An Initial Public Offering (IPO) marks the first sale of a company's shares to the public, allowing it to raise capital for expansion and increase its market visibility. Understanding the IPO process, valuation methods, and market impact is crucial for making informed investment decisions. Explore the rest of the article to learn how an IPO can influence your investment strategy and the overall financial market.

Table of Comparison

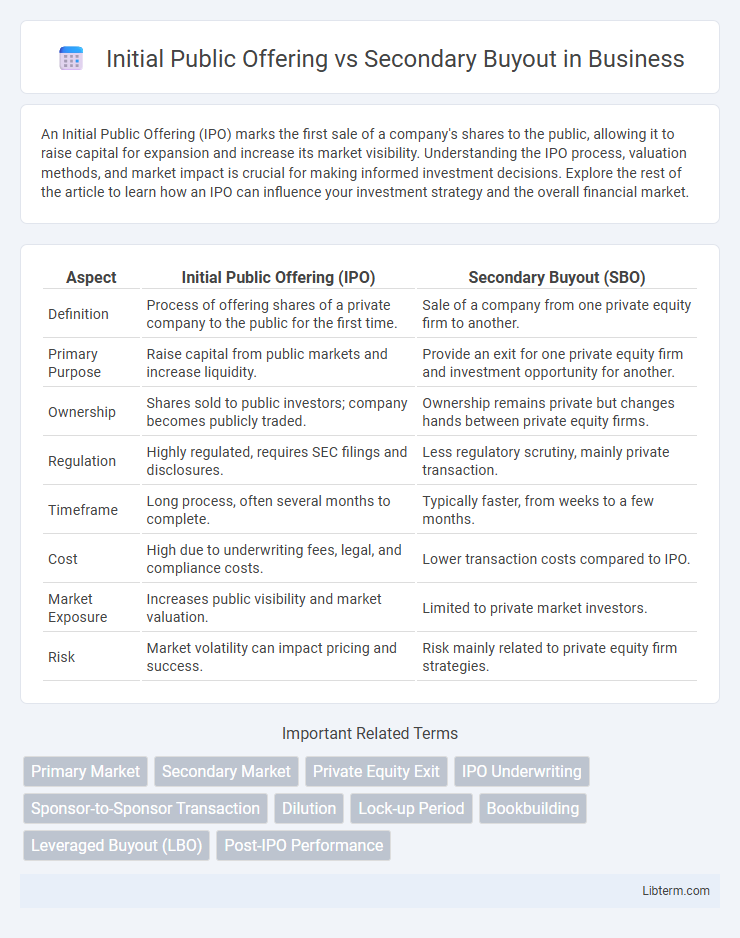

| Aspect | Initial Public Offering (IPO) | Secondary Buyout (SBO) |

|---|---|---|

| Definition | Process of offering shares of a private company to the public for the first time. | Sale of a company from one private equity firm to another. |

| Primary Purpose | Raise capital from public markets and increase liquidity. | Provide an exit for one private equity firm and investment opportunity for another. |

| Ownership | Shares sold to public investors; company becomes publicly traded. | Ownership remains private but changes hands between private equity firms. |

| Regulation | Highly regulated, requires SEC filings and disclosures. | Less regulatory scrutiny, mainly private transaction. |

| Timeframe | Long process, often several months to complete. | Typically faster, from weeks to a few months. |

| Cost | High due to underwriting fees, legal, and compliance costs. | Lower transaction costs compared to IPO. |

| Market Exposure | Increases public visibility and market valuation. | Limited to private market investors. |

| Risk | Market volatility can impact pricing and success. | Risk mainly related to private equity firm strategies. |

Introduction to Initial Public Offering (IPO)

An Initial Public Offering (IPO) is the process by which a private company offers shares to the public for the first time, enabling it to raise capital and expand its operations. IPOs provide liquidity for early investors and increase the company's visibility and credibility in the financial markets. This method contrasts with a Secondary Buyout, where private equity firms sell their stakes in a company to another private equity buyer, rather than entering public markets.

