Recapitalization is a financial strategy used by companies to restructure their debt and equity mix, improving financial stability and optimizing capital structure. This process can enhance your company's creditworthiness and reduce the cost of capital, facilitating growth and operational efficiency. Explore the rest of the article to understand how recapitalization can benefit your business and the different methods available.

Table of Comparison

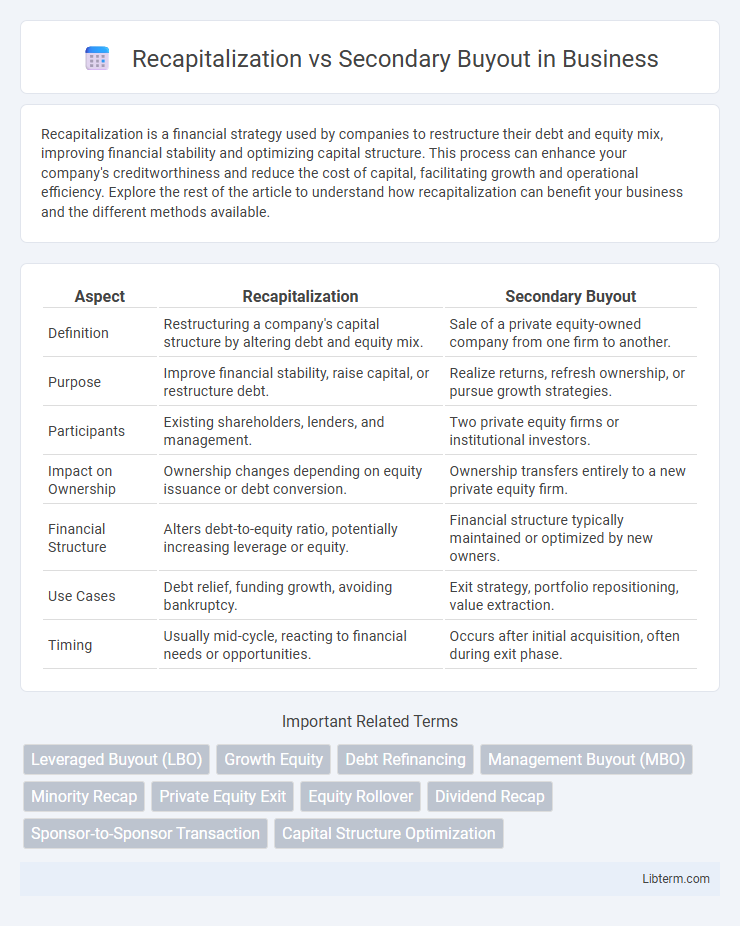

| Aspect | Recapitalization | Secondary Buyout |

|---|---|---|

| Definition | Restructuring a company's capital structure by altering debt and equity mix. | Sale of a private equity-owned company from one firm to another. |

| Purpose | Improve financial stability, raise capital, or restructure debt. | Realize returns, refresh ownership, or pursue growth strategies. |

| Participants | Existing shareholders, lenders, and management. | Two private equity firms or institutional investors. |

| Impact on Ownership | Ownership changes depending on equity issuance or debt conversion. | Ownership transfers entirely to a new private equity firm. |

| Financial Structure | Alters debt-to-equity ratio, potentially increasing leverage or equity. | Financial structure typically maintained or optimized by new owners. |

| Use Cases | Debt relief, funding growth, avoiding bankruptcy. | Exit strategy, portfolio repositioning, value extraction. |

| Timing | Usually mid-cycle, reacting to financial needs or opportunities. | Occurs after initial acquisition, often during exit phase. |

Understanding Recapitalization: Definition and Purpose

Recapitalization involves restructuring a company's debt and equity mixture to optimize financial stability and support growth strategies. This process aims to improve capital structure by increasing debt to reduce equity dilution or vice versa, often enhancing cash flow management and shareholder value. Understanding recapitalization helps businesses manage risks, reduce cost of capital, and prepare for expansions or transitions such as mergers or acquisitions.

