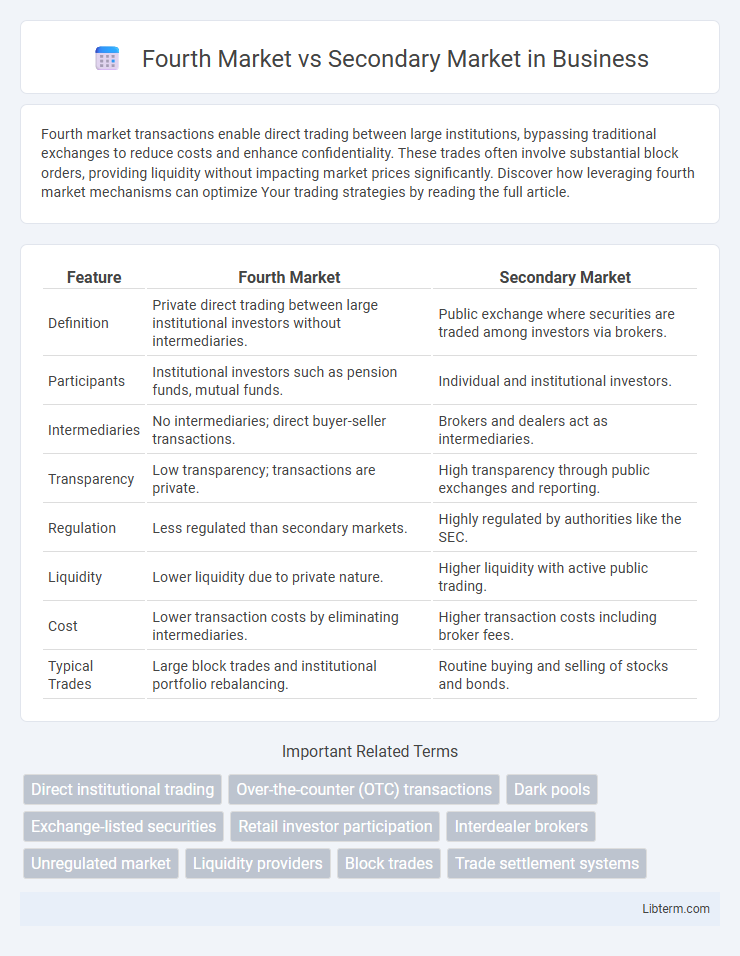

Fourth market transactions enable direct trading between large institutions, bypassing traditional exchanges to reduce costs and enhance confidentiality. These trades often involve substantial block orders, providing liquidity without impacting market prices significantly. Discover how leveraging fourth market mechanisms can optimize Your trading strategies by reading the full article.

Table of Comparison

| Feature | Fourth Market | Secondary Market |

|---|---|---|

| Definition | Private direct trading between large institutional investors without intermediaries. | Public exchange where securities are traded among investors via brokers. |

| Participants | Institutional investors such as pension funds, mutual funds. | Individual and institutional investors. |

| Intermediaries | No intermediaries; direct buyer-seller transactions. | Brokers and dealers act as intermediaries. |

| Transparency | Low transparency; transactions are private. | High transparency through public exchanges and reporting. |

| Regulation | Less regulated than secondary markets. | Highly regulated by authorities like the SEC. |

| Liquidity | Lower liquidity due to private nature. | Higher liquidity with active public trading. |

| Cost | Lower transaction costs by eliminating intermediaries. | Higher transaction costs including broker fees. |

| Typical Trades | Large block trades and institutional portfolio rebalancing. | Routine buying and selling of stocks and bonds. |

Introduction to Fourth Market and Secondary Market

The Fourth Market involves direct trading of securities between institutional investors without intermediaries or exchanges, enhancing privacy and reducing transaction costs. The Secondary Market facilitates the buying and selling of previously issued securities through organized exchanges like the NYSE or NASDAQ, providing liquidity and price discovery. Both markets play crucial roles in the overall financial ecosystem by enabling efficient capital flow and investment opportunities.

