Private equity firms specialize in acquiring and managing private companies to enhance their value and generate substantial returns for investors. These firms deploy capital strategically through buyouts, growth funding, and restructurings, focusing on long-term profitability. Discover how private equity firms operate and the benefits they can bring to your investment portfolio by reading the rest of the article.

Table of Comparison

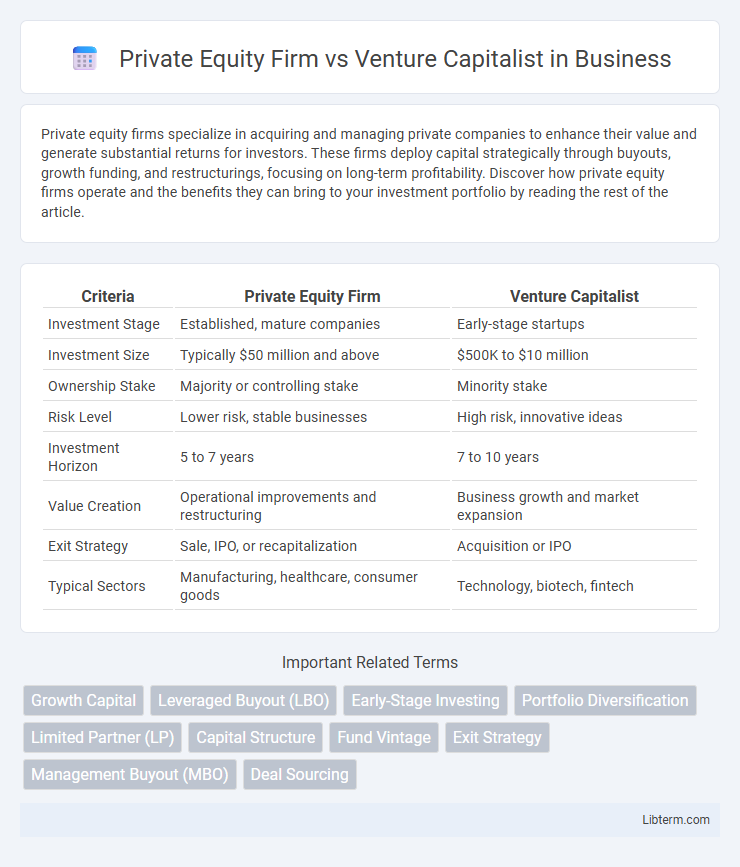

| Criteria | Private Equity Firm | Venture Capitalist |

|---|---|---|

| Investment Stage | Established, mature companies | Early-stage startups |

| Investment Size | Typically $50 million and above | $500K to $10 million |

| Ownership Stake | Majority or controlling stake | Minority stake |

| Risk Level | Lower risk, stable businesses | High risk, innovative ideas |

| Investment Horizon | 5 to 7 years | 7 to 10 years |

| Value Creation | Operational improvements and restructuring | Business growth and market expansion |

| Exit Strategy | Sale, IPO, or recapitalization | Acquisition or IPO |

| Typical Sectors | Manufacturing, healthcare, consumer goods | Technology, biotech, fintech |

Introduction to Private Equity and Venture Capital

Private equity firms specialize in acquiring mature companies, often taking full ownership to improve operations and drive long-term growth, typically investing large sums through buyouts. Venture capitalists focus on early-stage startups with high growth potential, providing crucial funding in exchange for equity and actively supporting innovation within emerging industries. Both play vital roles in the financial ecosystem, differing primarily in investment stage, risk profile, and company maturity.

Key Differences Between Private Equity Firms and Venture Capitalists

Private equity firms typically invest in mature companies through leveraged buyouts, aiming for control and operational improvements, whereas venture capitalists focus on early-stage startups with high growth potential by acquiring minority stakes. Private equity deals usually involve larger capital investments and longer holding periods compared to venture capital's smaller investments and quicker exits. The risk profile differs as private equity investments are in established companies with stable cash flows, while venture capital targets high-risk, high-reward innovation-driven ventures.

Investment Stages and Funding Rounds

Private equity firms typically invest in mature companies during later stages such as growth, expansion, or buyouts, often participating in later funding rounds like Series C or beyond. Venture capitalists focus on early-stage investments, including seed and Series A funding rounds, targeting startups with high growth potential. The funding amounts from private equity are generally larger and aimed at restructuring or scaling established businesses, whereas venture capital funding supports initial product development and market entry.

Target Businesses and Industries

Private equity firms typically target mature companies with established revenues and stable cash flows across industries such as manufacturing, healthcare, and technology, aiming to improve operational efficiency and long-term growth. Venture capitalists focus on early-stage startups in high-growth sectors like software, biotechnology, and clean energy, providing capital for innovation and rapid expansion. The differing risk profiles and investment horizons dictate their preference for businesses at distinct development stages within diverse industry landscapes.

Ownership Structure and Control

Private equity firms typically acquire majority ownership stakes, enabling substantial control over portfolio companies' strategic decisions and operations. Venture capitalists usually take minority equity positions, providing guidance and support while allowing founders to retain significant control. This ownership difference influences decision-making authority and governance dynamics within invested companies.

Risk Profile and Return Expectations

Private equity firms typically target mature companies with stable cash flows, offering lower risk but steady returns through operational improvements and leverage. Venture capitalists invest in early-stage startups with high growth potential, accepting higher risk in exchange for the possibility of outsized returns from successful exits. Risk tolerance and return expectations differ significantly, with private equity favoring moderate risk and consistent returns, whereas venture capital embraces high volatility for exponential payoff opportunities.

Decision-Making Processes

Private equity firms prioritize mature companies with stable cash flows, conducting extensive due diligence to assess financial health, market position, and operational efficiency before committing capital. Venture capitalists focus on early-stage startups, evaluating potential for rapid growth, innovation, and market disruption, often basing decisions on founding team strength and scalability prospects. Both use quantitative analysis and qualitative judgment but differ fundamentally in risk tolerance and investment horizons during their decision-making processes.

Value Creation Strategies

Private equity firms primarily create value by acquiring established companies, improving operational efficiency, and driving strategic growth to enhance profitability before exiting. Venture capitalists focus on early-stage startups, providing capital and mentorship to fuel innovation, market expansion, and scalable business models. Both utilize distinct value creation strategies tailored to company maturity, with private equity emphasizing restructuring and operational improvements, while venture capital prioritizes product development and market penetration.

Exit Strategies and Time Horizons

Private equity firms typically pursue exit strategies such as leveraged buyouts and strategic sales within a 4 to 7-year time horizon, focusing on mature companies with established cash flows. Venture capitalists aim for exits via initial public offerings (IPOs) or acquisitions, usually over a longer 7 to 10-year horizon, targeting high-growth startups with scalable business models. The differing timeframes and exit preferences reflect private equity's emphasis on operational improvements and venture capital's focus on rapid innovation and market disruption.

Choosing Between Private Equity and Venture Capital

Choosing between private equity and venture capital depends on the company's growth stage and capital needs; private equity firms typically invest in mature companies seeking operational improvements and large-scale expansions, while venture capitalists focus on early-stage startups with high growth potential. Private equity investments often involve significant control and restructuring, whereas venture capital provides funding coupled with strategic guidance to foster innovation and scale. Understanding these differences helps business owners align funding strategies with long-term objectives and risk tolerance.

Private Equity Firm Infographic

libterm.com

libterm.com