SAFE protocols ensure the security of your data by implementing stringent encryption and access controls that protect against unauthorized breaches. Organizations adopting SAFE frameworks benefit from robust risk management strategies tailored to their specific operational needs. Explore the full article to learn how SAFE can enhance your cybersecurity posture effectively.

Table of Comparison

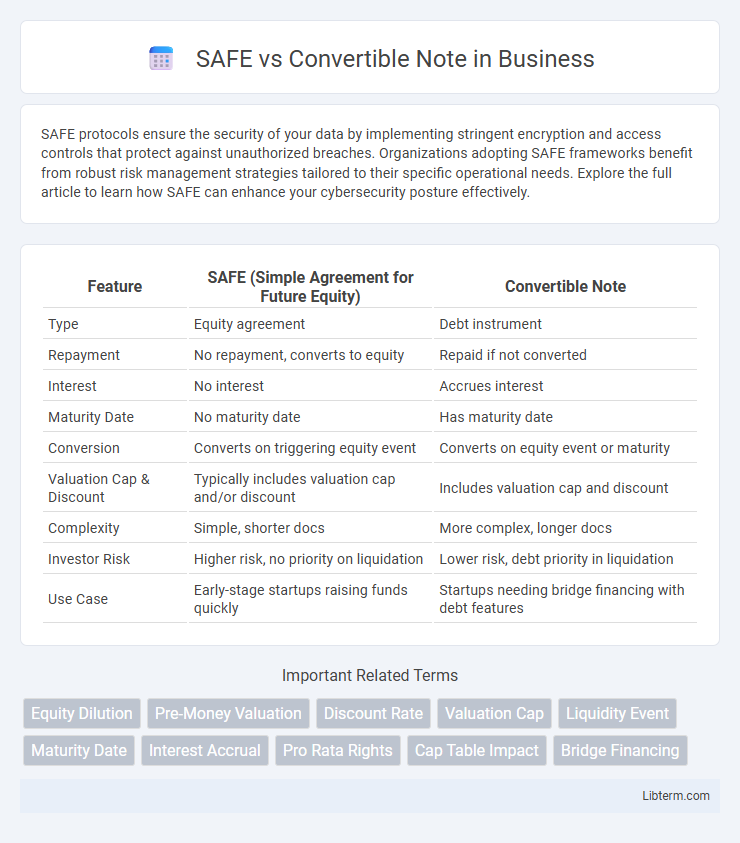

| Feature | SAFE (Simple Agreement for Future Equity) | Convertible Note |

|---|---|---|

| Type | Equity agreement | Debt instrument |

| Repayment | No repayment, converts to equity | Repaid if not converted |

| Interest | No interest | Accrues interest |

| Maturity Date | No maturity date | Has maturity date |

| Conversion | Converts on triggering equity event | Converts on equity event or maturity |

| Valuation Cap & Discount | Typically includes valuation cap and/or discount | Includes valuation cap and discount |

| Complexity | Simple, shorter docs | More complex, longer docs |

| Investor Risk | Higher risk, no priority on liquidation | Lower risk, debt priority in liquidation |

| Use Case | Early-stage startups raising funds quickly | Startups needing bridge financing with debt features |

Introduction to SAFE and Convertible Notes

SAFE (Simple Agreement for Future Equity) is an investment contract that allows startups to raise capital by providing investors with a future equity stake without setting a valuation at the time of investment. Convertible notes are debt instruments that convert into equity at a later financing round, typically including interest and a maturity date, blending debt and equity features. Both SAFE and convertible notes streamline early-stage startup funding but differ in terms of structure, investor rights, and potential dilution effects.

Key Differences Between SAFE and Convertible Notes

SAFE (Simple Agreement for Future Equity) and Convertible Notes are both investment instruments used by startups to raise capital without immediately setting a valuation. Key differences include that SAFEs do not accrue interest and have no maturity date, while Convertible Notes function as debt with interest and a specified maturity, requiring repayment or conversion by a deadline. Additionally, SAFEs offer simpler and faster agreements due to fewer legal complexities, whereas Convertible Notes often involve more detailed terms like interest rates and covenants.

