Hedge funds are private investment vehicles that utilize diverse strategies like long-short equity, arbitrage, and leverage to generate high returns for accredited investors. These funds often aim for absolute returns regardless of market conditions, making them attractive for portfolio diversification and risk management. Explore the rest of the article to understand how hedge funds could fit into your investment strategy.

Table of Comparison

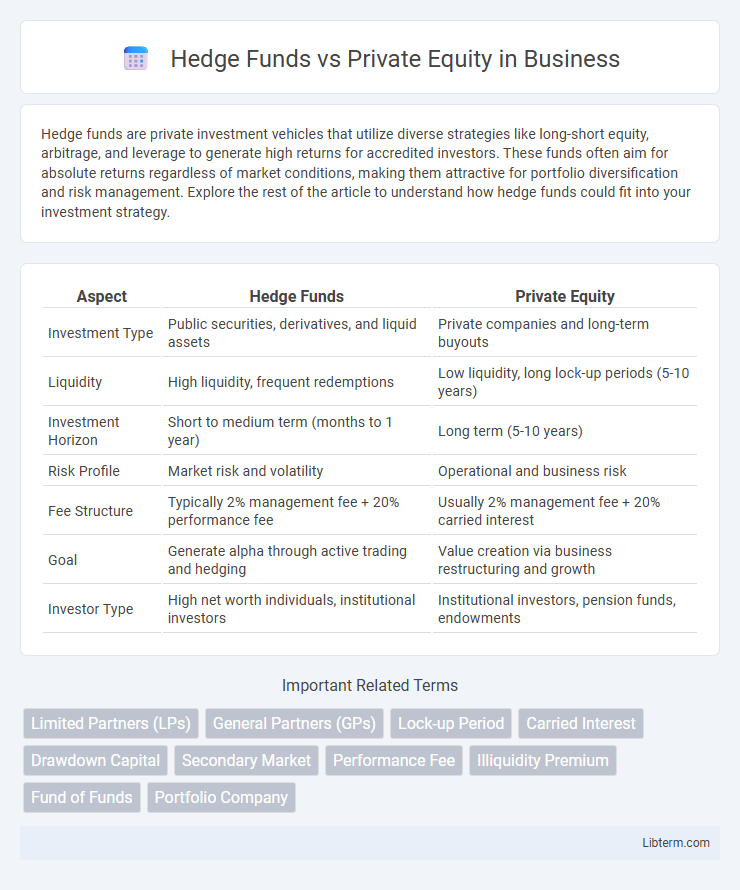

| Aspect | Hedge Funds | Private Equity |

|---|---|---|

| Investment Type | Public securities, derivatives, and liquid assets | Private companies and long-term buyouts |

| Liquidity | High liquidity, frequent redemptions | Low liquidity, long lock-up periods (5-10 years) |

| Investment Horizon | Short to medium term (months to 1 year) | Long term (5-10 years) |

| Risk Profile | Market risk and volatility | Operational and business risk |

| Fee Structure | Typically 2% management fee + 20% performance fee | Usually 2% management fee + 20% carried interest |

| Goal | Generate alpha through active trading and hedging | Value creation via business restructuring and growth |

| Investor Type | High net worth individuals, institutional investors | Institutional investors, pension funds, endowments |

Introduction to Hedge Funds and Private Equity

Hedge funds are pooled investment vehicles that employ diverse strategies such as long-short equity, arbitrage, and global macro to generate returns, often using leverage and derivatives for risk management. Private equity involves direct investment in private companies or buyouts, focusing on long-term value creation through strategic improvements, operational efficiency, and governance enhancements. Both asset classes aim to deliver superior risk-adjusted returns but differ significantly in liquidity, investment horizon, and regulatory frameworks.

Key Differences Between Hedge Funds and Private Equity

Hedge funds primarily engage in liquid investments such as stocks, bonds, and derivatives to generate short-term returns, whereas private equity focuses on long-term investments by acquiring ownership stakes in private companies through buyouts and venture capital. Hedge funds emphasize active trading strategies and leverage to maximize returns, while private equity involves hands-on management and operational improvements to enhance portfolio company value. Additionally, hedge funds typically offer high liquidity with quarterly or monthly redemption options, contrasting with private equity's illiquid nature, often locking capital for 7 to 10 years.

