Convertible stock offers investors the unique advantage of converting preferred shares into a predetermined number of common shares, combining the benefits of fixed dividends with potential equity growth. This financial instrument allows companies to raise capital while providing shareholders flexibility and a hedge against market volatility. Explore the article to understand how convertible stock can enhance your investment portfolio and the key factors to consider before investing.

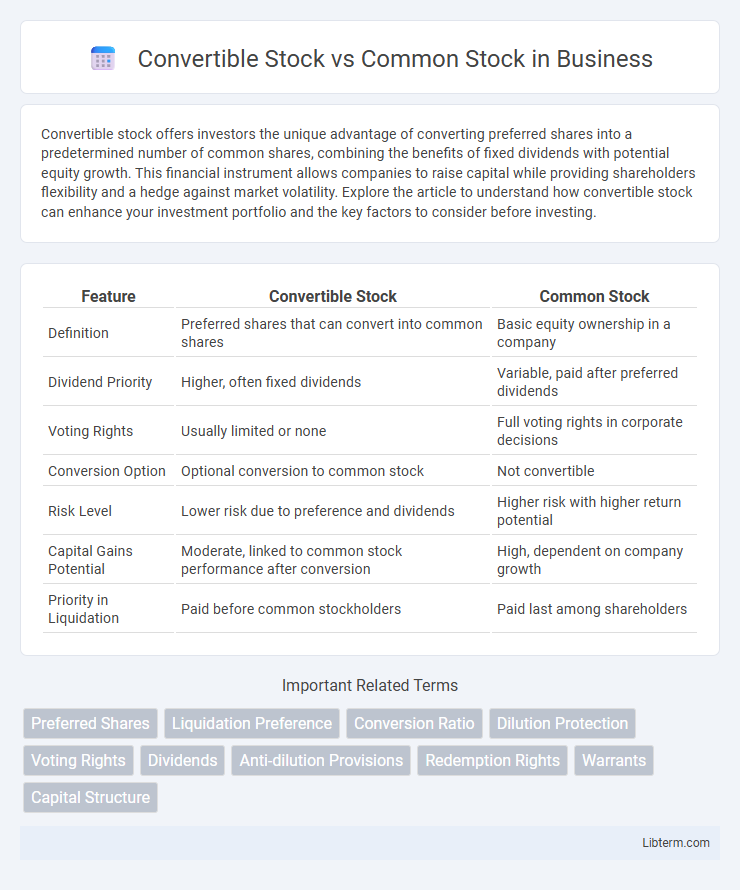

Table of Comparison

| Feature | Convertible Stock | Common Stock |

|---|---|---|

| Definition | Preferred shares that can convert into common shares | Basic equity ownership in a company |

| Dividend Priority | Higher, often fixed dividends | Variable, paid after preferred dividends |

| Voting Rights | Usually limited or none | Full voting rights in corporate decisions |

| Conversion Option | Optional conversion to common stock | Not convertible |

| Risk Level | Lower risk due to preference and dividends | Higher risk with higher return potential |

| Capital Gains Potential | Moderate, linked to common stock performance after conversion | High, dependent on company growth |

| Priority in Liquidation | Paid before common stockholders | Paid last among shareholders |

Introduction to Convertible Stock and Common Stock

Convertible stock is a type of preferred stock that investors can convert into a predetermined number of common stock shares, offering potential upside participation while maintaining some priority in dividends and liquidation. Common stock represents ownership equity, giving shareholders voting rights and a claim on residual company profits after preferred dividends are paid. The choice between convertible stock and common stock impacts risk, return, and control considerations for investors and companies alike.

Key Differences Between Convertible and Common Stock

Convertible stock offers the unique feature of converting into a predetermined number of common stock shares, providing investors potential equity upside, whereas common stock represents direct ownership with voting rights and dividends. Convertible stock typically carries lower dividend yields and less volatility compared to common stock, benefiting investors seeking reduced risk and income stability. The conversion option in convertible stock creates a hybrid security that combines fixed income characteristics with equity participation, distinguishing it from the straightforward ownership of common stock.

How Convertible Stock Works

Convertible stock allows investors to convert their preferred shares into a predetermined number of common shares, providing potential upside if the company's common stock price rises. The conversion ratio and timing are specified in the stock agreement, enabling holders to benefit from equity appreciation while retaining some preferred stock advantages like fixed dividends. This hybrid feature makes convertible stock a strategic option for investors seeking both income stability and capital gains.

How Common Stock Functions

Common stock represents ownership in a corporation, granting shareholders voting rights and potential dividends. Unlike convertible stock, common stock does not have a conversion feature or preferential treatment in dividend payments and liquidation preference. Investors in common stock benefit from capital appreciation directly tied to the company's performance and market valuation.

Advantages of Convertible Stock

Convertible stock offers investors the advantage of fixed dividend payments similar to preferred shares while retaining the potential upside of converting into common stock at a predetermined ratio. This hybrid feature provides downside protection through priority in dividends and asset claims during liquidation, enhancing financial security. The embedded option to convert allows shareholders to participate in equity appreciation without immediate risk, combining income stability with growth potential.

Benefits of Common Stock Ownership

Common stock ownership grants shareholders voting rights, allowing influence over corporate decisions and board elections. It also offers the potential for dividends and capital appreciation as the company grows. Unlike convertible stock, common stock provides direct participation in the company's profits and residual assets during liquidation.

Risks and Downsides of Convertible Stock

Convertible stock carries risks such as dilution of common shareholders' equity when conversions occur, reducing existing ownership percentages. Investors face uncertainty due to fluctuating conversion values linked to the underlying common stock price, potentially limiting upside gains if the common stock underperforms. Furthermore, convertible stockholders typically have lower dividend yields and limited voting rights compared to common stock, which may diminish income and influence in corporate decisions.

Potential Drawbacks of Common Stock

Common stock holders face potential drawbacks such as diluted ownership and limited control during company expansion or additional financing rounds. In contrast to convertible stock, common stock typically lacks the option to convert into preferred shares or debt, reducing flexibility in capital structure management. Additionally, common stockholders often have lower priority in dividend payments and asset liquidation compared to holders of convertible or preferred stock.

When to Choose Convertible Stock Over Common Stock

Convertible stock is ideal for investors seeking potential equity upside with downside protection, as it can be converted into common stock under favorable market conditions. Companies often issue convertible stock during early funding rounds to attract investors by offering the option to convert shares while initially providing fixed dividends or preferential treatment. Opt for convertible stock when expecting company growth coupled with risk management, making it preferable over common stock that carries higher volatility without guaranteed returns.

Conclusion: Which Stock Type Is Right for You?

Convertible stock offers the advantage of fixed dividends with the potential to convert into common stock, providing both stability and upside potential, while common stock grants voting rights and direct participation in company growth but with higher risk and volatility. Investors seeking steady income and downside protection may prefer convertible stock, whereas those aiming for long-term capital appreciation and influence in corporate decisions might choose common stock. Assess your risk tolerance, investment horizon, and preference for income versus growth to determine the optimal stock type for your portfolio.

Convertible Stock Infographic

libterm.com

libterm.com