Money market accounts offer a blend of higher interest rates compared to regular savings accounts and easy access to your funds through checks or debit cards. These accounts typically require a higher minimum balance but provide better liquidity and safety, making them an ideal choice for managing Your emergency savings or short-term financial goals. Explore the article to learn how a money market account can enhance Your financial strategy.

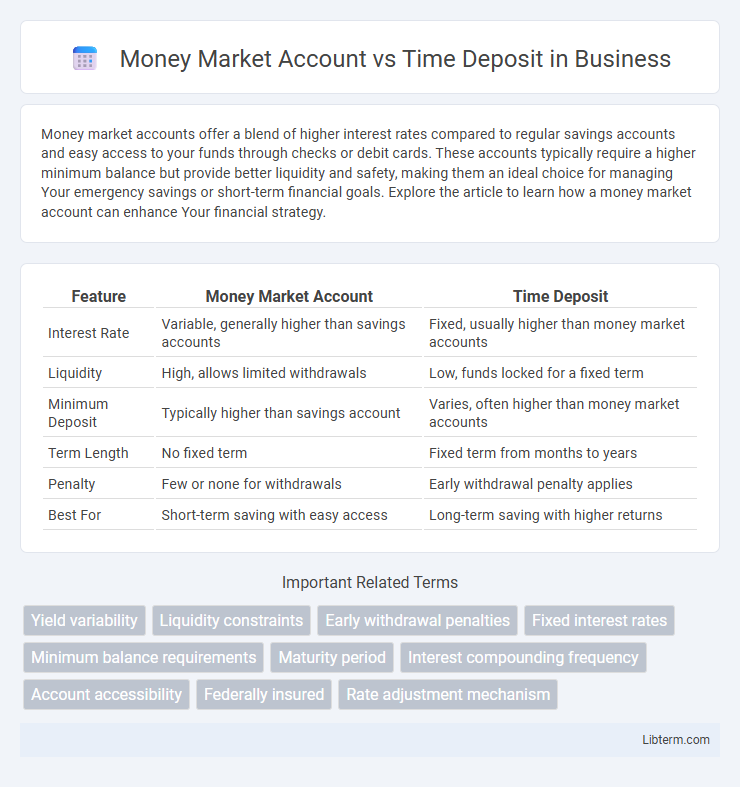

Table of Comparison

| Feature | Money Market Account | Time Deposit |

|---|---|---|

| Interest Rate | Variable, generally higher than savings accounts | Fixed, usually higher than money market accounts |

| Liquidity | High, allows limited withdrawals | Low, funds locked for a fixed term |

| Minimum Deposit | Typically higher than savings account | Varies, often higher than money market accounts |

| Term Length | No fixed term | Fixed term from months to years |

| Penalty | Few or none for withdrawals | Early withdrawal penalty applies |

| Best For | Short-term saving with easy access | Long-term saving with higher returns |

Understanding Money Market Accounts

Money market accounts offer higher interest rates than regular savings accounts by investing in short-term, low-risk securities such as Treasury bills and commercial paper. They provide liquidity with limited check-writing abilities, making them suitable for emergency funds and short-term savings goals. Unlike time deposits, money market accounts do not require funds to be locked in for a fixed term, allowing easier access to cash without early withdrawal penalties.

What Is a Time Deposit?

A time deposit is a fixed-term investment offered by banks where funds are locked in for a specified period, earning a higher interest rate compared to regular savings accounts. Unlike money market accounts, time deposits restrict withdrawals until the maturity date, often ranging from months to years. This financial instrument guarantees principal safety and predictable returns, making it ideal for investors seeking low-risk, long-term savings options.

Key Features of Money Market Accounts

Money Market Accounts offer higher interest rates than regular savings accounts, with easy access to funds through checks and debit cards, making them ideal for short-term savings and liquidity. They typically require a higher minimum balance and provide limited monthly transactions, balancing accessibility with competitive returns. Unlike Time Deposits, which lock funds for a fixed term, Money Market Accounts combine flexibility with relatively stable yields in a low-risk environment.

Key Features of Time Deposits

Time deposits offer fixed interest rates for a predetermined term, providing predictable returns and capital protection. They require funds to be locked in for the duration, with penalties imposed for early withdrawal. This investment appeals to risk-averse individuals seeking steady income without market volatility.

Interest Rates: Money Market vs Time Deposit

Money market accounts typically offer variable interest rates that fluctuate with market conditions, often providing higher liquidity compared to time deposits. Time deposits, such as certificates of deposit (CDs), usually feature fixed interest rates locked in for a specified term, which can result in higher returns if rates remain stable or decline. Comparing interest rates between these options hinges on balancing the benefit of stable, potentially higher fixed returns against the flexibility of variable rates tied to money market conditions.

Liquidity and Accessibility Compared

Money Market Accounts offer higher liquidity and easier accessibility, allowing account holders to make multiple withdrawals or transfers per month without penalties. Time Deposits, also known as Certificates of Deposit (CDs), lock funds for a fixed term, limiting access and imposing penalties for early withdrawal. This difference significantly impacts short-term financial flexibility and emergency fund availability.

Safety and Insurance Protections

Money Market Accounts (MMAs) and Time Deposits, such as Certificates of Deposit (CDs), both offer strong safety features through Federal Deposit Insurance Corporation (FDIC) insurance, covering up to $250,000 per depositor, per institution. MMAs provide liquidity and insured protection on deposited funds while allowing easy access to cash, whereas Time Deposits lock funds for a fixed term but also benefit from the same FDIC insurance guarantees. Both account types mitigate risk by safeguarding principal investments, making them reliable options for conservative savers prioritizing capital preservation.

Minimum Balance and Deposit Requirements

Money Market Accounts typically require a minimum balance ranging from $500 to $2,500 to avoid fees and earn interest, while Time Deposits, such as Certificates of Deposit (CDs), often have a minimum deposit starting at $1,000 or higher depending on the financial institution. Money Market Accounts offer more flexibility with deposits and withdrawals, allowing variable amounts above the minimum balance, whereas Time Deposits mandate a fixed initial deposit that remains locked until maturity. Failure to maintain the minimum balance in a Money Market Account can result in monthly fees or lower interest rates, while early withdrawal from Time Deposits usually incurs penalties.

Penalties and Withdrawal Restrictions

Money Market Accounts typically offer limited withdrawal options, often restricting transactions to six per month to comply with federal regulations, with penalties including fees or conversion to a checking account for excessive withdrawals. Time Deposits, such as Certificates of Deposit (CDs), impose strict withdrawal restrictions, where early withdrawal usually incurs a penalty equivalent to several months' interest, significantly reducing the earned yield. Understanding these penalties and withdrawal constraints is crucial for selecting the right savings instrument based on liquidity needs and financial goals.

Choosing the Right Option for Your Saving Goals

Money Market Accounts offer liquidity with competitive interest rates, making them ideal for short-term savings or emergency funds. Time Deposits, or Certificates of Deposit (CDs), lock in funds for a fixed term with higher interest rates, best suited for long-term goals and maximizing returns. Assess your need for access to funds versus interest rate benefits to select between flexible liquidity and guaranteed higher yields.

Money Market Account Infographic

libterm.com

libterm.com