Accretion refers to the gradual accumulation of particles or matter, often observed in astrophysics where celestial bodies grow by collecting surrounding dust and gas. This natural process plays a critical role in the formation of planets, stars, and galaxies, shaping the universe as we know it. Explore the rest of the article to understand how accretion impacts cosmic evolution and your knowledge of space phenomena.

Table of Comparison

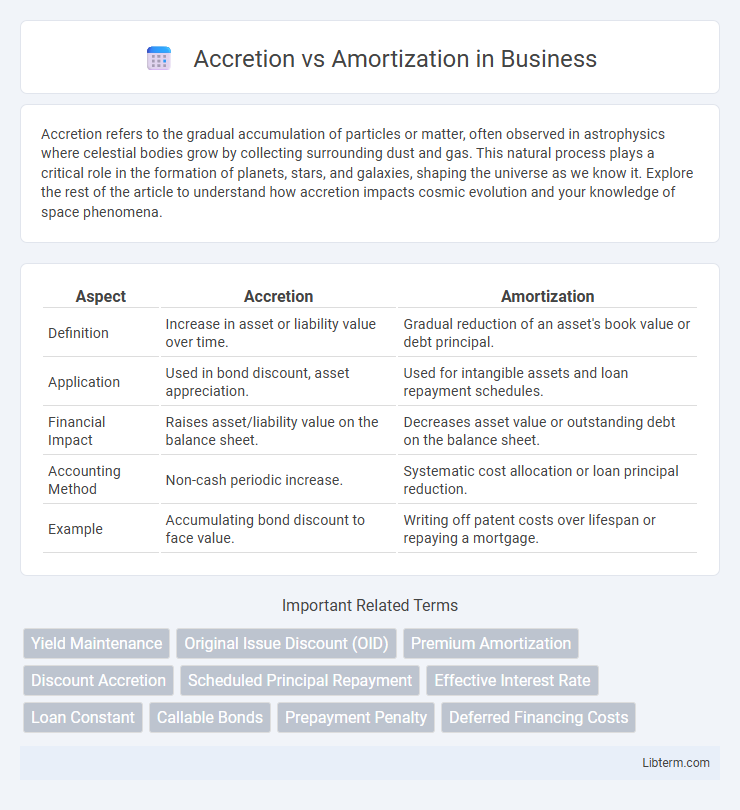

| Aspect | Accretion | Amortization |

|---|---|---|

| Definition | Increase in asset or liability value over time. | Gradual reduction of an asset's book value or debt principal. |

| Application | Used in bond discount, asset appreciation. | Used for intangible assets and loan repayment schedules. |

| Financial Impact | Raises asset/liability value on the balance sheet. | Decreases asset value or outstanding debt on the balance sheet. |

| Accounting Method | Non-cash periodic increase. | Systematic cost allocation or loan principal reduction. |

| Example | Accumulating bond discount to face value. | Writing off patent costs over lifespan or repaying a mortgage. |

Introduction to Accretion and Amortization

Accretion refers to the gradual increase in the value of a financial asset or liability over time, commonly seen in bond discount adjustments where the bond's carrying amount rises to face value as maturity approaches. Amortization involves systematically reducing the cost of an intangible asset or the principal of a loan over a specified period through regular payments. Both accretion and amortization are fundamental in accounting and finance for accurately reflecting the changing value of assets and liabilities on financial statements.

Defining Accretion

Accretion refers to the gradual increase in the value of an asset over time, often due to interest earnings or the accumulation of value in financial instruments such as zero-coupon bonds. It contrasts with amortization, which is the systematic reduction of a liability or intangible asset's value through scheduled payments or expense recognition. Understanding accretion is crucial in finance for accurately measuring the true growth or cost of investments and obligations.

Understanding Amortization

Amortization refers to the gradual reduction of a debt or intangible asset over a specified period through scheduled payments or expense recognition. It systematically allocates the cost of intangible assets, such as patents or copyrights, across their useful life, reflecting their consumption or expiration. Understanding amortization helps businesses accurately report asset value and manage liabilities by matching expenses to revenue periods.

Key Differences Between Accretion and Amortization

Accretion involves the gradual increase in the value of an asset due to interest or growth, commonly seen in financial instruments like zero-coupon bonds, whereas amortization refers to the systematic reduction of a debt or intangible asset value over a specified period. Accretion typically affects payables or liabilities increasing their book value to maturity, while amortization applies to the allocation of intangible assets or loan principal repayment on the balance sheet. Understanding these differences is crucial for accurate financial reporting and effective asset and liability management in accounting practices.

Accretion in Financial Reporting

Accretion in financial reporting refers to the gradual increase in the value of a discounted financial liability or asset over time, reflecting the passage of time and the effect of interest. It is commonly used in the context of asset retirement obligations, bond discount amortization, and lease liabilities to allocate expense or interest revenue accurately. Accretion expense is recognized periodically to align the carrying amount of the liability or asset with its eventual settlement value.

Amortization in Accounting Practice

Amortization in accounting practice involves systematically allocating the cost of intangible assets, such as patents or copyrights, over their useful life to reflect expense recognition accurately. This process aligns with the matching principle by spreading out the expense to match revenue generated by the asset, enhancing financial statement reliability. Unlike accretion, which pertains to the gradual increase in the value of a financial asset or liability, amortization specifically targets cost allocation and depreciation of intangible assets on balance sheets.

Common Applications in Business and Finance

Accretion is commonly applied in bond valuation and investment accounting to calculate the gradual increase in the value of discounted instruments or liabilities. Amortization is frequently used for systematically reducing intangible asset values and spreading loan principal repayments over time. Businesses rely on accretion for asset appreciation and amortization for expense allocation and debt servicing in financial statements.

Impact on Financial Statements

Accretion increases the carrying amount of a liability or asset over time, impacting the balance sheet by gradually raising the value of obligations such as asset retirement costs. Amortization systematically reduces the value of intangible assets or prepaid expenses, decreasing asset balances on the balance sheet while simultaneously recognizing expense on the income statement. Both processes affect net income and equity but differ in their approach to expense recognition and asset or liability valuation.

Benefits and Limitations of Each Method

Accretion enhances the value of payable liabilities or receivable assets by gradually adjusting them to their future value, benefiting financial accuracy and compliance with accounting standards while potentially complicating cash flow analysis due to its non-cash nature. Amortization systematically reduces intangible assets or debt over time, providing clear expense recognition and aiding in profit measurement, but it may obscure the asset's current market value and reduce flexibility in financial reporting. Both methods improve financial transparency and predictability but require careful application to avoid misinterpretation of an entity's financial health.

Conclusion: Choosing Between Accretion and Amortization

Choosing between accretion and amortization depends on the specific financial context and accounting goals, as accretion typically applies to increasing asset values or liabilities over time, while amortization spreads out the cost of intangible assets or debt reductions. Businesses aiming to recognize gradual value growth or interest expenses often prefer accretion methods. In contrast, amortization suits entities managing asset costs or debt repayment schedules to match expenses with revenue generation periods.

Accretion Infographic

libterm.com

libterm.com