Employee Stock Purchase Plans (ESPPs) offer employees a valuable opportunity to buy company shares at a discounted price, fostering ownership and potential financial growth. Participating in an ESPP can enhance your long-term investment portfolio while aligning your interests with company success. Explore the full article to learn how to maximize the benefits of your Employee Stock Purchase Plan.

Table of Comparison

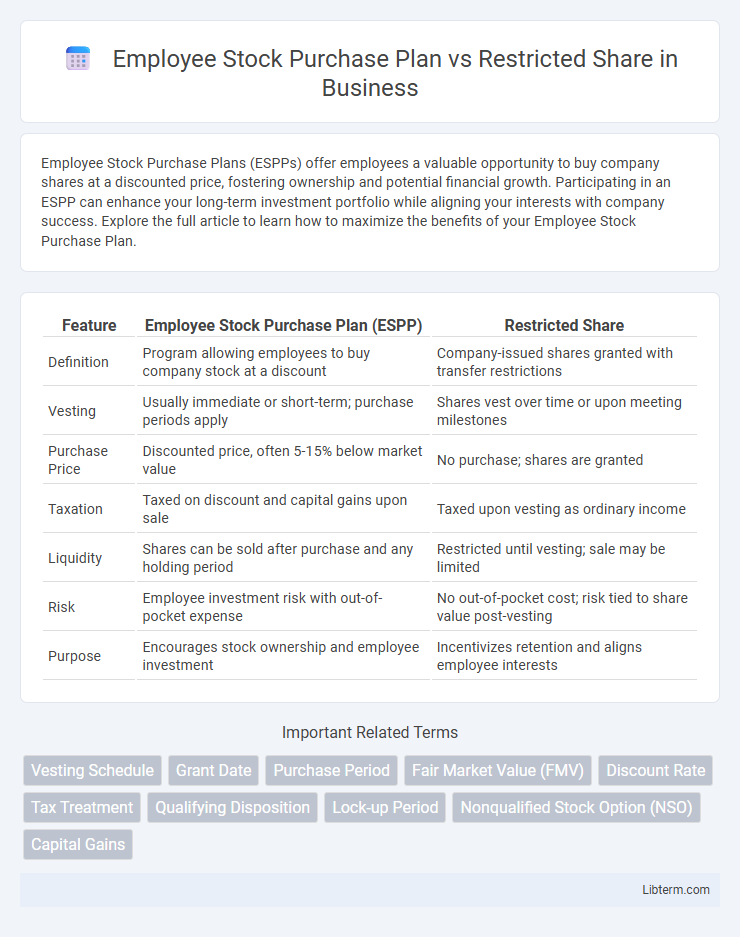

| Feature | Employee Stock Purchase Plan (ESPP) | Restricted Share |

|---|---|---|

| Definition | Program allowing employees to buy company stock at a discount | Company-issued shares granted with transfer restrictions |

| Vesting | Usually immediate or short-term; purchase periods apply | Shares vest over time or upon meeting milestones |

| Purchase Price | Discounted price, often 5-15% below market value | No purchase; shares are granted |

| Taxation | Taxed on discount and capital gains upon sale | Taxed upon vesting as ordinary income |

| Liquidity | Shares can be sold after purchase and any holding period | Restricted until vesting; sale may be limited |

| Risk | Employee investment risk with out-of-pocket expense | No out-of-pocket cost; risk tied to share value post-vesting |

| Purpose | Encourages stock ownership and employee investment | Incentivizes retention and aligns employee interests |

Introduction to Employee Stock Purchase Plans and Restricted Shares

Employee Stock Purchase Plans (ESPPs) allow employees to buy company stock at a discounted price, typically through payroll deductions, fostering employee ownership and aligning interests with shareholders. Restricted Shares are company stock granted to employees subject to vesting conditions, which encourage long-term retention and performance by tying stock ownership to continued employment or achieving specific milestones. Both compensation methods serve as powerful tools to motivate employees with equity incentives but differ in purchase process, risk exposure, and timing of equity ownership.

Key Definitions: ESPP vs Restricted Shares

Employee Stock Purchase Plans (ESPP) allow employees to buy company stock at a discounted price, typically through payroll deductions over a specific offering period, enhancing employee ownership and motivation. Restricted Shares are company stock granted to employees with conditions such as vesting periods and performance targets, ensuring alignment with long-term company goals. While ESPP provides an opportunity for stock purchase at a discount, Restricted Shares serve as a direct incentive tied to retention and performance milestones.

