Venture capital fuels innovation by providing startups with the essential funding needed to scale their operations and enter new markets. Investors assess high-growth potential companies, balancing risk with the opportunity for substantial returns. Explore this article to understand how venture capital can transform your business ambitions and shape the future of industries.

Table of Comparison

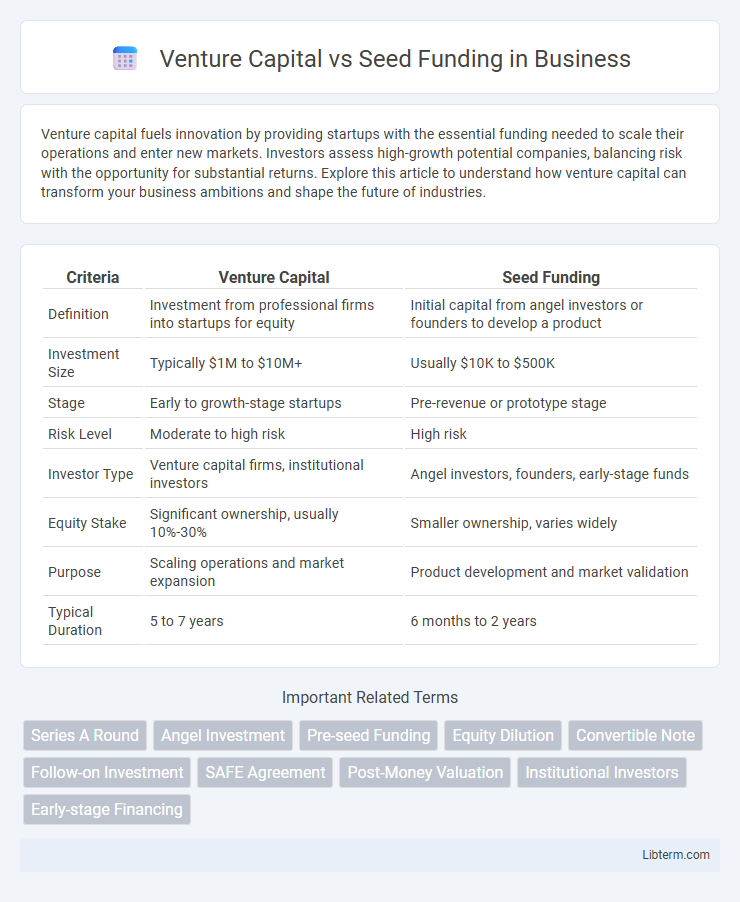

| Criteria | Venture Capital | Seed Funding |

|---|---|---|

| Definition | Investment from professional firms into startups for equity | Initial capital from angel investors or founders to develop a product |

| Investment Size | Typically $1M to $10M+ | Usually $10K to $500K |

| Stage | Early to growth-stage startups | Pre-revenue or prototype stage |

| Risk Level | Moderate to high risk | High risk |

| Investor Type | Venture capital firms, institutional investors | Angel investors, founders, early-stage funds |

| Equity Stake | Significant ownership, usually 10%-30% | Smaller ownership, varies widely |

| Purpose | Scaling operations and market expansion | Product development and market validation |

| Typical Duration | 5 to 7 years | 6 months to 2 years |

Introduction to Venture Capital and Seed Funding

Venture capital involves investing larger sums of money in startups with high growth potential, typically during later funding rounds, to accelerate business expansion and market reach. Seed funding is the initial capital raised to develop a business idea, covering early expenses like product development and market research before attracting major investors. Both funding types play crucial roles in the startup lifecycle, with seed funding enabling concept validation and venture capital driving scaling and commercialization.

Defining Venture Capital: Key Characteristics

Venture capital is a form of private equity financing provided by firms or individual investors to early-stage, high-potential startups in exchange for equity. Key characteristics include substantial funding amounts, active investor involvement in company growth, and a focus on scalability and exit strategies such as IPOs or acquisitions. Unlike seed funding, venture capital is typically sought after initial product development has shown traction and requires more rigorous due diligence and business maturity.

Understanding Seed Funding: Essentials and Purpose

Seed funding is the initial capital raised by startups to develop a prototype, conduct market research, and validate business ideas before scaling operations. It typically comes from angel investors, seed funds, or early-stage venture capitalists aiming to support product development and market entry. Understanding seed funding enables entrepreneurs to strategize resource allocation effectively and attract subsequent investment rounds.

Stages of Startup Funding: Where VC and Seed Fit

Seed funding typically represents the initial capital used to validate a startup's idea, develop a prototype, and attract early users, often sourced from angel investors or early-stage venture funds. Venture capital usually enters during later stages, such as Series A or beyond, when the startup has demonstrated product-market fit and requires significant funding to scale operations, expand teams, and penetrate larger markets. Understanding these stages helps founders strategically target the right type of investor to match their startup's growth phase and funding needs.

Amounts Raised: Seed Funding vs Venture Capital

Seed funding typically ranges from $25,000 to $2 million, providing early-stage startups with the capital needed to develop prototypes and validate business models. Venture capital investments are significantly larger, often between $2 million and $30 million, aimed at scaling businesses with proven traction and substantial market potential. The disparity in funding amounts reflects the different risk profiles and development stages targeted by seed investors and venture capitalists.

Investor Profiles: Who Offers Seed and VC Funding?

Seed funding primarily comes from angel investors, early-stage venture funds, and startup accelerators that focus on high-risk, high-reward opportunities in nascent companies. Venture capital investors, including institutional VC firms and corporate venture arms, typically engage in later stages, prioritizing startups with proven traction and scalable business models. Both investor profiles assess market potential and team expertise, but seed funders emphasize innovation potential while VCs focus on growth metrics and exit strategies.

Equity and Ownership Implications

Venture capital typically involves larger investments in exchange for significant equity stakes, often diluting founders' ownership but providing critical growth capital and strategic support. Seed funding generally offers smaller capital amounts with less equity surrendered, allowing founders to retain more control during early development stages. Understanding the percentage of ownership given up in each funding round is crucial for founders aiming to balance control with necessary financial resources.

Risks and Rewards: Comparative Analysis

Venture capital offers substantial funding with potential for high returns but comes with increased risk due to larger capital involvement and possible dilution of control. Seed funding involves lower investment amounts, reducing financial risk while providing early-stage support to validate business ideas, yet it offers limited immediate scaling potential. Comparing both, venture capital suits startups aiming for rapid growth and market capture, whereas seed funding is ideal for initial development with manageable risk exposure.

Decision Factors: Choosing Between Seed and VC Funding

Decision factors between seed funding and venture capital primarily hinge on the startup's growth stage, capital requirements, and risk tolerance. Seed funding suits early-stage companies needing smaller amounts to develop prototypes or validate concepts, often involving friends, family, or angel investors. Venture capital targets startups with proven traction seeking substantial funds for scaling operations, requiring extensive due diligence and offering strategic support but demanding equity and control considerations.

Conclusion: Which Funding Option is Right for Your Startup?

Choosing between venture capital and seed funding depends on your startup's stage, growth potential, and capital needs; seed funding suits early-stage ventures seeking smaller amounts to validate ideas, while venture capital targets startups ready for rapid expansion with substantial capital. Evaluate factors such as equity dilution, investor involvement, and long-term business goals to determine the ideal funding path. Aligning the funding option with your startup's vision and operational requirements ensures sustainable growth and maximizes value creation.

Venture Capital Infographic

libterm.com

libterm.com