Divestiture is the strategic process where a company sells off or liquidates a portion of its assets, business units, or subsidiaries to streamline operations or raise capital. It often aims to improve financial health, focus on core competencies, or comply with regulatory requirements. Explore the rest of the article to understand how divestiture can impact your business strategy and financial outcomes.

Table of Comparison

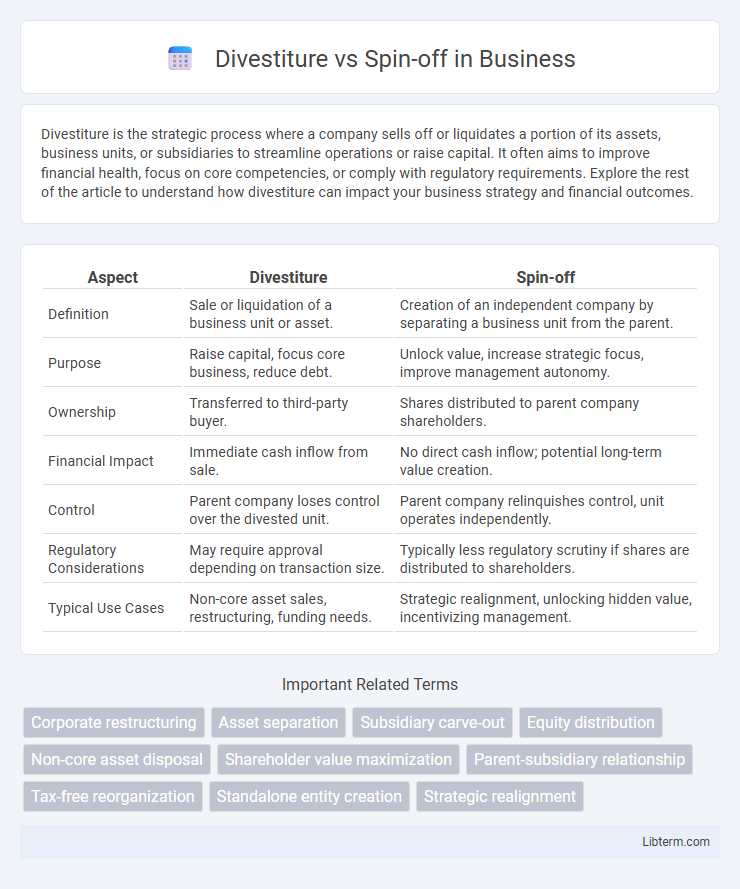

| Aspect | Divestiture | Spin-off |

|---|---|---|

| Definition | Sale or liquidation of a business unit or asset. | Creation of an independent company by separating a business unit from the parent. |

| Purpose | Raise capital, focus core business, reduce debt. | Unlock value, increase strategic focus, improve management autonomy. |

| Ownership | Transferred to third-party buyer. | Shares distributed to parent company shareholders. |

| Financial Impact | Immediate cash inflow from sale. | No direct cash inflow; potential long-term value creation. |

| Control | Parent company loses control over the divested unit. | Parent company relinquishes control, unit operates independently. |

| Regulatory Considerations | May require approval depending on transaction size. | Typically less regulatory scrutiny if shares are distributed to shareholders. |

| Typical Use Cases | Non-core asset sales, restructuring, funding needs. | Strategic realignment, unlocking hidden value, incentivizing management. |

Introduction to Divestiture and Spin-off

Divestiture involves a company selling or liquidating a business unit or asset to streamline operations, improve financial health, or focus on core activities. Spin-off refers to creating an independent company by distributing shares of a subsidiary or division to existing shareholders, enabling focused management and potential market value growth. Both strategies serve as corporate restructuring tools to enhance shareholder value and operational efficiency.

Definitions: What is a Divestiture?

