High Days Inventory Outstanding (DIO) indicates that a company holds inventory for an extended period before selling it, which can tie up capital and increase storage costs. Managing your inventory efficiently is crucial to improve cash flow and operational performance. Explore the rest of the article to learn strategies for optimizing your DIO and enhancing your business profitability.

Table of Comparison

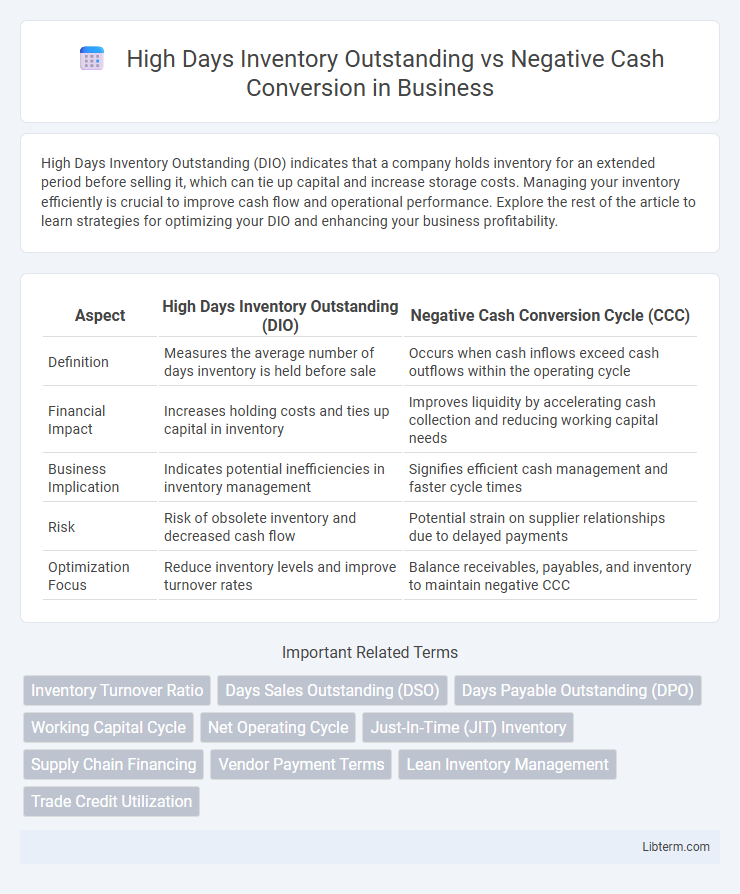

| Aspect | High Days Inventory Outstanding (DIO) | Negative Cash Conversion Cycle (CCC) |

|---|---|---|

| Definition | Measures the average number of days inventory is held before sale | Occurs when cash inflows exceed cash outflows within the operating cycle |

| Financial Impact | Increases holding costs and ties up capital in inventory | Improves liquidity by accelerating cash collection and reducing working capital needs |

| Business Implication | Indicates potential inefficiencies in inventory management | Signifies efficient cash management and faster cycle times |

| Risk | Risk of obsolete inventory and decreased cash flow | Potential strain on supplier relationships due to delayed payments |

| Optimization Focus | Reduce inventory levels and improve turnover rates | Balance receivables, payables, and inventory to maintain negative CCC |

Understanding Days Inventory Outstanding (DIO)

Days Inventory Outstanding (DIO) measures the average number of days a company holds inventory before selling it, serving as a key indicator of operational efficiency in inventory management. A high DIO suggests slower inventory turnover, potentially leading to cash flow constraints and contributing to negative cash conversion cycles. Efficiently managing DIO optimizes working capital by reducing holding costs and improving liquidity, which is critical to avoiding negative cash flow scenarios.

What Is Negative Cash Conversion Cycle?

Negative Cash Conversion Cycle (CCC) occurs when a company collects payments from customers faster than it pays its suppliers, resulting in a cash inflow before cash outflow. High Days Inventory Outstanding (DIO) typically extends inventory holding periods but can still contribute to a negative CCC if accounts payable days exceed the combined days of inventory and receivables. This financial strategy improves liquidity and reduces reliance on external financing by accelerating cash flow through efficient working capital management.

