Strategic alliances enable companies to combine resources and expertise, accelerating innovation and market expansion without the complexities of mergers. These partnerships enhance competitive advantage by leveraging complementary strengths and sharing risks. Discover how your business can benefit from forming a strategic alliance by reading the rest of this article.

Table of Comparison

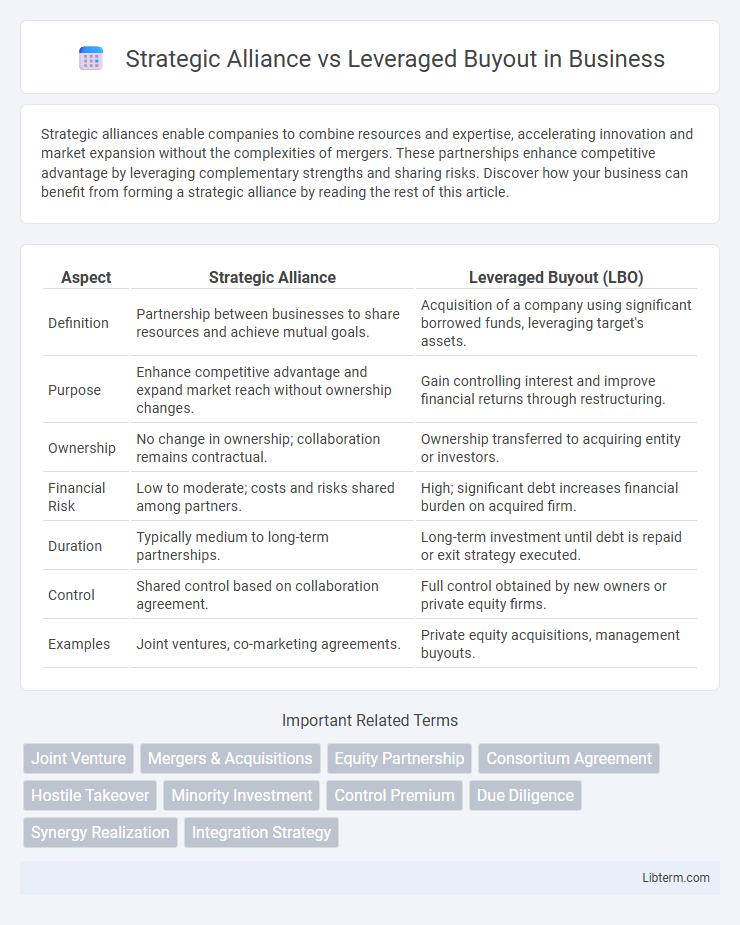

| Aspect | Strategic Alliance | Leveraged Buyout (LBO) |

|---|---|---|

| Definition | Partnership between businesses to share resources and achieve mutual goals. | Acquisition of a company using significant borrowed funds, leveraging target's assets. |

| Purpose | Enhance competitive advantage and expand market reach without ownership changes. | Gain controlling interest and improve financial returns through restructuring. |

| Ownership | No change in ownership; collaboration remains contractual. | Ownership transferred to acquiring entity or investors. |

| Financial Risk | Low to moderate; costs and risks shared among partners. | High; significant debt increases financial burden on acquired firm. |

| Duration | Typically medium to long-term partnerships. | Long-term investment until debt is repaid or exit strategy executed. |

| Control | Shared control based on collaboration agreement. | Full control obtained by new owners or private equity firms. |

| Examples | Joint ventures, co-marketing agreements. | Private equity acquisitions, management buyouts. |

Introduction to Strategic Alliances and Leveraged Buyouts

Strategic alliances involve partnerships between companies aimed at achieving mutual goals by sharing resources, expertise, and market access without merging ownership. Leveraged buyouts (LBOs) refer to the acquisition of a company using a significant amount of borrowed capital, typically secured by the target company's assets, to purchase equity and gain control. Both strategies are used for growth and value creation but differ fundamentally in structure, risk, and financial implications.