What is a Secondary Buyout? Key Features Explained

A Secondary Buyout (SBO) occurs when one private equity firm sells its portfolio company to another private equity firm, offering liquidity and a strategic exit solution. Key features include a transfer of ownership between private equity investors rather than a trade sale or IPO, the opportunity for the acquiring firm to implement value-creation strategies, and often a focus on operational improvements or market expansion to drive future returns. Unlike recapitalization, which involves restructuring a company's debt and equity mix to optimize capital structure, SBOs emphasize ownership transition within the private equity ecosystem.

Differences Between Recapitalization and Secondary Buyout

Recapitalization involves restructuring a company's debt and equity mix to optimize capital structure without changing ownership, while a secondary buyout occurs when one private equity firm sells its stake to another. Recapitalization aims to improve financial stability or fund growth, whereas a secondary buyout facilitates ownership transfer and strategic realignment. Differences lie in objectives, with recapitalization centered on capital strategy and secondary buyout focused on changing control and investor exit opportunities.

Situations Best Suited for Recapitalization

Recapitalization is best suited for companies seeking to stabilize their capital structure during periods of financial distress or to fund growth without full ownership transfer. It allows existing shareholders to retain control while raising capital from new or existing investors, making it ideal for businesses aiming to manage debt or finance expansions. This strategy often benefits family-owned firms or closely-held companies looking to optimize equity and debt balance without a complete exit.

When to Consider a Secondary Buyout

A secondary buyout should be considered when a private equity firm seeks to exit an investment but finds limited strategic buyers or IPO options available. This transaction allows one PE firm to sell its stake to another, providing liquidity while enabling continued growth under new management. Secondary buyouts are ideal in mature companies needing fresh capital or operational expertise to advance value creation.

Key Players Involved in Each Strategy

Recapitalization typically involves existing company shareholders, management teams, and financial institutions like private equity firms or banks that provide new capital to restructure the balance sheet. In a secondary buyout, the transaction primarily includes the selling private equity firm, the acquiring private equity firm, and the target company's management, with both firms focusing on portfolio optimization and value creation. Understanding the distinct roles of investors, management, and financiers in each strategy helps clarify the transactional dynamics and strategic objectives underlying recapitalizations and secondary buyouts.

Financial Implications: Recapitalization vs Secondary Buyout

Recapitalization restructures a company's capital structure to optimize debt and equity balance, often improving liquidity and reducing cost of capital. Secondary buyouts involve selling a portfolio company from one private equity firm to another, potentially leading to valuation premiums and increased transaction fees. Both impact financial metrics differently: recapitalization affects leverage ratios and shareholder value, while secondary buyouts influence ownership concentration and future exit opportunities.

Impact on Management and Ownership Structure

Recapitalization often allows existing management to retain significant control and equity stakes, providing flexibility in capital structure without a complete ownership turnover. Secondary buyouts involve a full transfer of ownership to another private equity firm, frequently resulting in management team changes or reduced ownership influence. The impact on management under recapitalization tends to be less disruptive, while secondary buyouts typically bring new strategic direction and ownership priorities.

Advantages and Risks of Recapitalization

Recapitalization offers advantages such as improved capital structure flexibility, enhanced shareholder returns, and the ability to refinance debt under favorable terms, which can stabilize the company's financial position. Risks include increased leverage leading to higher financial risk, potential dilution of existing shareholders, and the complexity of restructuring that may disrupt operations. Compared to secondary buyouts, recapitalization focuses more on restructuring capital rather than ownership changes, which can limit the impact on management control but may constrain long-term growth if debt levels become unsustainable.

Secondary Buyout: Benefits and Potential Drawbacks

Secondary buyouts offer private equity firms liquidity by enabling the sale of portfolio companies to other financial investors, often at an attractive valuation due to improved operational performance. This transaction type can provide strategic advantages, including portfolio diversification and extended investment horizons for acquiring firms. Potential drawbacks include risks of valuation inflation, transaction fees, and the possibility of limited operational improvements under continuous private equity ownership.

Recapitalization Infographic

libterm.com

libterm.com