Eligibility Criteria for Participation

Employee Stock Purchase Plans (ESPPs) typically allow all eligible employees, often requiring a minimum tenure such as 30 to 90 days, to buy company stock at a discounted price through payroll deductions. Restricted Share Units (RSUs) are usually granted based on criteria like job level, performance, or tenure, with eligibility often limited to key employees or executives under specific vesting schedules. While ESPPs promote broad employee ownership, RSUs target retention and motivation of select talent through customized eligibility conditions.

How Employee Stock Purchase Plans Work

Employee Stock Purchase Plans (ESPPs) enable employees to buy company shares at a discounted rate, often through payroll deductions accumulated over a defined offering period. These plans typically include a look-back provision, allowing purchase at the lower price between the start or end of the offering period, maximizing potential gains. In contrast, Restricted Shares are granted outright but come with vesting conditions, whereas ESPPs require active employee participation to acquire shares.

Understanding Restricted Share Mechanisms

Restricted Shares grant employees actual ownership with conditions that limit transferability and impose vesting schedules, aligning their interests with company performance. Unlike Employee Stock Purchase Plans, which allow discounted stock purchases but not immediate ownership, Restricted Shares typically restrict dividends and voting rights until vesting criteria are met. Understanding the vesting period, forfeiture conditions, and tax implications is essential for maximizing benefits and managing risks associated with Restricted Share awards.

Tax Implications: ESPP vs Restricted Shares

Employee Stock Purchase Plans (ESPPs) offer tax advantages where employees can purchase shares at a discount, with favorable tax treatment if shares are held for more than one year after purchase and two years from the offering date, resulting in long-term capital gains on sale. Restricted Shares are typically taxed as ordinary income upon vesting based on the fair market value of the shares, and any subsequent gain in share price is taxed as capital gains when sold. The key tax difference is that ESPPs can provide deferred tax benefits with potential capital gains treatment, whereas Restricted Shares generate immediate income tax liability at vesting.

Vesting Schedules and Ownership Rights

Employee Stock Purchase Plans (ESPPs) typically allow employees to purchase company shares at a discount, with ownership rights granted immediately upon purchase, whereas restricted shares involve a vesting schedule that delays ownership until certain conditions, such as time-based or performance milestones, are met. ESPP shares often have fewer restrictions post-purchase, giving employees immediate voting rights and dividends, while restricted shares limit these rights until full vesting occurs. Understanding the differences in vesting schedules and ownership rights is crucial for employees to maximize benefits and make informed decisions about equity compensation.

Financial Benefits and Risks Comparison

Employee Stock Purchase Plans (ESPPs) allow employees to buy company shares at a discounted price, providing immediate financial benefits through potential cost savings and stock appreciation, while minimizing initial investment risk. Restricted Shares grant ownership of company stock subject to vesting conditions, offering long-term capital gains but exposing employees to risks related to stock price volatility and forfeiture if vesting requirements are unmet. ESPPs carry lower risk due to discounted purchase and liquidity upon purchase, whereas Restricted Shares offer greater upside potential paired with higher risk tied to performance and tenure commitments.

Impact on Employee Retention and Motivation

Employee Stock Purchase Plans (ESPPs) encourage employee retention by offering discounted company shares, fostering a sense of ownership and aligning employees' financial interests with company performance. Restricted Shares, often subject to vesting periods, serve as powerful retention tools by providing tangible incentives that employees only fully realize after remaining with the company for a certain duration. Both compensation strategies enhance motivation, but Restricted Shares typically drive longer-term commitment due to their conditional nature tied to continued employment.

Choosing the Right Equity Compensation: Factors to Consider

When choosing the right equity compensation between an Employee Stock Purchase Plan (ESPP) and Restricted Stock Units (RSUs), consider vesting schedules, tax implications, and liquidity options. ESPPs often provide discounted stock purchase opportunities with potential tax advantages but require employee investment and carry market risk, while RSUs grant shares subject to vesting conditions, offering guaranteed ownership upon fulfillment. Evaluating personal financial goals, risk tolerance, and company stock performance is crucial for optimizing compensation benefits.

Employee Stock Purchase Plan Infographic

libterm.com

libterm.com