Understanding Secondary Buyout (SBO)

A Secondary Buyout (SBO) occurs when a private equity firm sells a portfolio company to another private equity firm rather than taking it public through an Initial Public Offering (IPO). SBOs provide an alternative exit strategy that enables firms to realize returns while transferring ownership within private markets. Unlike IPOs, which involve listing shares on public exchanges for broader investor access, SBOs maintain transactions within the private equity ecosystem.

Key Differences Between IPO and SBO

An Initial Public Offering (IPO) involves a private company offering shares to the public for the first time, allowing it to raise capital and gain market exposure. In contrast, a Secondary Buyout (SBO) occurs when one private equity firm sells a portfolio company to another private equity firm, focusing on ownership transfer without public market involvement. IPOs emphasize public market entry and regulatory compliance, whereas SBOs prioritize private equity portfolio management and value maximization.

Process Overview: IPO vs Secondary Buyout

An Initial Public Offering (IPO) involves a private company offering its shares to the public for the first time, requiring extensive regulatory filings, underwriting by investment banks, and market valuation to facilitate public trading. A Secondary Buyout occurs when one private equity firm sells its stake in a company to another private equity firm, focusing on negotiated terms, due diligence, and transfer of ownership without public market involvement. The IPO process emphasizes transparency and broad investor access, while Secondary Buyouts center on private negotiations and strategic portfolio management.

Advantages of Choosing an IPO

Choosing an Initial Public Offering (IPO) enables companies to access substantial capital markets, raising significant funds for expansion, debt reduction, or innovation. IPOs enhance corporate visibility and credibility, attracting new investors, customers, and strategic partners while providing liquidity options for early shareholders. Public listing also facilitates better market valuation and enables the use of stock as currency for acquisitions or employee incentives.

Benefits of Opting for a Secondary Buyout

A Secondary Buyout offers benefits such as providing liquidity to existing shareholders while enabling the company to access new capital and strategic guidance from a fresh investor. This approach often involves less market volatility and regulatory complexity compared to an Initial Public Offering (IPO), allowing for a more controlled and flexible transaction process. Moreover, secondary buyouts can accelerate growth by leveraging the operational expertise of the new private equity owner without the pressures of public market scrutiny.

Risks and Challenges of IPOs

Initial Public Offerings (IPOs) face significant risks including market volatility, regulatory scrutiny, and pricing uncertainty that can impact the company's valuation and investor confidence. Companies undergoing an IPO often encounter challenges such as extensive disclosure requirements, potential loss of control, and pressure to meet quarterly earnings expectations. These factors contrast with Secondary Buyouts, where private equity firms typically manage risks through established valuations and fewer public market constraints.

Risks and Challenges of Secondary Buyouts

Secondary buyouts carry risks such as overvaluation due to repeated asset flipping, increased leverage leading to financial instability, and potential regulatory scrutiny affecting deal timelines. These transactions often face challenges in achieving value creation, as subsequent buyers may struggle to implement operational improvements or exit strategies efficiently. Market volatility and limited transparency can hinder accurate asset appraisal, escalating the risk profile compared to initial public offerings.

Choosing the Right Exit Strategy: IPO or SBO?

Choosing the right exit strategy depends on factors such as market conditions, company maturity, and investor goals, with Initial Public Offerings (IPOs) offering access to public capital and increased liquidity, while Secondary Buyouts (SBOs) involve selling to another private equity firm, providing a potentially faster, less volatile exit. IPOs typically require extensive regulatory compliance, higher costs, and transparency, making them suitable for companies ready for public scrutiny and long-term growth. SBOs offer flexibility and confidentiality, appealing to firms seeking a quicker turnaround without public market pressures.

Conclusion: Comparing IPO and Secondary Buyout

Initial Public Offerings (IPOs) provide companies with access to public capital markets, enhancing liquidity and brand visibility, while Secondary Buyouts involve private equity firms selling companies to other private equity investors, often enabling operational improvements without public market pressures. IPOs typically offer greater valuation transparency and regulatory scrutiny, whereas Secondary Buyouts prioritize strategic repositioning and long-term value creation within private equity networks. Choosing between IPO and Secondary Buyout depends on factors like market conditions, growth stage, and the company's desire for public exposure versus private strategic realignment.

Initial Public Offering Infographic

libterm.com

libterm.com