Defining Strategic Alliances

Strategic alliances are collaborative agreements between two or more companies to leverage shared resources, capabilities, or market access while remaining independent entities. These partnerships focus on achieving mutual benefits such as enhanced innovation, expanded distribution channels, or combined expertise without full ownership transfer. Unlike leveraged buyouts, which involve acquiring majority control through significant debt financing, strategic alliances emphasize cooperation and synergy without altering company ownership structures.

What is a Leveraged Buyout (LBO)?

A Leveraged Buyout (LBO) is a financial transaction where a company is acquired using a significant amount of borrowed money, often secured by the assets of the company being purchased. This strategy enables investors to control a larger company with a relatively small equity investment, aiming to improve the company's performance and eventually sell it for a profit. LBOs are distinct from strategic alliances, which involve partnerships for mutual benefit without ownership changes or high debt leverage.

Key Differences Between Strategic Alliances and LBOs

Strategic alliances involve collaboration between two or more companies to achieve mutually beneficial goals without creating a new entity, focusing on shared resources and market expansion. Leveraged buyouts (LBOs) occur when a company is acquired primarily using borrowed funds, emphasizing ownership control and financial restructuring. Key differences include the nature of partnership versus control acquisition, risk distribution, and financial structure, with alliances spreading risk and LBOs concentrating it through debt.

Advantages of Strategic Alliances

Strategic alliances offer advantages such as shared resources and expertise, enabling companies to enter new markets with reduced risk and lower capital investment compared to leveraged buyouts. They facilitate innovation and flexibility by allowing firms to collaborate on specific projects without full ownership commitments. This approach enhances competitive positioning through synergy while preserving operational independence.

Benefits of Leveraged Buyouts

Leveraged buyouts (LBOs) offer significant benefits, including enabling investors to acquire undervalued companies using minimal equity and substantial debt, which can amplify returns on investment. They facilitate operational restructuring and management incentives, aligning interests to enhance company performance and profitability. LBOs also provide opportunities for improved cash flow management and asset utilization, driving long-term value creation for stakeholders.

Risks Involved in Strategic Alliances vs LBOs

Strategic alliances face risks such as cultural clashes, misaligned objectives, and potential loss of proprietary information due to the collaborative nature of partnerships. Leveraged buyouts (LBOs) inherently carry financial risks including high debt burdens, interest rate fluctuations, and potential asset liquidation if cash flows underperform. While strategic alliances emphasize operational and relational risks, LBOs predominantly present significant financial and market-driven vulnerabilities.

When to Choose a Strategic Alliance

Choose a strategic alliance when companies aim to share resources, technology, or market access without full ownership transfer, enabling flexibility and risk-sharing. Strategic alliances are ideal for entering new markets, co-developing products, or enhancing competitive advantage while maintaining independence. In contrast, leveraged buyouts require substantial capital investment and control transfer, suited for full acquisition and restructuring scenarios.

Ideal Scenarios for Leveraged Buyouts

Leveraged buyouts (LBOs) are ideal in scenarios where a company has stable cash flows and tangible assets to serve as collateral for acquiring debt, enabling private equity firms to enhance returns through financial leverage. Companies undergoing operational restructuring or those undervalued in the market present prime opportunities for LBOs, allowing investors to implement strategic improvements and unlock value. LBOs are less suitable for companies in volatile industries or with significant intangible assets, where unpredictable cash flows increase financial risk.

Conclusion: Strategic Alliance or Leveraged Buyout?

Strategic alliances offer flexibility and shared resources without full ownership transfer, ideal for companies seeking collaboration and risk-sharing. Leveraged buyouts provide complete control and the potential for high returns, but involve significant financial risk and debt. Choosing between a strategic alliance and a leveraged buyout depends on a firm's risk tolerance, capital availability, and long-term growth objectives.

Strategic Alliance Infographic

libterm.com

libterm.com