Gross profit margin measures the percentage of revenue remaining after deducting the cost of goods sold, reflecting a company's efficiency in managing production costs. Higher margins indicate greater profitability and effective cost control, crucial for sustainable business growth. Explore the rest of this article to understand how optimizing your gross profit margin can enhance financial performance.

Table of Comparison

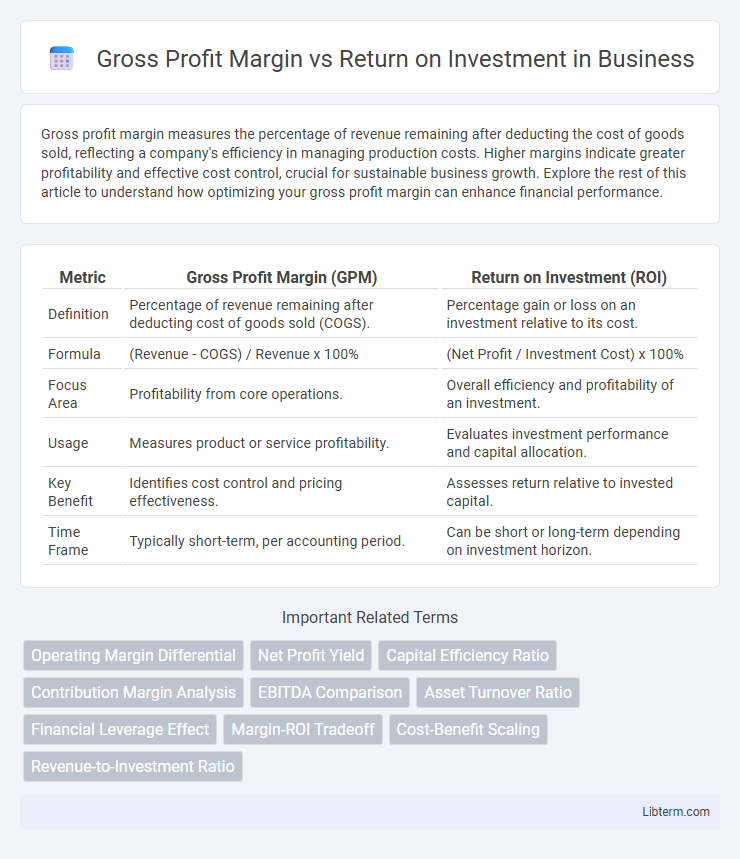

| Metric | Gross Profit Margin (GPM) | Return on Investment (ROI) |

|---|---|---|

| Definition | Percentage of revenue remaining after deducting cost of goods sold (COGS). | Percentage gain or loss on an investment relative to its cost. |

| Formula | (Revenue - COGS) / Revenue x 100% | (Net Profit / Investment Cost) x 100% |

| Focus Area | Profitability from core operations. | Overall efficiency and profitability of an investment. |

| Usage | Measures product or service profitability. | Evaluates investment performance and capital allocation. |

| Key Benefit | Identifies cost control and pricing effectiveness. | Assesses return relative to invested capital. |

| Time Frame | Typically short-term, per accounting period. | Can be short or long-term depending on investment horizon. |

Introduction to Gross Profit Margin and Return on Investment

Gross Profit Margin measures the percentage of revenue remaining after deducting the cost of goods sold, indicating a company's efficiency in production and pricing strategies. Return on Investment (ROI) evaluates the profitability of an investment by comparing net profit to the initial cost, reflecting overall financial performance and capital utilization. Both metrics provide essential insights for assessing business profitability and guiding strategic financial decisions.

Defining Gross Profit Margin

Gross Profit Margin measures the percentage of revenue that exceeds the cost of goods sold, reflecting a company's core profitability before operating expenses. It is calculated by dividing gross profit by total revenue and indicates how efficiently a business produces and sells its products. Understanding Gross Profit Margin is essential for assessing product pricing strategies and operational efficiency in comparison to the broader financial metric of Return on Investment (ROI).

Understanding Return on Investment

Return on Investment (ROI) measures the efficiency of an investment by comparing net profit to the initial cost, providing a clear indicator of profitability relative to investment amount. Unlike Gross Profit Margin, which reflects profitability from sales after deducting the cost of goods sold, ROI encompasses total returns, including operating expenses and other investment costs. Understanding ROI helps businesses assess overall financial performance and make informed decisions about allocating capital to maximize long-term value.

Key Differences Between Gross Profit Margin and ROI

Gross Profit Margin measures the percentage of revenue remaining after deducting the cost of goods sold, focusing on operational efficiency and pricing strategy. Return on Investment (ROI) assesses the profitability of an investment relative to its cost, providing a broader perspective on overall financial performance and capital utilization. Key differences include Gross Profit Margin's emphasis on core profit generation within sales cycles, while ROI evaluates the effectiveness of total investments in generating returns.

How to Calculate Gross Profit Margin

Gross Profit Margin is calculated by subtracting the Cost of Goods Sold (COGS) from total revenue, then dividing the result by total revenue and multiplying by 100 to express it as a percentage. This metric indicates the percentage of revenue that exceeds the direct costs of producing goods or services, reflecting operational efficiency. Unlike Return on Investment (ROI), which measures overall profitability relative to investment costs, Gross Profit Margin specifically focuses on core product profitability before other expenses.

How to Calculate Return on Investment

Return on Investment (ROI) is calculated by dividing the net profit from an investment by the initial cost of the investment and then multiplying the result by 100 to express it as a percentage. For example, if an investment yields a net profit of $10,000 and the initial cost was $50,000, the ROI would be (10,000 / 50,000) x 100 = 20%. Understanding ROI helps businesses evaluate the efficiency of capital allocated compared to gross profit margin, which measures profitability relative to revenue.

Importance in Financial Analysis

Gross Profit Margin measures the percentage of revenue retained after deducting the cost of goods sold, highlighting operational efficiency and pricing strategy effectiveness. Return on Investment (ROI) quantifies the profitability of investments by comparing net returns to the invested capital, essential for evaluating asset performance and strategic decisions. Both metrics provide critical insights for financial analysis, enabling businesses to optimize profit generation and resource allocation.

Impact on Business Decision-Making

Gross Profit Margin measures the efficiency of production and pricing strategies by indicating the percentage of revenue exceeding the cost of goods sold, crucial for short-term pricing decisions and cost control. Return on Investment (ROI) evaluates the overall profitability relative to the capital invested, guiding long-term strategic decisions such as capital allocation and project selection. Businesses prioritize Gross Profit Margin to optimize operational efficiency while leveraging ROI to assess the viability and potential returns of investments, ensuring balanced financial growth.

Common Mistakes When Comparing Gross Profit Margin and ROI

Confusing gross profit margin, which measures profitability from core operations, with return on investment (ROI), which evaluates overall efficiency of capital use, is a frequent error. Comparing these metrics without adjusting for business scale or investment scope leads to misleading conclusions about financial health. Ignoring the impact of fixed costs and non-operating expenses further distorts the assessment between gross profit margin and ROI.

Choosing the Right Metric for Your Business Goals

Gross Profit Margin measures the efficiency of production and pricing by indicating the percentage of revenue exceeding cost of goods sold, ideal for businesses prioritizing operational profitability. Return on Investment (ROI) evaluates overall financial performance by comparing net profit to the total invested capital, suited for assessing the effectiveness of capital allocation and strategic initiatives. Selecting the right metric depends on whether your business goal is optimizing core operations or maximizing returns from investments and growth opportunities.

Gross Profit Margin Infographic

libterm.com

libterm.com