A futures contract is a standardized legal agreement to buy or sell an asset at a predetermined price on a specific future date, widely used in commodities, finance, and trading markets to hedge risk or speculate on price movements. These contracts facilitate price discovery and provide liquidity, allowing market participants to manage exposure effectively. Explore the rest of the article to understand how futures contracts impact your investment strategy and market decisions.

Table of Comparison

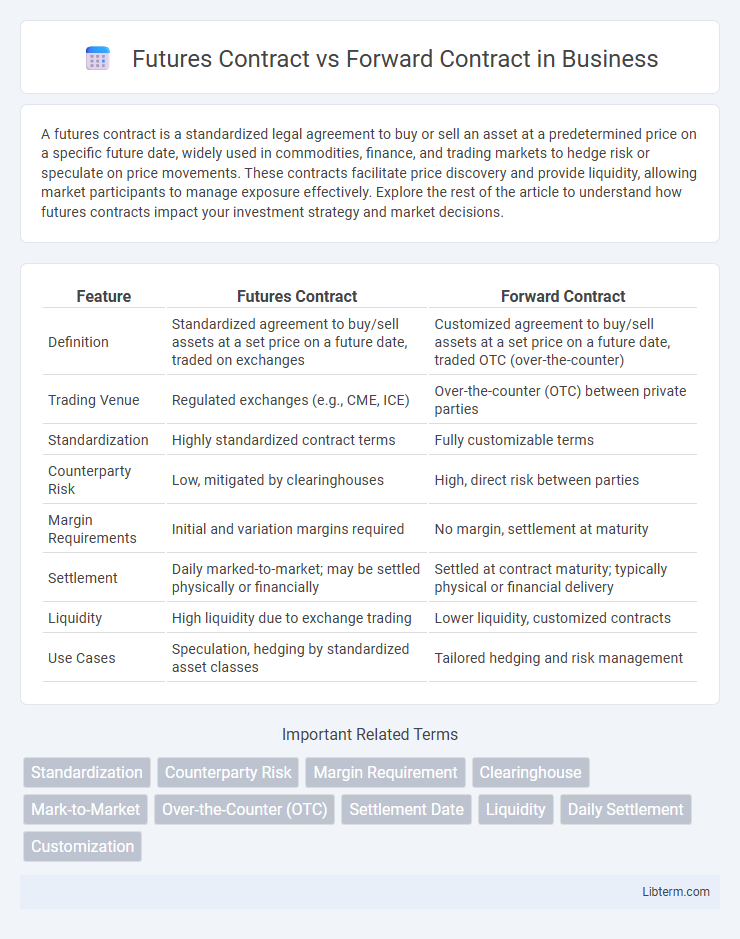

| Feature | Futures Contract | Forward Contract |

|---|---|---|

| Definition | Standardized agreement to buy/sell assets at a set price on a future date, traded on exchanges | Customized agreement to buy/sell assets at a set price on a future date, traded OTC (over-the-counter) |

| Trading Venue | Regulated exchanges (e.g., CME, ICE) | Over-the-counter (OTC) between private parties |

| Standardization | Highly standardized contract terms | Fully customizable terms |

| Counterparty Risk | Low, mitigated by clearinghouses | High, direct risk between parties |

| Margin Requirements | Initial and variation margins required | No margin, settlement at maturity |

| Settlement | Daily marked-to-market; may be settled physically or financially | Settled at contract maturity; typically physical or financial delivery |

| Liquidity | High liquidity due to exchange trading | Lower liquidity, customized contracts |

| Use Cases | Speculation, hedging by standardized asset classes | Tailored hedging and risk management |

Introduction to Futures and Forward Contracts

Futures contracts are standardized agreements traded on exchanges to buy or sell assets at a predetermined price on a specific future date, providing high liquidity and reduced counterparty risk through clearinghouses. Forward contracts are customized, over-the-counter agreements between two parties to buy or sell an asset at a specified price on a future date, often tailored to specific needs but carrying higher counterparty risk. Both instruments are essential for hedging and speculation in financial markets, with futures favored for their standardization and forwards for their flexibility.

