Interest rate swaps allow businesses and investors to exchange fixed interest rate payments for floating rate payments, managing exposure to interest rate fluctuations effectively. These financial derivatives are commonly used to hedge risk or speculate on changes in interest rates, providing flexibility in debt management. Discover how interest rate swaps can optimize Your financial strategy by exploring the detailed insights in this article.

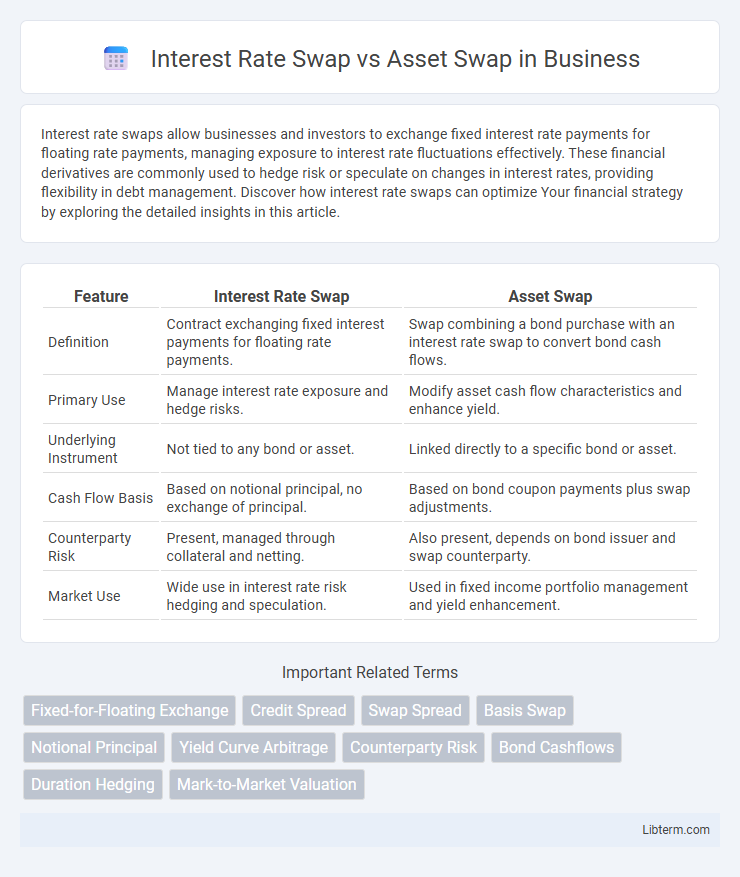

Table of Comparison

| Feature | Interest Rate Swap | Asset Swap |

|---|---|---|

| Definition | Contract exchanging fixed interest payments for floating rate payments. | Swap combining a bond purchase with an interest rate swap to convert bond cash flows. |

| Primary Use | Manage interest rate exposure and hedge risks. | Modify asset cash flow characteristics and enhance yield. |

| Underlying Instrument | Not tied to any bond or asset. | Linked directly to a specific bond or asset. |

| Cash Flow Basis | Based on notional principal, no exchange of principal. | Based on bond coupon payments plus swap adjustments. |

| Counterparty Risk | Present, managed through collateral and netting. | Also present, depends on bond issuer and swap counterparty. |

| Market Use | Wide use in interest rate risk hedging and speculation. | Used in fixed income portfolio management and yield enhancement. |

Introduction to Interest Rate Swaps and Asset Swaps

Interest rate swaps involve exchanging fixed interest rate payments for floating rate payments on a notional principal, allowing parties to hedge interest rate exposure or speculate on rate movements. Asset swaps combine a bond and an interest rate swap, enabling investors to convert fixed-income securities into floating-rate instruments for enhanced yield and risk management. Understanding the mechanics and purposes of interest rate swaps and asset swaps is crucial for optimizing fixed income portfolio strategies.

What Is an Interest Rate Swap?

An Interest Rate Swap is a financial derivative contract where two parties exchange cash flows based on different interest rate benchmarks, typically swapping fixed-rate payments for floating-rate payments. This instrument helps manage interest rate risk by allowing entities to hedge against fluctuations in rates or to alter their interest rate exposure without refinancing underlying debt. Unlike an Asset Swap, which combines a bond with an interest rate swap to alter the bond's cash flow characteristics, an Interest Rate Swap focuses solely on exchanging interest rate payments between counterparties.

