Seed fund refers to the initial capital provided to startup companies to support early development and market research efforts. This funding is crucial for transforming innovative ideas into viable products or services, often covering expenses like product design, business setup, and early marketing. Discover how seed funding can accelerate Your startup journey and the key strategies to secure it in the rest of this article.

Table of Comparison

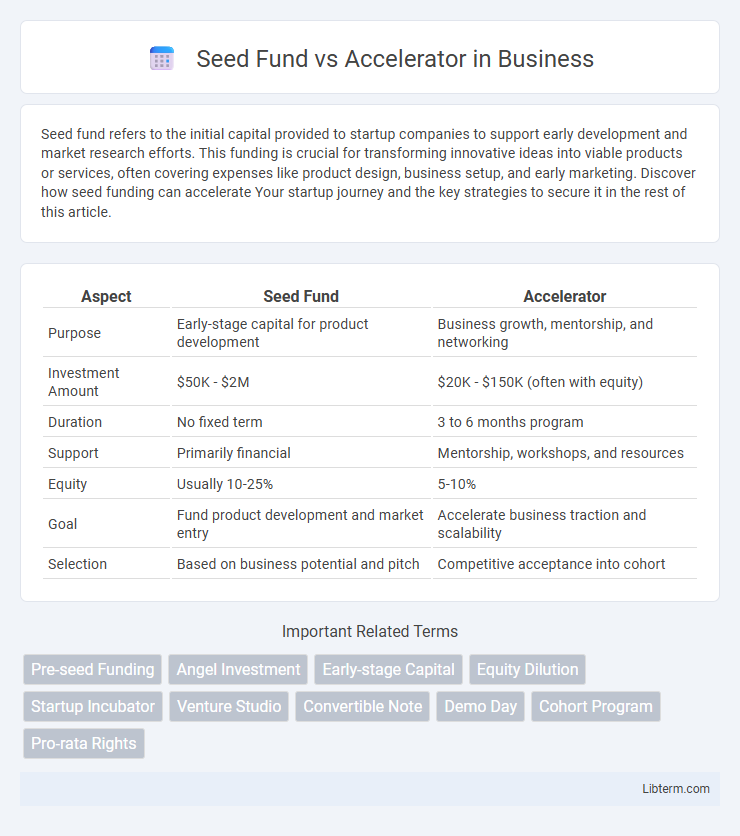

| Aspect | Seed Fund | Accelerator |

|---|---|---|

| Purpose | Early-stage capital for product development | Business growth, mentorship, and networking |

| Investment Amount | $50K - $2M | $20K - $150K (often with equity) |

| Duration | No fixed term | 3 to 6 months program |

| Support | Primarily financial | Mentorship, workshops, and resources |

| Equity | Usually 10-25% | 5-10% |

| Goal | Fund product development and market entry | Accelerate business traction and scalability |

| Selection | Based on business potential and pitch | Competitive acceptance into cohort |

Introduction to Seed Funds and Accelerators

Seed funds provide early-stage capital to startups, typically in exchange for equity, supporting product development and market research. Accelerators offer structured programs that include mentorship, resources, and networking opportunities, culminating in a demo day to attract further investment. Both aim to accelerate startup growth but differ in funding scale, support structure, and program duration.

Key Differences Between Seed Funds and Accelerators

Seed funds provide early-stage capital to startups in exchange for equity, often focusing on financial investment and longer-term support, while accelerators offer structured mentorship programs, resources, and networking opportunities within a fixed timeframe. Seed funds typically require startups to have a developed business model or prototype, whereas accelerators accept startups at even earlier stages to fast-track product-market fit. The primary difference lies in seed funds emphasizing funding and equity stakes, contrasting with accelerators' emphasis on intensive guidance and rapid growth within cohorts.

How Seed Funds Work: Structure and Process

Seed funds operate by providing early-stage capital to startups in exchange for equity, typically during the initial phase of product development or market research. These funds are usually structured as limited partnerships, where fund managers raise capital from investors and allocate it through multiple investment rounds, focusing on scaling business prototypes. The process involves rigorous due diligence, term sheet negotiations, and active involvement in company strategy to ensure startups achieve key milestones for future funding rounds.

The Accelerator Model: What Startups Can Expect

The Accelerator model provides startups with intensive mentorship, structured programs, and access to investor networks over a fixed period, typically 3 to 6 months, designed to rapidly scale business growth. Startups can expect seed funding in exchange for equity, cohort-based learning environments, and demo days that showcase progress to potential investors. This model emphasizes accelerated development through expert guidance, strategic partnerships, and validation within a compressed timeframe.

Funding Amounts: Seed Fund vs Accelerator

Seed funds typically provide early-stage startups with funding amounts ranging from $50,000 to $2 million, focusing on initial product development and market fit. Accelerators generally offer smaller investments, usually between $20,000 and $150,000, combined with intensive mentorship and a fixed program duration. Funding from seed funds often comes with fewer programmatic obligations compared to accelerators, which emphasize rapid growth and cohort-based learning.

Support Beyond Capital: Mentorship and Resources

Seed funds provide early-stage startups with crucial capital alongside access to experienced investors who offer strategic guidance and industry connections. Accelerators deliver structured mentorship programs, workshops, and networking events designed to accelerate growth within a fixed timeframe, often with resources like office space and technology support. Both models emphasize support beyond financing, but accelerators typically offer a more intensive, hands-on approach to mentorship and operational resources.

Selection Criteria for Startups

Seed Fund selection criteria for startups focus on early-stage innovation potential, market viability, and the founding team's expertise, emphasizing scalable business models with clear growth paths. Accelerators prioritize startups with demonstrable traction, product-market fit, and the capacity to benefit from structured mentorship and intensive program resources within a fixed timeframe. Both evaluate market size and competitive advantage, but accelerators often seek commitment to rapid development and active participation in cohort-based environments.

Examples of Leading Seed Funds and Accelerators

Leading seed funds like Y Combinator and Sequoia Capital specialize in early-stage investments, providing startups with critical capital and mentorship to boost initial growth. Prominent accelerators such as Techstars and 500 Startups offer structured programs that combine funding, networking, and intensive training over a few months. Both seed funds and accelerators play vital roles in nurturing innovation, with seed funds focusing more on financial backing and accelerators emphasizing hands-on development and market readiness.

Choosing the Right Option for Your Startup

Choosing between a seed fund and an accelerator depends on your startup's specific needs and stage of development. Seed funds provide direct capital investment, ideal for startups requiring larger funding to scale quickly, while accelerators offer mentorship, networking, and structured programs that help early-stage companies refine their business models. Evaluate your growth goals, required resources, and desired support system to determine which option aligns best with your startup's trajectory.

Conclusion: Which Path Fits Your Startup’s Needs?

Choosing between seed funding and an accelerator depends on your startup's development stage and growth goals. Seed funds provide essential capital to fuel early-stage product development and initial market entry, while accelerators offer structured mentorship, networking opportunities, and rapid scaling support. Founders seeking capital infusion combined with strategic guidance and industry connections often find accelerators more beneficial, whereas startups prioritizing flexible funding to refine their business model may lean toward seed funding.

Seed Fund Infographic

libterm.com

libterm.com