Private equity investors specialize in acquiring equity ownership in private companies, aiming to enhance value through strategic management and operational improvements. Their investments typically focus on long-term growth and profitability, often involving restructuring or scaling businesses. Discover how private equity investors can impact your financial strategies by reading the full article.

Table of Comparison

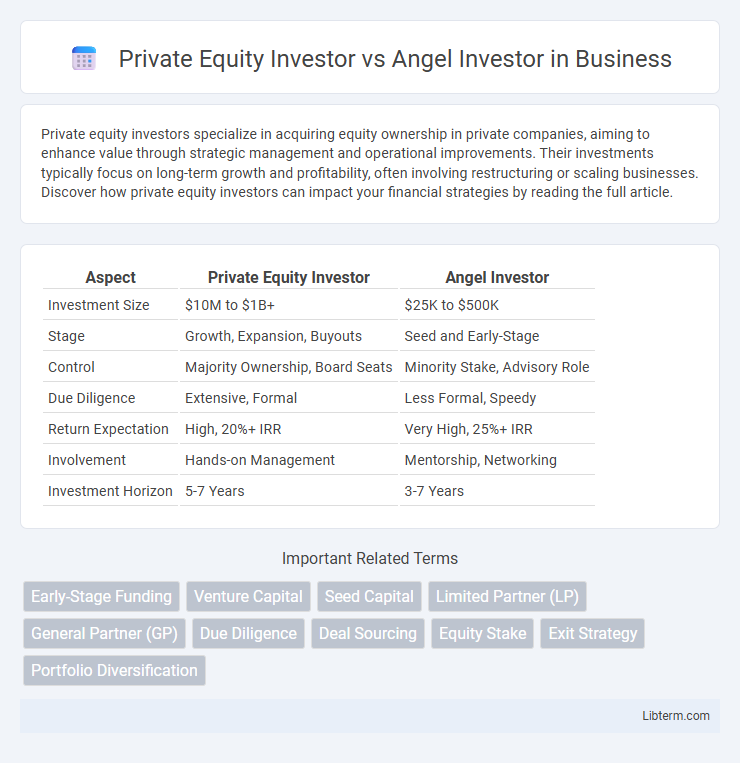

| Aspect | Private Equity Investor | Angel Investor |

|---|---|---|

| Investment Size | $10M to $1B+ | $25K to $500K |

| Stage | Growth, Expansion, Buyouts | Seed and Early-Stage |

| Control | Majority Ownership, Board Seats | Minority Stake, Advisory Role |

| Due Diligence | Extensive, Formal | Less Formal, Speedy |

| Return Expectation | High, 20%+ IRR | Very High, 25%+ IRR |

| Involvement | Hands-on Management | Mentorship, Networking |

| Investment Horizon | 5-7 Years | 3-7 Years |

Understanding Private Equity Investors

Private equity investors typically invest larger sums of capital into established companies with proven business models, aiming for significant ownership stakes and long-term value creation. They conduct rigorous financial due diligence and seek companies with strong growth potential or those needing operational improvements for turnaround. Unlike angel investors who provide early-stage funding, private equity firms focus on scaling or restructuring businesses to maximize returns before an eventual exit.

What Is an Angel Investor?

An angel investor is an individual who provides early-stage capital to startups in exchange for equity ownership, often taking higher risks than traditional investors. They typically invest smaller amounts compared to private equity firms but offer valuable mentorship and industry connections to help startups grow. Angel investors play a crucial role in bridging the funding gap between friends-and-family rounds and larger venture capital or private equity investments.

Key Differences Between Private Equity and Angel Investors

Private equity investors typically manage large funds and invest substantial capital in established companies aiming for significant control and long-term growth, while angel investors usually provide smaller amounts of personal money to early-stage startups in exchange for equity or convertible debt. Private equity focuses on mature businesses with proven revenue streams, emphasizing operational improvements and exit strategies such as IPOs or buyouts, whereas angel investors often take higher risks by supporting innovative ideas and founders in their nascent stages. The involvement level also varies; private equity firms conduct extensive due diligence and implement strategic management, unlike angel investors who may offer mentorship and networking support but less formal oversight.

Investment Stages: Early vs. Late-Stage Funding

Private equity investors typically focus on late-stage funding, investing substantial capital in established companies seeking expansion, restructuring, or market consolidation. Angel investors provide early-stage funding, offering smaller amounts of capital to startups and emerging businesses during their initial development phases. This distinction impacts risk tolerance, investment involvement, and expected returns between the two types of investors.

Typical Investment Sizes and Structures

Private equity investors typically commit larger capital amounts, often ranging from $10 million to several hundred million dollars, focusing on majority stakes and structured deal terms such as leveraged buyouts or growth capital. Angel investors usually invest smaller sums, generally between $25,000 and $500,000, often participating in early-stage funding rounds with equity stakes or convertible notes. The investment structure for private equity involves extensive due diligence, formal governance rights, and exit strategies, whereas angel investments tend to be more flexible, informal, and founder-friendly with less stringent control provisions.

Due Diligence Approaches

Private equity investors conduct extensive due diligence that includes in-depth financial analysis, market evaluation, legal audits, and management assessments to mitigate risks in substantial investments. Angel investors typically perform a more streamlined due diligence process focusing on founder background, product viability, and initial market potential, often relying on personal judgment and networks. The rigorous, data-driven approach of private equity contrasts with the more relational and intuition-based due diligence common among angel investors.

Involvement and Influence on Portfolio Companies

Private equity investors typically exert significant control and strategic influence over portfolio companies by often acquiring majority stakes and actively participating in management decisions to drive growth and operational improvements. Angel investors usually provide early-stage funding with less direct involvement, offering guidance and mentorship while allowing founders to maintain control. The level of influence from private equity investors is generally deeper and more hands-on compared to the advisory and financial support role commonly seen with angel investors.

Risk Tolerance and Return Expectations

Private equity investors typically exhibit moderate to high risk tolerance with expectations of substantial returns generated from mature companies through leveraged buyouts or growth capital. Angel investors accept higher risk, often investing in early-stage startups with uncertain prospects but potential for exponential returns. The risk-return profile of private equity is generally more balanced and longer-term compared to the high volatility and immediate scale potential favored by angel investors.

Exit Strategies for Private Equity and Angel Investors

Private equity investors typically pursue exit strategies such as initial public offerings (IPOs), mergers and acquisitions (M&A), or secondary sales to achieve substantial returns on their investments. Angel investors often exit through early-stage company buyouts or subsequent funding rounds led by venture capitalists, capitalizing on the startup's growth trajectory. Both investor types aim to maximize returns, but private equity favors structured, large-scale exits while angels rely on the company's early market validation events.

Choosing the Right Investor for Your Business

Selecting the right investor for your business depends on factors such as investment size, control preferences, and growth stage. Private equity investors typically provide larger capital infusions, demand significant equity shares, and seek substantial influence in management decisions, making them suitable for established companies aiming for rapid expansion. Angel investors offer smaller funding amounts, with more flexible terms and mentorship, fitting early-stage startups looking for guidance alongside financial support.

Private Equity Investor Infographic

libterm.com

libterm.com