Venture capital fuels innovative startups by providing essential funding and strategic support to accelerate growth and market entry. This investment focuses on high-potential companies with scalable business models and disruptive technologies. Discover how venture capital can transform your entrepreneurial journey by exploring the insights ahead.

Table of Comparison

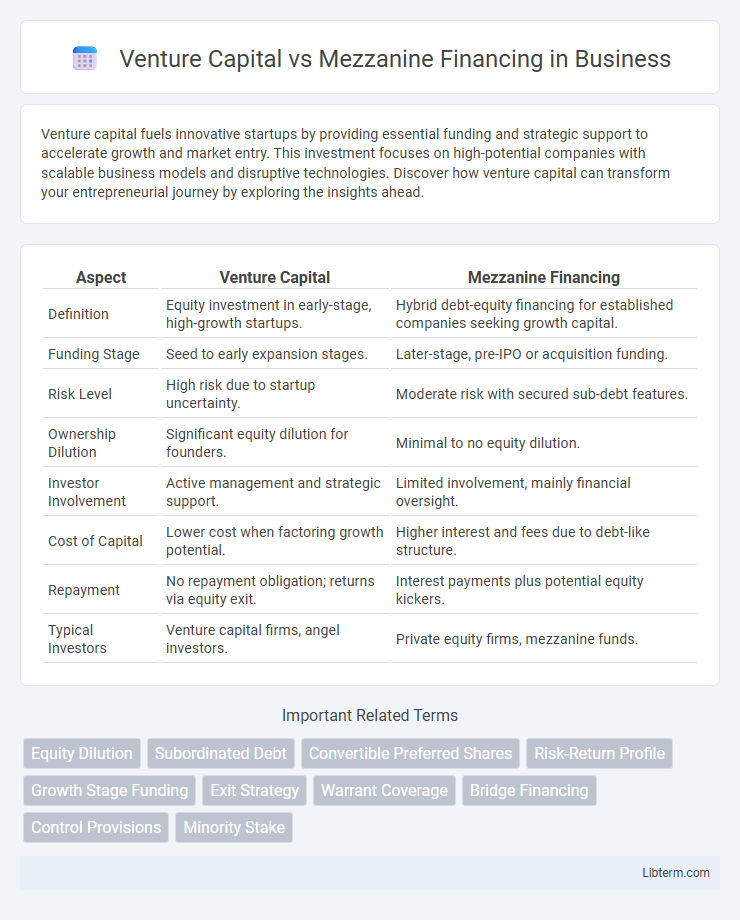

| Aspect | Venture Capital | Mezzanine Financing |

|---|---|---|

| Definition | Equity investment in early-stage, high-growth startups. | Hybrid debt-equity financing for established companies seeking growth capital. |

| Funding Stage | Seed to early expansion stages. | Later-stage, pre-IPO or acquisition funding. |

| Risk Level | High risk due to startup uncertainty. | Moderate risk with secured sub-debt features. |

| Ownership Dilution | Significant equity dilution for founders. | Minimal to no equity dilution. |

| Investor Involvement | Active management and strategic support. | Limited involvement, mainly financial oversight. |

| Cost of Capital | Lower cost when factoring growth potential. | Higher interest and fees due to debt-like structure. |

| Repayment | No repayment obligation; returns via equity exit. | Interest payments plus potential equity kickers. |

| Typical Investors | Venture capital firms, angel investors. | Private equity firms, mezzanine funds. |

Introduction to Venture Capital and Mezzanine Financing

Venture capital involves investing equity in early-stage, high-growth startups in exchange for ownership stakes, typically to fuel innovation and rapid expansion. Mezzanine financing is a hybrid of debt and equity that provides capital to more mature companies seeking growth or acquisitions, often structured as subordinated debt with warrants or conversion options. Both financing methods play critical roles in the capital structure, with venture capital emphasizing risk and growth potential, while mezzanine financing balances risk with fixed returns and potential equity upside.