Definition of Fourth Market

The Fourth Market refers to the direct trading of securities between institutional investors without the involvement of brokers or exchanges, enabling large block transactions to occur privately. This market contrasts with the Secondary Market, where securities are bought and sold through brokers, exchanges, or electronic trading platforms among individual and institutional investors. Fourth Market transactions typically offer greater anonymity, lower transaction costs, and reduced market impact compared to conventional Secondary Market trades.

Definition of Secondary Market

The secondary market is a financial marketplace where investors buy and sell securities that were previously issued in the primary market, providing liquidity and enabling price discovery for stocks, bonds, and other financial instruments. Unlike the fourth market, which involves direct transactions between institutional investors without intermediaries, the secondary market operates through exchanges and broker-dealers. This market plays a crucial role in facilitating continuous trading and helping investors adjust their portfolios based on market conditions.

Key Participants in Fourth Market

Key participants in the Fourth Market primarily include large institutional investors such as pension funds, mutual funds, insurance companies, and hedge funds, who trade securities directly between themselves without the involvement of brokers or exchanges. Unlike the Secondary Market, which involves retail investors and intermediaries facilitating trades on organized exchanges, the Fourth Market operates through private negotiated transactions, enhancing anonymity and reducing transaction costs. These direct trades enable significant block transactions, helping institutional investors to maintain privacy and minimize market impact.

Key Participants in Secondary Market

Key participants in the secondary market include individual investors, institutional investors such as mutual funds and pension funds, market makers, and brokers who facilitate trading of existing securities. These entities engage in buying and selling stocks, bonds, and other financial instruments previously issued in the primary market, providing liquidity and price discovery. Unlike the fourth market, which involves direct transactions between large institutional traders without broker intermediaries, the secondary market depends heavily on intermediaries to match buyers and sellers.

Trading Mechanisms Compared

Fourth market trading involves direct, institutional-level transactions between large investors without intermediaries, enhancing confidentiality and reducing transaction costs. Secondary market trading occurs on public exchanges where securities are bought and sold through brokers or electronic trading platforms, providing liquidity and price transparency. The fourth market utilizes private networks or electronic communication systems (ECNs), while the secondary market relies on regulated exchange mechanisms and market makers.

Advantages of Fourth Market Trading

Fourth market trading offers direct institutional investor transactions without intermediaries, significantly reducing transaction costs and enhancing price transparency. This market facilitates large block trades that minimize market impact and preserve confidentiality, benefiting both buyers and sellers. The absence of exchange fees and lower latency further improves efficiency compared to the secondary market.

Advantages of Secondary Market Trading

Secondary market trading offers enhanced liquidity, enabling investors to buy and sell securities quickly without directly involving the issuing company. It provides transparent price discovery through continuous trading on exchanges, reflecting real-time supply and demand dynamics. Access to a broad investor base in the secondary market also allows for better diversification and risk management opportunities compared to the more limited, private transactions characteristic of the fourth market.

Risks and Challenges in Both Markets

The Fourth Market involves direct trading between institutional investors without intermediaries, reducing costs but increasing counterparty risk and limited transparency. The Secondary Market offers liquidity through exchanges or brokers but exposes participants to market volatility and regulatory complexities. Both markets face challenges in price discovery accuracy, though the Fourth Market's lower oversight contrasts with the Secondary Market's stricter compliance environment.

Summary: Choosing Between Fourth and Secondary Markets

Fourth markets enable institutions to trade large blocks of securities directly, reducing costs and avoiding market impact, while secondary markets offer liquidity and transparency for a broader range of public investors. Choosing between these markets depends on the trade size, desired anonymity, and immediacy; large institutional trades favor the fourth market for efficiency, whereas retail investors typically participate in the secondary market for access and price discovery. Understanding specific needs around transaction size, speed, and confidentiality helps determine the optimal market venue.

Fourth Market Infographic

libterm.com

libterm.com