Selling concessions can significantly enhance the appeal of a property by offering buyers financial incentives such as closing cost assistance or repair credits. These concessions make your listing more competitive in a crowded market while potentially speeding up the sale process. Explore the full article to learn how selling concessions can work to your advantage in today's real estate environment.

Table of Comparison

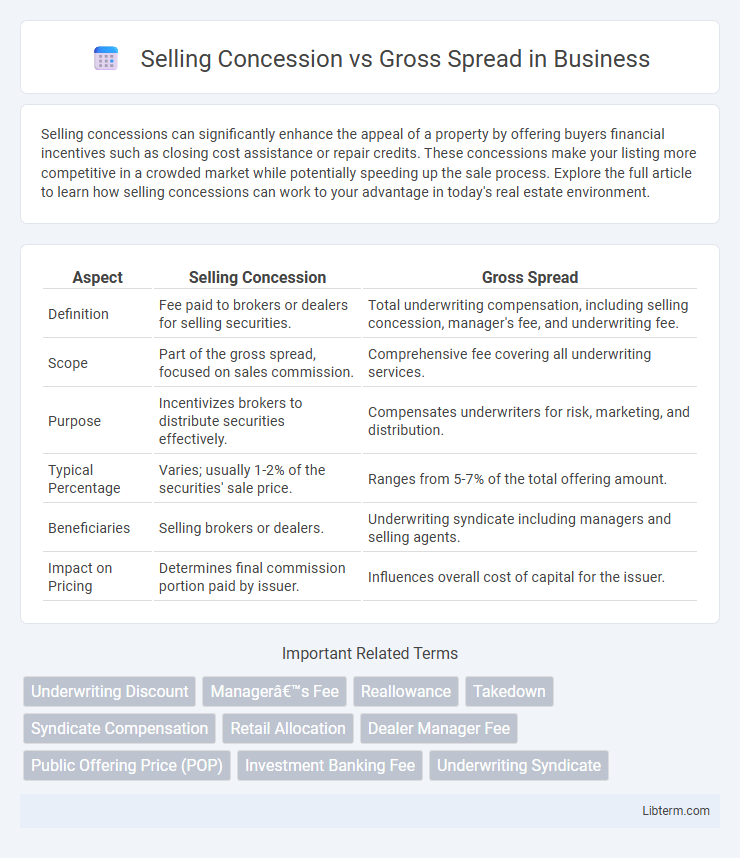

| Aspect | Selling Concession | Gross Spread |

|---|---|---|

| Definition | Fee paid to brokers or dealers for selling securities. | Total underwriting compensation, including selling concession, manager's fee, and underwriting fee. |

| Scope | Part of the gross spread, focused on sales commission. | Comprehensive fee covering all underwriting services. |

| Purpose | Incentivizes brokers to distribute securities effectively. | Compensates underwriters for risk, marketing, and distribution. |

| Typical Percentage | Varies; usually 1-2% of the securities' sale price. | Ranges from 5-7% of the total offering amount. |

| Beneficiaries | Selling brokers or dealers. | Underwriting syndicate including managers and selling agents. |

| Impact on Pricing | Determines final commission portion paid by issuer. | Influences overall cost of capital for the issuer. |

Introduction to Selling Concession and Gross Spread

Selling concession refers to the fee paid to underwriters or brokers for distributing securities during an offering, incentivizing them to sell shares to investors. Gross spread represents the total underwriting compensation, encompassing the selling concession, manager fee, and additional expenses deducted from the offering proceeds. Understanding the distinction between selling concession and gross spread is crucial for evaluating the cost structure and profitability of securities issuance.

Key Definitions in Investment Banking Fees

Selling concession in investment banking refers to the fee paid to brokers or underwriters for distributing securities to investors, acting as compensation for their sales efforts. Gross spread represents the overall difference between the price at which underwriters buy securities from the issuer and the price at which they sell them to the public, encompassing the selling concession along with management and underwriting fees. Understanding these key definitions is essential for analyzing the cost structure and profitability of securities offerings in investment banking.

Components of Underwriting Compensation

Selling concession and gross spread are key components of underwriting compensation in securities offerings. The gross spread represents the total underwriting fee, usually expressed as a percentage of the offering size, which is divided among managers, selling group members, and dealers. Selling concessions specifically refer to the portion of the gross spread paid to brokers or dealers who directly sell shares to investors, incentivizing active distribution in the market.

Detailed Overview of Gross Spread

Gross spread represents the total compensation earned by underwriters for managing and distributing a security offering, typically expressed as a percentage of the total deal size. It encompasses several components including the underwriting fee, the management fee, and the selling concession, which is the portion paid to brokers who sell the securities. Understanding gross spread is essential for evaluating the costs associated with public offerings and comparing the financial impact on issuers across different underwriting syndicates.

Understanding Selling Concession

Understanding selling concession is crucial in investment banking as it represents the portion of the gross spread allocated to broker-dealers for distributing new securities to investors. This fee incentivizes underwriters to actively market and sell the offering, directly impacting the underwriting syndicate's compensation structure. Differentiating selling concession from other components of the gross spread, such as the manager's fee and underwriting fee, is essential for accurately evaluating the total underwriting costs and broker-dealer earnings.

Differences Between Gross Spread and Selling Concession

Gross spread represents the total underwriting fee earned by investment banks from a securities offering, encompassing both the selling concession and other fees like the management fee and underwriting fee. The selling concession refers specifically to the portion of the gross spread paid to brokers or dealers who actually sell the securities to investors. While gross spread captures the overall cost structure of the underwriting process, the selling concession isolates the direct compensation for the sales efforts within that structure.

Impact on Issuer’s Fundraising Costs

Selling concession directly reduces the issuer's net proceeds by increasing the underwriter's compensation, leading to higher fundraising costs. Gross spread encompasses the total fees paid to underwriters, including the selling concession, underwriting fee, and management fee, which collectively impact the issuer's expenses. A higher selling concession within the gross spread elevates the overall cost of capital, diminishing the funds available to the issuer from the offering.

Role in Syndicate Structure and Fee Allocation

Selling concession represents the portion of the underwriting spread allocated to syndicate members responsible for selling securities, directly incentivizing distribution efforts within the syndicate structure. Gross spread encompasses the total underwriting fee, including the management fee, underwriting fee, and selling concession, serving as the comprehensive compensation for the underwriting syndicate. The selling concession aligns fees with individual syndicate members' sales performance, while the gross spread reflects the overall cost and fee distribution among all underwriters involved.

Industry Practices and Regulatory Considerations

Selling concessions, typically a percentage of the gross spread, serve as commissions to underwriters for selling securities and vary based on deal size and market conditions. Industry practices dictate that a higher selling concession incentivizes brokers to actively market offerings, while regulatory frameworks, such as SEC Rule 415 and FINRA regulations, ensure transparency and fairness in allocation of gross spreads between management fees, underwriting fees, and selling concessions. Proper disclosure and adherence to these regulations mitigate conflicts of interest and maintain market integrity during public offerings.

Conclusion: Choosing Between Selling Concession and Gross Spread

Choosing between selling concession and gross spread depends on the issuer's objectives and market conditions. Selling concessions incentivize underwriters to actively market securities, enhancing distribution efficiency and potentially reducing the issuer's net cost. Gross spread determines the total underwriting compensation, affecting overall deal pricing, so issuers must balance rewarding underwriters with minimizing financing expenses.

Selling Concession Infographic

libterm.com

libterm.com