Key Differences Between High DIO and Negative Cash Conversion

High Days Inventory Outstanding (DIO) indicates the average number of days a company holds inventory before selling it, reflecting inventory management efficiency, while Negative Cash Conversion Cycle (CCC) means a company collects cash from sales faster than it pays its suppliers, highlighting superior working capital management. High DIO typically signals slower inventory turnover and potential cash flow constraints due to capital tied up in stock; in contrast, Negative CCC demonstrates effective cash flow optimization by minimizing the time between cash outflows and inflows. Key differences lie in liquidity impact and operational efficiency: High DIO can strain cash resources and delay revenue realization, whereas Negative CCC enhances liquidity and accelerates cash availability for business activities.

Causes of High Days Inventory Outstanding

High Days Inventory Outstanding (DIO) typically results from inefficient inventory management, such as overstocking or slow-moving products, leading to prolonged holding periods. Causes include inaccurate demand forecasting, supply chain disruptions, and production delays that prevent timely inventory turnover. Persistent high DIO ties up cash and contributes to Negative Cash Conversion Cycles, where the company's cash flow is strained due to delayed sales recovery and inventory liquidation.

Impacts of Negative Cash Conversion on Working Capital

High Days Inventory Outstanding (DIO) indicates how long inventory remains unsold, directly affecting cash flow and working capital liquidity. Negative Cash Conversion Cycle (CCC) means a company collects cash from sales before paying suppliers, improving short-term liquidity but potentially squeezing supplier relationships. Negative CCC can optimize working capital by reducing the need for external financing, yet high DIO may counteract these benefits by tying up cash in unsold stock.

High DIO: Risks and Business Implications

High Days Inventory Outstanding (DIO) signifies excessive inventory holding periods, which can lead to significant liquidity risks and increased storage costs for businesses. Prolonged high DIO negatively impacts working capital efficiency, tying up funds that could otherwise support growth or operational flexibility. Persistent high DIO often results in obsolescence risk, reduced cash flows, and heightened vulnerability to market demand fluctuations, exacerbating the negative cash conversion cycle.

How Negative Cash Conversion Improves Liquidity

Negative Cash Conversion Cycle (CCC) accelerates cash inflows by reducing the time between paying suppliers and receiving customer payments, which contrasts with high Days Inventory Outstanding (DIO) that ties up capital in stock. Lower or negative CCC improves liquidity by minimizing working capital requirements and freeing cash for operational needs or investments. Companies leveraging negative CCC gain a competitive edge through enhanced cash flow management, even when facing elevated inventory levels reflected by DIO metrics.

Strategies to Manage High Days Inventory Outstanding

High Days Inventory Outstanding (DIO) indicates the average number of days a company holds inventory before selling it, and high DIO can tie up capital, leading to negative Cash Conversion Cycles (CCC) where cash is locked in inventory and receivables. Effective strategies to manage high DIO include improving demand forecasting accuracy using AI-driven analytics, implementing just-in-time (JIT) inventory systems to reduce excess stock, and strengthening supplier relationships to enable faster replenishment cycles. Streamlining inventory turnover directly enhances liquidity, reduces holding costs, and mitigates risks associated with obsolete stock.

Real-World Examples: High DIO vs Negative Cash Conversion

High Days Inventory Outstanding (DIO) often signals excess stock tying up capital, while Negative Cash Conversion Cycle (CCC) indicates efficient cash management by receiving payments before paying suppliers. Companies like Amazon maintain low DIO and negative CCC by leveraging rapid inventory turnover and supplier payment terms to optimize cash flow. Conversely, retailers with high DIO, such as those facing seasonal demand spikes, struggle with cash flow despite substantial sales, highlighting the operational impact on working capital management.

Optimizing Inventory for Better Cash Flow Management

High Days Inventory Outstanding (DIO) signals excess stock tying up capital, which directly impacts cash flow by delaying conversions from inventory to sales revenue. Negative Cash Conversion Cycle occurs when a company pays suppliers faster than it collects cash from customers, worsening liquidity and stressing operational cash flow. Optimizing inventory levels through demand forecasting and lean inventory practices reduces DIO, improving turnover rates and enabling smoother cash flow management.

High Days Inventory Outstanding Infographic

libterm.com

libterm.com