Understanding Asset Swaps

Asset swaps transform fixed-rate bonds into synthetic floating-rate instruments, allowing investors to hedge interest rate risk or adjust cash flow profiles. Unlike interest rate swaps, which exchange fixed and floating rate payments without underlying securities, asset swaps involve an actual bond combined with an interest rate swap structure. This combination enables more precise risk management and enhanced liquidity options in fixed income portfolios.

Key Differences Between Interest Rate Swap and Asset Swap

Interest Rate Swaps primarily involve exchanging fixed and floating interest payments based on a notional principal without transferring the underlying asset, while Asset Swaps combine bond ownership with an interest rate swap to hedge or enhance returns on a specific security. Interest Rate Swaps manage interest rate exposure by swapping cash flows between two parties, whereas Asset Swaps integrate asset risk by adjusting the fixed coupon bond payments to floating rates plus a spread. Key differences include the underlying assets involved, the objective of risk management, and the cash flow structure, with Interest Rate Swaps focusing solely on interest payments and Asset Swaps blending bond ownership with interest rate swaps for customized risk-return profiles.

How Interest Rate Swaps Work

Interest rate swaps involve exchanging fixed interest rate payments for floating rate payments based on a notional principal, allowing parties to hedge interest rate exposure or speculate on rate movements. The floating leg is typically tied to a benchmark rate such as LIBOR or SOFR, resetting periodically, while the fixed leg remains constant throughout the swap's duration. This financial derivative enables corporations and investors to manage cash flow volatility and optimize funding costs without exchanging the principal amount.

How Asset Swaps Operate

Asset swaps function by combining a fixed-rate bond with an interest rate swap to convert the bond's cash flows into floating rates, enabling investors to hedge interest rate risk or take advantage of interest rate movements. In this process, the investor pays fixed coupon payments from the bond and receives floating payments tied to a benchmark rate such as LIBOR or SOFR, effectively transforming the bond's fixed income stream. This mechanism allows for customized exposure to interest rate fluctuations while maintaining the underlying credit risk of the bond.

Use Cases for Interest Rate Swaps

Interest rate swaps are primarily used by corporations and financial institutions to hedge interest rate exposure, manage debt portfolios, and stabilize cash flows by exchanging fixed-rate interest payments for floating-rate payments or vice versa. They enable firms to tailor interest rate risk management strategies without altering the underlying assets or liabilities, often employed in managing variable-rate loans or optimizing borrowing costs. In contrast, asset swaps combine a fixed-income security with an interest rate swap to create synthetic floating-rate instruments, primarily used to enhance yield or manage credit risk on bond holdings.

Use Cases for Asset Swaps

Asset swaps are primarily used by investors seeking to manage interest rate risk on fixed-income securities while maintaining exposure to the underlying asset's credit risk; they enable the transformation of fixed-rate bond cash flows into floating-rate payments aligned with benchmark rates such as LIBOR or SOFR. This type of swap is particularly useful for portfolio managers who want to hedge interest rate fluctuations without selling the bond, or for arbitrageurs aiming to exploit pricing inefficiencies between the bond and the swap market. In contrast, interest rate swaps are mainly used for exchanging fixed interest payments for floating rates or vice versa without involving underlying bond holdings.

Risk Factors: Interest Rate Swap vs Asset Swap

Interest rate swaps expose parties primarily to interest rate risk, as they exchange fixed for floating-rate cash flows, potentially leading to basis and counterparty credit risk. Asset swaps combine bond holdings with swaps, introducing credit risk linked to the underlying bond issuer alongside market and interest rate risks. The complexity of asset swaps requires careful assessment of both creditworthiness and interest rate movements compared to the more straightforward exposure of pure interest rate swaps.

Which Swap Is Right for You?

Interest rate swaps suit companies seeking to manage exposure to fluctuations in benchmark interest rates by exchanging fixed for floating rate payments, ideal for hedging interest rate risk on debt. Asset swaps combine a bond with an interest rate swap to transform the cash flows and can optimize yield or credit risk, preferred by investors aiming to customize fixed-income returns. Evaluate your risk tolerance, cash flow needs, and investment objectives to determine whether the simpler interest rate swap or the integrated asset swap aligns better with your financial strategy.

Interest Rate Swap Infographic

libterm.com

libterm.com