A divestiture is a corporate strategy where a company sells, liquidates, or disposes of a business unit, subsidiary, asset, or product line to streamline operations, reduce debt, or focus on core competencies. It involves transferring ownership to another company or entity, often through a sale or auction, enabling the divesting firm to raise capital or improve financial health. Divestitures differ from spin-offs in that ownership is transferred to an external party rather than distributing shares to existing shareholders.

Definitions: What is a Spin-off?

A spin-off is a corporate strategy where a parent company creates an independent company by distributing new shares of an existing business unit to its current shareholders. This process enables the spun-off entity to operate as a separate organization with its own management and financial structure, often enhancing focus and unlocking shareholder value. Spin-offs differ from divestitures, where assets or business units are sold outright to external buyers instead of being distributed to shareholders.

Key Differences Between Divestiture and Spin-off

Divestiture involves a company selling or liquidating a business unit or asset to third parties, often to streamline operations or raise capital. Spin-offs create an independent company by distributing shares of a subsidiary to existing shareholders, maintaining ownership separation without external sale. Key differences include divestiture's focus on external sale or liquidation versus spin-off's method of ownership separation and creation of a new, stand-alone entity without immediate cash transaction.

Strategic Reasons for Divestitures

Divestitures strategically enable companies to streamline operations by selling non-core or underperforming assets, thereby improving focus on core competencies and enhancing overall financial health. They facilitate capital generation that can be reinvested into higher-growth areas, driving innovation and competitive advantage. Divestitures also help mitigate risks by shedding business units that face regulatory challenges, market volatility, or declining profitability.

Strategic Reasons for Spin-offs

Spin-offs strategically enable companies to unlock shareholder value by separating non-core or underperforming divisions, allowing each entity to focus on its distinct market opportunities and operational efficiencies. This separation often leads to increased managerial focus, improved resource allocation, and enhanced agility for the spun-off company to innovate and grow independently. Firms pursue spin-offs to streamline portfolios, reduce complexity, and respond more swiftly to competitive pressures or regulatory environments.

Financial Implications: Divestiture vs Spin-off

Divestitures generate immediate cash flow through the outright sale of business units, often improving short-term liquidity and reducing debt, whereas spin-offs typically create separate publicly traded companies, unlocking shareholder value over time without immediate cash inflow. Spin-offs can result in tax advantages for parent companies and shareholders, while divestitures may trigger significant capital gains taxes depending on transaction structure. Both strategies impact balance sheets differently: divestitures reduce asset base instantly, whereas spin-offs allocate assets and liabilities to the new entity, influencing financial ratios and investor perceptions.

Impact on Shareholders and Stakeholders

Divestitures typically lead to immediate changes in shareholder value by redistributing assets or cash, often providing liquidity or focusing the company's core operations, which can enhance long-term shareholder returns. Spin-offs create independent entities whose shares are directly distributed to existing shareholders, potentially unlocking hidden value and allowing stakeholders to invest selectively in distinct businesses. Both strategies impact stakeholders differently: divestitures may result in job restructuring or realignment of supplier relationships, while spin-offs often maintain operational continuity but demand stakeholder adaptation to new corporate structures.

Case Studies: Successful Divestitures and Spin-offs

Successful divestitures like eBay's spin-off of PayPal in 2015 unlocked significant shareholder value and improved operational focus. Similarly, Hewlett-Packard's 2015 spin-off of its enterprise business created distinct entities with tailored strategies, enhancing market responsiveness. These case studies demonstrate how strategic divestitures and spin-offs can optimize core competencies and drive growth by allowing companies to concentrate on their primary business areas.

Choosing the Right Strategy: Divestiture or Spin-off?

Choosing the right strategy between divestiture and spin-off depends on the company's financial goals, market positioning, and operational focus. Divestiture involves selling a business unit to streamline core operations and generate immediate capital, often favored for rapid restructuring or debt reduction. Spin-offs create independent companies by distributing shares to existing shareholders, preserving value for long-term growth while maintaining some level of strategic separation.

Divestiture Infographic

libterm.com

libterm.com