Defining Venture Capital: Key Features

Venture capital involves equity financing provided to early-stage, high-growth startups with significant risk and high return potential, often in technology or innovative sectors. Key features include active investor involvement in business decisions, funding rounds tied to milestones, and a focus on rapid scaling and exit strategies like IPOs or acquisitions. Unlike mezzanine financing, venture capital does not require collateral and dilutes ownership but offers substantial growth funding and strategic support.

Understanding Mezzanine Financing: Core Concepts

Mezzanine financing is a hybrid capital instrument combining features of debt and equity, typically used by companies to finance expansion without diluting control. It often involves subordinated debt with embedded equity options such as warrants, offering investors higher returns than traditional debt while providing flexible repayment terms for the borrower. Unlike venture capital, which focuses on early-stage equity investment, mezzanine financing serves mature companies seeking growth capital with less ownership relinquishment.

Funding Stages: When Each Option Is Used

Venture capital funding is typically used during early funding stages such as seed and Series A rounds to fuel rapid growth and product development for startups with high growth potential. Mezzanine financing is more common in later funding stages, especially during expansion or pre-IPO phases, providing subordinated debt with equity conversion features to companies looking to scale operations without diluting ownership significantly. Choosing between these options depends on the company's maturity, risk profile, and capital structure goals.

Typical Investors in Venture Capital vs Mezzanine Financing

Typical investors in venture capital include angel investors, early-stage venture capital firms, and institutional investors seeking high-growth potential startups. Mezzanine financing investors are often private equity firms, hedge funds, and specialized mezzanine funds focused on more mature companies with established cash flows. Venture capital investors prioritize equity stakes and potential high returns, while mezzanine investors seek hybrid debt-equity instruments with lower risk and steady income.

Risk Profiles and Return Expectations

Venture capital typically involves high risk as investors finance early-stage startups with uncertain market potential, expecting substantial returns often exceeding 20-30% annually. Mezzanine financing carries moderate risk, positioned between debt and equity, offering returns in the range of 12-20%, frequently through interest payments and equity kickers. The risk profile of venture capital reflects equity loss in failure scenarios, whereas mezzanine financing often includes collateral and priority claims, reducing downside exposure.

Ownership Dilution and Control Implications

Venture capital involves exchanging equity for funding, resulting in significant ownership dilution and shared control with investors who often seek board seats and strategic influence. Mezzanine financing typically combines debt with a smaller equity component, causing less ownership dilution while allowing original owners to retain greater operational control. The choice between these financing methods hinges on the company's willingness to dilute ownership versus maintaining control while accessing flexible capital.

Investment Structures: Equity vs Debt Instruments

Venture capital primarily involves equity investments where investors acquire ownership stakes in early-stage companies, sharing both risks and rewards through stock or shares. Mezzanine financing combines debt and equity features, often structured as subordinated debt with embedded equity options like warrants or conversion rights, providing lenders potential upside while retaining priority in repayment. This hybrid structure makes mezzanine financing a flexible option for growth-stage companies seeking capital without immediate dilution of control.

Exit Strategies and Time Horizons

Venture capital typically targets high-growth startups with exit strategies centered on initial public offerings (IPOs) or acquisitions within 5 to 7 years, emphasizing liquidity events that maximize return on equity. In contrast, mezzanine financing serves as subordinated debt for mature companies seeking expansion capital, with exit options including debt repayment, equity conversion, or recapitalization, generally spanning a 3 to 5-year horizon. The time horizon difference reflects venture capital's focus on rapid scale and equity stakes, whereas mezzanine financing balances debt and equity elements with shorter, more predictable exit timelines.

Choosing the Right Financing: Factors to Consider

Evaluating the choice between venture capital and mezzanine financing requires assessing company growth stage, risk tolerance, and capital needs. Venture capital suits early-stage startups seeking equity investment and strategic support, whereas mezzanine financing benefits mature businesses aiming for expansion with less equity dilution. Key factors include cost of capital, control implications, repayment terms, and investor expectations.

Venture Capital Infographic

libterm.com

libterm.com