic recommendations favor a hybrid approach, tailoring the choice to company size, financial goals, and employee engagement objectives to maximize retention, incentivization, and shareholder value.

Employee Stock Purchase Plan (ESPP) Infographic

libterm.com

libterm.com