How SAFEs Work: Structure and Mechanics

SAFEs (Simple Agreements for Future Equity) are agreements where investors provide capital in exchange for future equity without accruing interest or having a maturity date. The investment converts to equity during a qualified financing round, typically at a discount or valuation cap, allowing investors to benefit from a lower share price than new investors. SAFEs streamline fundraising by simplifying legal terms and eliminating debt features inherent in convertible notes, providing a more flexible and founder-friendly financing instrument.

How Convertible Notes Work: Structure and Mechanics

Convertible notes function as short-term debt instruments that convert into equity during a future financing round, typically at a discount or with a valuation cap to reward early investors. They accrue interest, which also converts into shares, aligning investor and company incentives by delaying valuation until a priced round occurs. The structure includes a maturity date, after which the note either converts or must be repaid, providing a balance between investor protection and startup flexibility.

Legal Considerations: SAFE vs Convertible Notes

SAFE agreements provide a simpler legal framework with fewer contractual terms and obligations, reducing negotiation time and legal costs compared to convertible notes. Convertible notes function as debt instruments with defined maturity dates and interest rates, which may create repayment or default risks, requiring more detailed legal scrutiny. Investors and startups must carefully evaluate these legal differences to align with their financing strategies and risk tolerance.

Investor Perspective: Pros and Cons of Each

SAFE agreements offer investors quicker deal closure and simplified terms, minimizing negotiation complexities and providing potential for high returns in startup equity. Convertible notes secure investor debt status with interest accrual and maturity dates, offering downside protection through repayment priority in liquidation but potentially complicating valuation during conversion. Investors weigh SAFE's upfront simplicity and equity upside against convertible notes' structured risk mitigation and clearer exit timelines.

Founder Perspective: Choosing the Right Instrument

Founders must evaluate the pros and cons of SAFEs and convertible notes to determine the best fundraising tool aligned with their startup's growth stage and risk profile. SAFEs offer simplicity and speed without interest accrual or maturity dates, reducing administrative burdens and founder stress during early fundraising. Convertible notes provide investor protection through interest and maturity terms, potentially affecting startup control and requiring founders to prepare for debt conversion scenarios.

Impact on Valuation and Dilution

SAFE agreements do not set a valuation cap or discount at the time of investment, leading to uncertainty in dilution until the next priced funding round occurs. Convertible notes typically include a valuation cap and discount rate, providing investors with more defined ownership percentages and potential dilution effects upon conversion. The choice between SAFE and convertible notes directly impacts founder dilution, investor equity stakes, and company valuation dynamics during subsequent financing events.

Common Use Cases for SAFE and Convertible Notes

SAFEs are commonly used in early-stage seed financings due to their simplicity and speed, enabling startups to raise capital without setting a valuation immediately. Convertible notes are often preferred in situations where investors seek debt-like protections such as interest accrual and maturity dates, typically in pre-seed or bridge rounds. Both instruments facilitate deferred equity conversion, but SAFEs are favored for straightforward seed rounds while convertible notes suit more structured financing with investor safeguards.

Which is Best for Your Startup: SAFE or Convertible Note?

SAFE agreements provide startups with a simpler, faster way to raise capital without accruing debt or interest, making them ideal for early-stage companies seeking minimal legal complexity. Convertible notes, while involving debt and interest, offer more investor protection and can be advantageous if the startup anticipates a longer fundraising timeline or prefers defined repayment terms. Choosing between SAFE and convertible notes depends on your startup's maturity, fundraising goals, and investor preferences, with SAFEs favored for quick, low-cost funding and convertible notes suited for structured agreements with potential debt implications.

SAFE Infographic

libterm.com

libterm.com