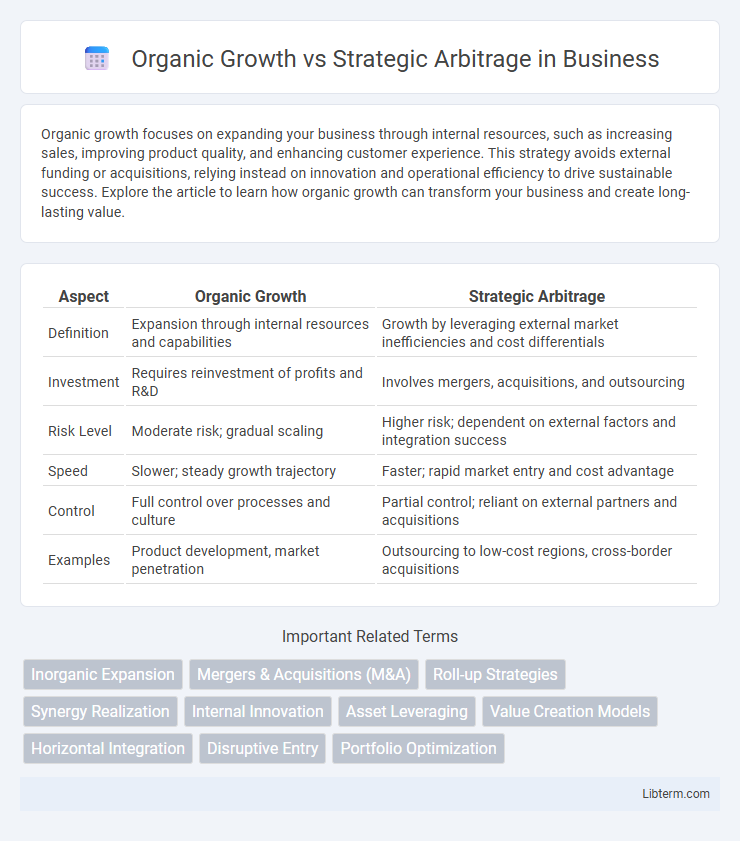

Organic growth focuses on expanding your business through internal resources, such as increasing sales, improving product quality, and enhancing customer experience. This strategy avoids external funding or acquisitions, relying instead on innovation and operational efficiency to drive sustainable success. Explore the article to learn how organic growth can transform your business and create long-lasting value.

Table of Comparison

| Aspect | Organic Growth | Strategic Arbitrage |

|---|---|---|

| Definition | Expansion through internal resources and capabilities | Growth by leveraging external market inefficiencies and cost differentials |

| Investment | Requires reinvestment of profits and R&D | Involves mergers, acquisitions, and outsourcing |

| Risk Level | Moderate risk; gradual scaling | Higher risk; dependent on external factors and integration success |

| Speed | Slower; steady growth trajectory | Faster; rapid market entry and cost advantage |

| Control | Full control over processes and culture | Partial control; reliant on external partners and acquisitions |

| Examples | Product development, market penetration | Outsourcing to low-cost regions, cross-border acquisitions |

Understanding Organic Growth: Definition and Key Drivers

Organic growth refers to the expansion of a company's operations through increasing output, customer base, or sales without mergers or acquisitions. Key drivers include enhanced product development, improved customer retention, market penetration, and innovation within existing business lines. Sustainable organic growth relies on leveraging internal resources, strengthening brand loyalty, and optimizing operational efficiency.

What is Strategic Arbitrage? Core Concepts Explained

Strategic arbitrage refers to the business strategy of leveraging cost differences between various geographic regions or markets to achieve competitive advantages and maximize profitability. This approach often involves outsourcing, offshoring, or partnering with entities in lower-cost environments to access talent, production, or resources more efficiently than competitors restricted to organic growth. Core concepts include exploiting global labor markets, optimizing supply chains, and leveraging regional expertise to enhance innovation and reduce operational expenses.

Comparing the Fundamentals: Organic Growth vs Strategic Arbitrage

Organic growth relies on expanding a company's internal capabilities through innovation, customer retention, and increased sales, emphasizing sustainable revenue generation over time. Strategic arbitrage, by contrast, capitalizes on exploiting market inefficiencies or geographic cost differentials to gain competitive advantages quickly, often through acquisitions or outsourcing. While organic growth prioritizes long-term value creation via internal improvements, strategic arbitrage targets immediate gains by leveraging external opportunities for cost reduction or market expansion.

Advantages of Organic Growth for Sustainable Success

Organic growth fosters sustainable success by strengthening a company's core competencies and enhancing customer loyalty through consistent value delivery. It encourages innovation and operational efficiency by leveraging internal resources and incremental improvements, reducing reliance on external acquisitions or market fluctuations. This approach ensures long-term stability, builds brand credibility, and supports a resilient market position.

Risks and Rewards of Strategic Arbitrage Approaches

Strategic arbitrage involves acquiring or entering new markets through external resources, often offering accelerated expansion and access to innovative assets but carries risks such as cultural misalignment, integration challenges, and high upfront costs. The potential rewards include competitive advantage, diversified revenue streams, and rapid market penetration. However, mismanagement can lead to value erosion, operational disruptions, and failure to realize anticipated synergies.

Case Studies: Businesses Thriving Through Organic Growth

Companies like Amazon and Apple exemplify organic growth by expanding through innovation, customer loyalty, and reinvestment of profits. Their case studies reveal sustainable increases in market share driven by product development and enhanced customer experiences rather than acquisitions. This approach leverages internal capabilities and brand equity to achieve long-term competitive advantages and financial performance.

Notable Examples of Successful Strategic Arbitrage

Strategic arbitrage involves leveraging geographic or market differences to accelerate growth, as seen in companies like Apple outsourcing manufacturing to China to reduce costs while maintaining innovation in the U.S. Another notable example is Starbucks' global expansion by adapting its menu and store experience to local cultures, optimizing both operational efficiency and customer engagement. Amazon's use of cloud infrastructure across various regions exemplifies strategic arbitrage by enhancing service delivery and scaling rapidly in diverse markets.

When to Choose Organic Growth Over Strategic Arbitrage

Choosing organic growth over strategic arbitrage is ideal when a company aims to strengthen its core competencies and sustain long-term brand equity within its existing market. Organic growth prioritizes internal investment in innovation, customer relationships, and operational improvements, fostering resilience and gradual value creation. This approach suits businesses seeking stability, reduced integration risks, and a deepened market presence without the complexities or uncertainties of acquiring external assets.

Integrating Both Strategies: A Hybrid Growth Approach

Integrating organic growth and strategic arbitrage creates a hybrid growth approach that leverages internal development and external acquisition opportunities to maximize business expansion. This method balances steady, innovation-driven progress with rapid market entry through strategic deals, optimizing resource allocation and competitive positioning. Combining these strategies enables companies to adapt dynamically to market changes while sustaining long-term growth and value creation.

Future Trends: The Evolution of Growth Strategies in Business

Future trends in business growth strategies emphasize a shift from traditional organic growth to strategic arbitrage, leveraging global market inefficiencies for accelerated expansion. Advances in data analytics and artificial intelligence enable companies to identify and exploit arbitrage opportunities with precision, driving competitive advantages in cost and innovation. The evolution of growth methods highlights increased integration of digital tools and cross-border collaborations to maximize value creation and scalability.

Organic Growth Infographic

libterm.com

libterm.com