Dividends represent a portion of a company's earnings distributed to shareholders, providing a steady income stream and reflecting the company's financial health. Understanding how dividends work can enhance your investment strategy by identifying stocks that offer regular payouts and potential growth. Explore the rest of this article to learn how dividends can impact your portfolio and maximize your returns.

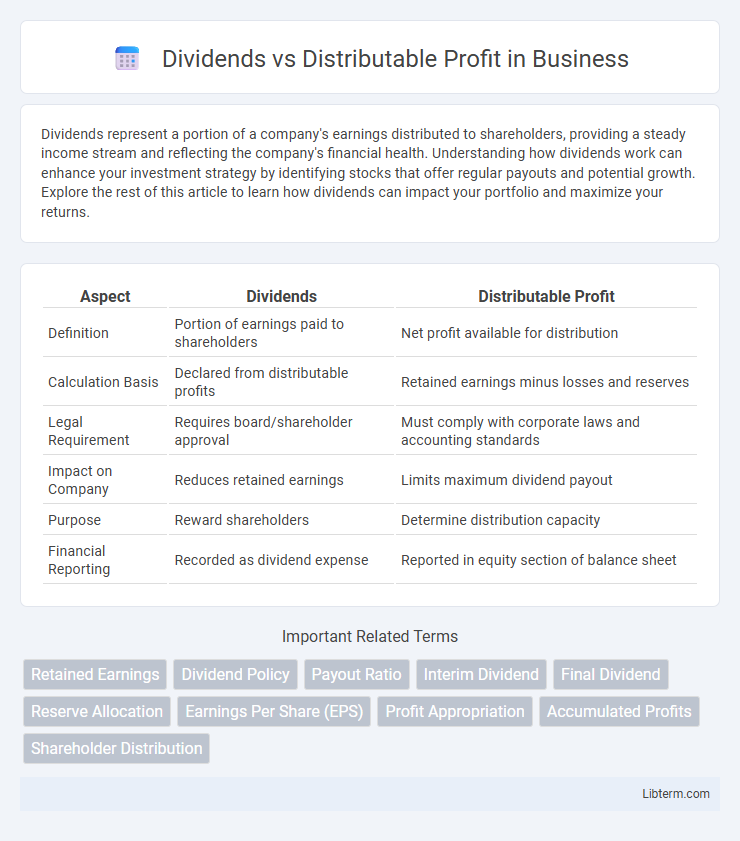

Table of Comparison

| Aspect | Dividends | Distributable Profit |

|---|---|---|

| Definition | Portion of earnings paid to shareholders | Net profit available for distribution |

| Calculation Basis | Declared from distributable profits | Retained earnings minus losses and reserves |

| Legal Requirement | Requires board/shareholder approval | Must comply with corporate laws and accounting standards |

| Impact on Company | Reduces retained earnings | Limits maximum dividend payout |

| Purpose | Reward shareholders | Determine distribution capacity |

| Financial Reporting | Recorded as dividend expense | Reported in equity section of balance sheet |

Introduction to Dividends and Distributable Profit

Dividends represent the portion of a company's earnings distributed to shareholders as a return on their investment, typically decided by the board of directors based on profitability and cash flow. Distributable profit refers to the amount of profit legally available for distribution after accounting for losses, reserves, and statutory requirements, ensuring financial stability. Understanding the distinction between dividends and distributable profit is crucial for compliance with corporate laws and maintaining a company's fiscal health.

Defining Dividends: A Shareholder Perspective

Dividends represent the portion of a company's earnings that shareholders receive as a return on their investment, reflecting the company's profitability and financial health. From a shareholder perspective, dividends provide a tangible income stream derived from distributable profit, which is the legally available surplus after meeting all liabilities and reserves. Understanding the distinction ensures that shareholders recognize dividends as authorized payments contingent upon sufficient distributable profit within the company's financial statements.

Understanding Distributable Profit: Financial Foundations

Distributable profit represents the net profit available for dividend payments after accounting for legal reserves, retained earnings, and any necessary adjustments stipulated by accounting standards or corporate law. It ensures that dividends are paid only from earned profits rather than capital, safeguarding company solvency and protecting creditors. Accurate calculation of distributable profit requires thorough analysis of financial statements, including the balance sheet and income statement, to confirm compliance with regulatory frameworks and sustainable dividend policies.

Key Legal Frameworks for Dividends and Profit Distribution

Key legal frameworks governing dividends and distributable profit include the Companies Act 2006 in the UK, which mandates that dividends can only be paid from profits available for distribution, typically accumulated realized profits minus accumulated realized losses. The European Union's Company Law Directives require member states to ensure that dividends do not reduce the company's capital below a certain threshold, protecting creditors and shareholders. Jurisdictions often require companies to prepare financial statements that accurately reflect distributable profits before authorizing dividend payments to comply with statutory solvency tests.

Major Differences Between Dividends and Distributable Profit

Dividends represent the cash or shares paid to shareholders as a return on their investment, declared from a company's distributable profit, which is the legally permissible portion of retained earnings after covering liabilities and reserves. The major difference lies in that distributable profit is an accounting measure defining the maximum amount available for distribution, while dividends are the actual payments decided by the board of directors within those limits. Distributable profit ensures financial stability by restricting dividend payments to profits earned, preventing depletion of capital.

Calculation Methods for Distributable Profit

Distributable profit calculation involves adjusting net profit by adding back non-distributable items such as unrealized gains and deducting reserves or previous losses to comply with legal and accounting standards. This figure forms the basis for dividend payments, ensuring that companies only distribute profits that are legally available and sustainable. Accurate assessment of distributable profit requires thorough analysis of financial statements, including retained earnings and statutory adjustments, to maintain shareholder equity and corporate solvency.

Dividend Policies: Types and Tax Implications

Dividend policies determine how companies distribute profits to shareholders, primarily through cash dividends, stock dividends, or special dividends, each impacting distributable profit differently. Distributable profit represents the net profit available for dividends after accounting for statutory reserves and retained earnings, serving as the legal basis for dividend payments. Tax implications vary by jurisdiction, with cash dividends typically subject to withholding tax, while stock dividends may offer tax deferral, influencing corporate strategies in optimizing shareholder returns.

Relationship Between Distributable Profit and Dividend Declaration

Distributable profit represents the portion of a company's retained earnings that is legally available for dividend payments after accounting for losses and statutory reserves. Dividend declaration depends directly on the amount of distributable profit, as companies cannot distribute dividends exceeding this threshold to comply with legal and fiduciary obligations. Monitoring distributable profit ensures sustainable dividend policies and preserves financial stability for both shareholders and the company.

Common Misconceptions About Dividends and Profits

Dividends are often mistakenly perceived as direct reflections of a company's total profits, but they are actually paid out from distributable profits, which exclude certain reserves and unrealized gains. Distributable profit is the portion of retained earnings legally available for dividend distribution and must comply with corporate laws and accounting regulations. Many shareholders confuse reported net income with distributable profit, leading to unrealistic dividend expectations not aligned with the company's financial policies or legal constraints.

Conclusion: Strategic Approaches to Profit Distribution

Strategic approaches to profit distribution require aligning dividends with distributable profit to ensure legal compliance and financial sustainability. Businesses must evaluate retained earnings and future investment needs while maintaining shareholder value through consistent dividend policies. Optimizing profit allocation balances immediate shareholder returns with long-term corporate growth objectives.

Dividends Infographic

libterm.com

libterm.com