Key Definitions: Futures vs Forward Contracts

Futures contracts are standardized agreements traded on regulated exchanges to buy or sell an asset at a predetermined price on a specified future date, ensuring liquidity and reduced counterparty risk. Forward contracts are customized, private agreements between two parties to buy or sell an asset at a specified price on a future date, carrying higher counterparty risk and less liquidity. Both instruments are used for hedging or speculation but differ significantly in terms of standardization, trading venue, and settlement mechanisms.

Market Structure and Trading Venues

Futures contracts are standardized agreements traded on centralized exchanges like the CME Group, ensuring high liquidity, transparent pricing, and regulated environments. Forward contracts are customized OTC instruments negotiated directly between parties, lacking standardization and centralized trading venues, which increases counterparty risk. The organized market structure of futures supports margining and daily settlement, whereas forwards rely on bilateral credit arrangements and settlement at contract maturity.

Standardization and Customization

Futures contracts are standardized agreements traded on regulated exchanges, featuring fixed contract sizes, settlement dates, and terms, which enhance liquidity and reduce counterparty risk. Forward contracts are customized, privately negotiated agreements tailored to the specific needs of the counterparties, allowing flexibility in contract size, delivery date, and underlying asset specifications but carrying higher counterparty risk. The standardization of futures contracts facilitates easier trading and price discovery, while the customization of forward contracts provides bespoke solutions for hedging unique exposures.

Settlement and Delivery Mechanisms

Futures contracts are standardized agreements traded on exchanges with daily settlement through a process called marking to market, ensuring gains and losses are realized each trading day. Forward contracts are customized private agreements between parties with settlement and delivery typically occurring at contract maturity, leading to higher counterparty risk. Futures require margin accounts and are usually settled in cash or physical delivery, while forwards often settle with physical delivery or net payment, depending on contract terms.

Counterparty Risk Management

Futures contracts are standardized and traded on regulated exchanges, which use clearinghouses to guarantee performance and significantly reduce counterparty risk through margin requirements and daily settlement. Forward contracts are privately negotiated agreements between two parties, exposing both to higher counterparty risk since they lack a central clearing mechanism and depend on the counterparties' creditworthiness. Effective counterparty risk management in forwards often involves credit assessments, collateral arrangements, and legal protections, whereas futures benefit from built-in exchange safeguards.

Pricing and Valuation Differences

Futures contracts are priced using daily mark-to-market settlement, reflecting current market conditions and reducing counterparty risk, while forward contracts settle only at maturity, resulting in valuation based on the underlying asset's expected price at contract expiration. Futures pricing incorporates interest rates, dividends, and convenience yield in a risk-neutral framework, typically modeled through no-arbitrage principles, whereas forwards rely on discounted expected future prices under the real-world measure, often adjusted for credit risk. The liquidity and standardization of futures result in continuous price discovery, contrasting with the bespoke nature of forwards, which creates valuation challenges due to limited market transparency and counterparty credit considerations.

Liquidity and Market Accessibility

Futures contracts offer higher liquidity due to standardized terms and centralized exchange trading, facilitating easier entry and exit for market participants. Forward contracts are customized agreements traded over-the-counter, resulting in less liquidity and limited market accessibility. The standardized nature and transparent pricing of futures enhance market efficiency and provide greater accessibility to a wider range of investors.

Use Cases in Risk Management

Futures contracts are standardized and traded on exchanges, making them ideal for hedging price risk in commodities, currencies, and financial instruments with high liquidity and transparency. Forward contracts offer customizable terms and are typically used by companies and financial institutions to hedge specific risks in assets or cash flows that require tailored agreements, such as foreign exchange exposure or interest rate risk. Both instruments are essential in risk management strategies, with futures providing ease of exit and daily settlement, while forwards deliver flexibility in contract specifications.

Advantages and Disadvantages Summary

Futures contracts offer standardized terms and are traded on regulated exchanges, providing high liquidity and reduced counterparty risk through daily settlement. Forward contracts allow customization tailored to specific needs but carry higher counterparty risk due to their over-the-counter nature and lack of daily marking to market. The choice between futures and forwards depends on the trade-off between flexibility and standardization, as well as risk management priorities.

Futures Contract Infographic

libterm.com

libterm.com