Understanding income tax is crucial for managing your finances and ensuring compliance with government regulations. It affects your earnings by determining how much you owe based on your income bracket, deductions, and credits. Explore this article to learn strategies that can help optimize your tax responsibilities and maximize your returns.

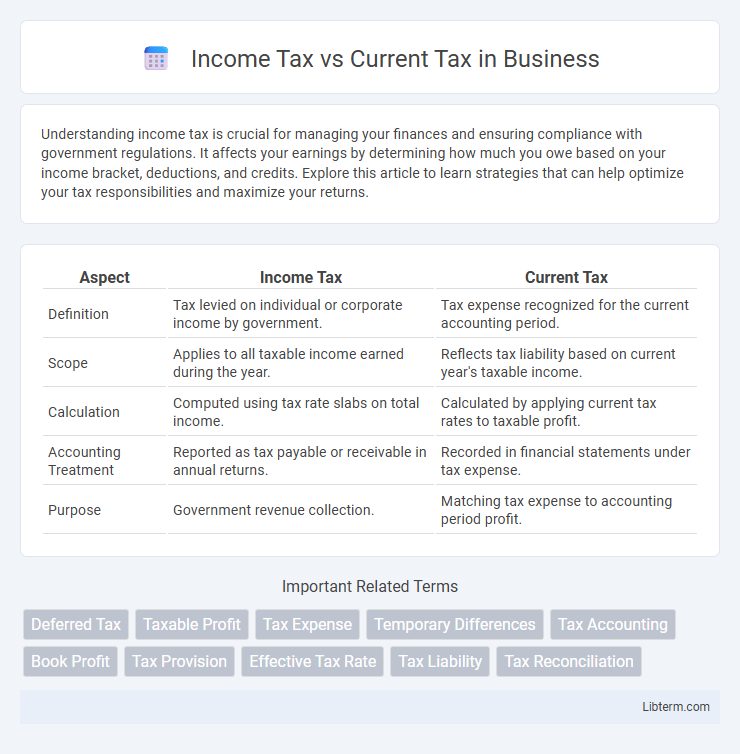

Table of Comparison

| Aspect | Income Tax | Current Tax |

|---|---|---|

| Definition | Tax levied on individual or corporate income by government. | Tax expense recognized for the current accounting period. |

| Scope | Applies to all taxable income earned during the year. | Reflects tax liability based on current year's taxable income. |

| Calculation | Computed using tax rate slabs on total income. | Calculated by applying current tax rates to taxable profit. |

| Accounting Treatment | Reported as tax payable or receivable in annual returns. | Recorded in financial statements under tax expense. |

| Purpose | Government revenue collection. | Matching tax expense to accounting period profit. |

Introduction to Income Tax and Current Tax

Income tax refers to the total tax imposed on an individual's or entity's earnings by the government, calculated based on taxable income as per relevant tax laws. Current tax represents the amount of income tax liability recognized in the financial statements for a specific accounting period, reflecting taxes payable for that period. Understanding the distinction between income tax and current tax is essential for accurate financial reporting and compliance with accounting standards such as IAS 12.

Defining Income Tax: An Overview

Income tax is a government-imposed tax on individuals' and corporations' earnings, calculated based on taxable income. Current tax represents the amount of income tax payable for a specific financial year, reflecting taxable profits and relevant tax rates. Defining income tax involves understanding its role as a direct tax levied on income sources such as salaries, business profits, and capital gains within a given tax period.

What is Current Tax?

Current tax refers to the amount of income tax payable or recoverable for a specific accounting period, calculated based on taxable profits as per tax laws. It represents the actual tax liability payable to tax authorities and is reported as a current liability or asset on the balance sheet. Current tax is distinct from deferred tax, which accounts for future tax consequences of temporary differences between accounting profit and taxable profit.

Key Differences Between Income Tax and Current Tax

Income tax refers to the total tax liability calculated based on taxable income for a financial year, including deferred taxes and adjustments, whereas current tax represents the amount of income tax payable or receivable for the current period as per taxable profits. Income tax encompasses the overall tax expense recognized in financial statements, while current tax is the specific portion owed to tax authorities within a given fiscal year. The key difference lies in income tax reflecting total tax expense, incorporating deferred components, whereas current tax strictly denotes the tax payable on current taxable income.

How Income Tax is Calculated

Income tax calculation involves applying the relevant tax rates to an individual's or company's taxable income, which is determined by subtracting allowable deductions, exemptions, and credits from the gross income. Current tax refers to the income tax liability recognized for the current period based on taxable profit, calculated according to prevailing tax laws and rates. This calculation is essential for financial reporting to accurately reflect tax expenses and liabilities on the balance sheet.

Methods for Calculating Current Tax

Current tax is primarily calculated using the taxable income reported on the financial statements, adjusted for permanent and temporary differences according to the income tax laws of the jurisdiction. The most common method involves applying the statutory tax rate to taxable profit, considering allowable deductions, tax credits, and carry-forward losses to determine the current tax liability. Deferred tax is excluded from this calculation, focusing solely on the current period's tax expense based on actual taxable income.

Importance of Differentiating Income Tax and Current Tax

Differentiating income tax and current tax is crucial for accurate financial reporting and compliance with accounting standards such as IAS 12. Income tax represents the total tax expense recognized in the financial statements, including both current tax liability and deferred tax, whereas current tax pertains only to the tax payable for the current period based on taxable income. Clear distinction ensures precise calculation of tax obligations, prevents misstatements in tax expense, and aids stakeholders in assessing an entity's true tax position.

Impact on Financial Statements

Income tax impacts financial statements by reducing net income through the recognition of income tax expenses, directly affecting the profit and loss account. Current tax represents the actual tax liability payable for the period, recorded as a current liability on the balance sheet, influencing cash flow forecasts. Differences between income tax expense and current tax create deferred tax assets or liabilities, impacting future periods' earnings and equity valuations.

Common Misconceptions About Income and Current Tax

Income tax is often confused with current tax, but they represent different concepts in accounting and taxation. Income tax refers to taxes on an entity's taxable income calculated based on applicable tax laws, while current tax is the amount payable or recoverable for the current period based on tax assessments. A common misconception is treating current tax as merely an expense, whereas it reflects the actual tax liability or asset for the period, requiring careful recognition in financial statements.

Conclusion: Choosing the Right Tax Approach

Selecting the appropriate tax approach depends on the financial reporting objectives and regulatory requirements of a business. Income tax reflects the tax expense based on accounting profit, aligning with accrual accounting principles, while current tax represents the actual tax payable or refundable to tax authorities for the current period. Businesses must evaluate their accounting policies and compliance needs to determine whether to prioritize income tax for accurate financial statement representation or current tax for immediate tax liabilities management.

Income Tax Infographic

libterm.com

libterm.com