Investment Strategies: Hedge Funds vs Private Equity

Hedge funds employ diverse investment strategies, including long/short equity, market neutral, and global macro, aiming for high liquidity and short- to medium-term gains through active trading across multiple asset classes. Private equity focuses on acquiring significant stakes or full ownership in private companies, implementing value-creation strategies such as operational improvements and strategic restructuring over a longer investment horizon, typically 5-10 years. The key difference lies in hedge funds' emphasis on public market securities with flexibility and quick turnover, whereas private equity targets illiquid private assets with hands-on management and long-term growth.

Fund Structure and Organization

Hedge funds typically employ an open-ended fund structure allowing investors to redeem shares periodically, while private equity funds utilize a closed-ended structure with fixed capital commitments and longer investment horizons. Hedge funds are often managed by investment managers who execute liquid strategies across diverse asset classes, whereas private equity funds are organized with general partners overseeing portfolio companies for value creation over multiple years. The organizational setup of private equity includes limited partners providing capital and general partners managing investments, contrasting with hedge funds' more flexible investor terms and active trading approach.

Risk and Return Profiles

Hedge funds typically pursue liquid, marketable securities with strategies designed for short- to medium-term gains, resulting in higher volatility and variable risk profiles that can range from moderate to aggressive. Private equity investments involve longer-term commitments in private companies, often with illiquid assets but the potential for substantial returns due to active management and operational improvements. The risk profile of private equity is generally higher due to illiquidity and longer investment horizons, but it often offers superior return potential compared to hedge funds' typically more diversified and liquid portfolios.

Liquidity and Investment Horizon

Hedge funds typically offer higher liquidity with investors often able to redeem capital quarterly or annually, aligned with their short-term investment horizon aimed at generating returns through market volatility. Private equity investments have a longer horizon, usually spanning 7 to 10 years, with capital locked in for extended periods to support business growth or restructuring before exit. The fundamental difference lies in hedge funds' flexibility versus private equity's commitment to long-term value creation.

Regulatory Environment

Hedge funds operate under the Investment Advisers Act of 1940, often benefiting from lighter regulatory scrutiny compared to private equity firms, which frequently face oversight from the Securities and Exchange Commission (SEC) due to their long-term investments and fiduciary duties. Private equity firms encounter stricter regulations related to fundraising, disclosure requirements, and shareholder protections, especially under the Dodd-Frank Act and other financial reforms implemented after the 2008 crisis. The regulatory environment's complexity influences fund structures, investor eligibility, and reporting standards, reflecting the distinct risk profiles and capital deployment strategies between hedge funds and private equity.

Fee Structures Compared

Hedge funds typically charge a 2% management fee and 20% performance fee, aligning investor returns with fund manager incentives. Private equity firms usually impose a 2% management fee on committed capital plus a 20% carried interest on realized profits, reflecting long-term investment horizons. These distinct fee structures impact investor costs and risk exposure differently across the two asset classes.

Typical Investors and Capital Requirements

Hedge funds typically attract high-net-worth individuals and institutional investors seeking liquid, diversified strategies with capital requirements often starting at $100,000 to $1 million. Private equity funds primarily target institutional investors such as pension funds, endowments, and family offices, with minimum investments usually ranging from $1 million to $10 million due to their long-term, illiquid nature. The significant capital commitment and longer investment horizons differentiate private equity from hedge funds, which offer more flexibility and shorter lock-up periods.

Choosing Between Hedge Funds and Private Equity

Choosing between hedge funds and private equity depends on investment horizon, risk tolerance, and liquidity needs. Hedge funds offer greater liquidity and short-term trading strategies, while private equity emphasizes long-term growth through direct company ownership and operational improvements. Investors seeking active involvement and longer time frames often prefer private equity, whereas those valuing flexibility and quicker returns lean toward hedge funds.

Hedge Funds Infographic

libterm.com

libterm.com