Dogs are loyal companions known for their intelligence and affectionate nature, making them ideal pets for families and individuals alike. Regular care, including proper nutrition, exercise, and veterinary checkups, ensures your dog's health and happiness. Discover more about choosing the right breed and training tips to enhance your bond in the rest of this article.

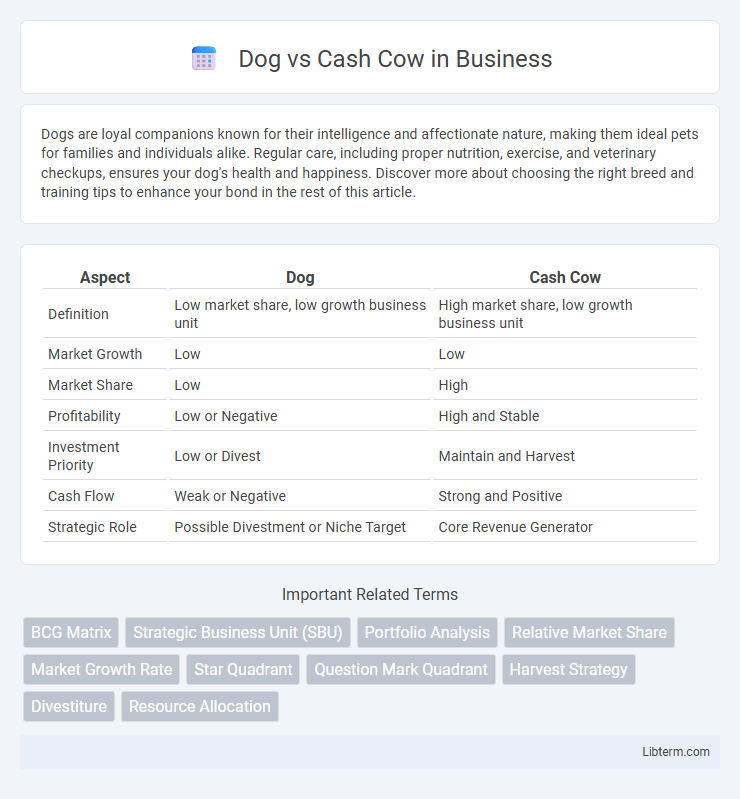

Table of Comparison

| Aspect | Dog | Cash Cow |

|---|---|---|

| Definition | Low market share, low growth business unit | High market share, low growth business unit |

| Market Growth | Low | Low |

| Market Share | Low | High |

| Profitability | Low or Negative | High and Stable |

| Investment Priority | Low or Divest | Maintain and Harvest |

| Cash Flow | Weak or Negative | Strong and Positive |

| Strategic Role | Possible Divestment or Niche Target | Core Revenue Generator |

Understanding the Concepts: Dog vs Cash Cow

In the BCG matrix, a Dog represents a business unit with low market share in a mature, slow-growing industry, often generating minimal profits or losses. A Cash Cow holds a high market share in a mature market, consistently producing strong cash flows that fund other business units. Understanding these concepts helps businesses allocate resources efficiently, balancing investments in growth and profitability.

Key Characteristics of Dogs in Business

Dogs in business are characterized by low market share and slow industry growth, often resulting in minimal profitability and limited potential for expansion. These products or units typically consume resources without generating significant returns, making them a strategic priority for divestment or restructuring. Companies must carefully evaluate Dogs to avoid resource-draining investments and focus on more promising business segments.

Defining Cash Cow: Features and Benefits

A Cash Cow is a business unit or product with a high market share in a slow-growing industry, generating consistent and substantial cash flow with minimal investment. It features stable demand, strong brand loyalty, and cost-efficiency, enabling companies to fund other segments with its profits. The primary benefit of a Cash Cow lies in its ability to provide financial stability and support long-term strategic initiatives.

Dog vs Cash Cow: Strategic Implications

Dogs represent products with low market share in slow-growing industries, often draining company resources without generating significant returns. Cash Cows, in contrast, hold high market share in mature markets, providing steady, reliable cash flow that funds other business units. Strategically, businesses should divest or revitalize Dogs while leveraging Cash Cows to invest in growth opportunities and innovation.

Financial Performance: Comparing Dogs and Cash Cows

Cash cows generate consistent, high cash flow with low investment, supporting stable financial performance and funding other business units, while dogs typically show low market share and minimal profitability, draining resources. Financial metrics such as return on investment (ROI) and profit margins are significantly higher in cash cows, making them reliable contributors to overall corporate value. In contrast, dogs often exhibit negative or negligible returns, leading to strategic divestment or repositioning to improve financial outcomes.

Portfolio Management: When to Keep or Divest

In portfolio management, dogs are low-growth, low-market-share units that often drain resources, suggesting divestment or reallocation to higher-performing areas is prudent. Cash cows generate steady cash flow with high market share in mature markets, typically warranting retention to fund new investments. Strategic decisions hinge on evaluating each business unit's long-term viability and contribution to overall corporate value.

Common Industry Examples of Dogs

Common industry examples of Dogs include products like IBM's personal computer division during the 1990s, struggling against fierce competition and declining market share. Another example is BlackBerry smartphones post-2010, as they lost relevance in the smartphone market dominated by iOS and Android devices. These business units typically have low market growth and low relative market share, representing weak positions in the BCG matrix.

Case Studies: Successful Cash Cow Strategies

Case studies on successful cash cow strategies reveal companies leveraging established products with high market share and consistent demand to generate steady cash flow. Brands like Apple's iPhone and Coca-Cola illustrate how continuous innovation and strong brand loyalty sustain profitability in mature markets. Effective cash cow management often involves optimizing cost efficiency while reinvesting profits into emerging growth areas.

Decision-Making Frameworks for Dogs and Cash Cows

In decision-making frameworks, Dogs and Cash Cows represent distinct business units within the BCG matrix, requiring tailored strategic approaches. Cash Cows, characterized by high market share in mature markets, typically demand strategies focused on maintaining dominance, optimizing cash flow, and funding other units. Dogs usually possess low market share in low-growth markets, prompting decisions to divest, reposition, or minimize investment to reallocate resources more effectively.

Future Prospects: Transitioning Dogs into Cash Cows

Transitioning Dogs into Cash Cows requires strategic investments in product innovation, market repositioning, and enhanced customer engagement to unlock latent value. By identifying niche markets and optimizing cost structures, businesses can transform low-growth, low-share Dogs into stable revenue generators with higher profit margins. Long-term success depends on data-driven decisions and continuous market analysis to adapt to evolving consumer preferences and competitive dynamics.

Dog Infographic

libterm.com

libterm.com