Strategic risk involves potential losses or setbacks that arise from flawed business strategies, poor decision-making, or changes in the competitive landscape. It can impact your organization's long-term goals, market position, and overall sustainability by disrupting operational plans and resource allocation. Explore the rest of the article to understand how to identify, assess, and manage strategic risks effectively.

Table of Comparison

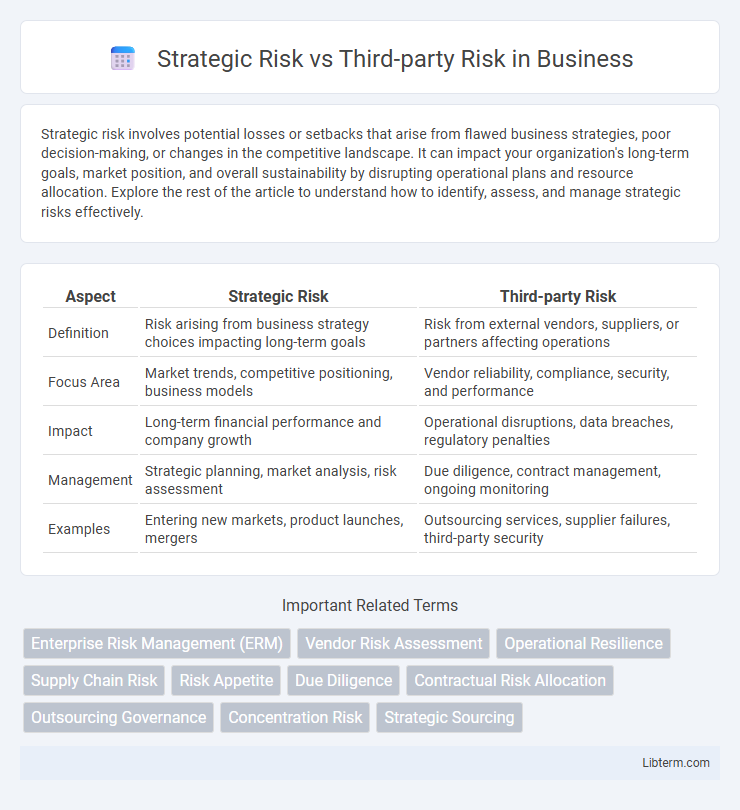

| Aspect | Strategic Risk | Third-party Risk |

|---|---|---|

| Definition | Risk arising from business strategy choices impacting long-term goals | Risk from external vendors, suppliers, or partners affecting operations |

| Focus Area | Market trends, competitive positioning, business models | Vendor reliability, compliance, security, and performance |

| Impact | Long-term financial performance and company growth | Operational disruptions, data breaches, regulatory penalties |

| Management | Strategic planning, market analysis, risk assessment | Due diligence, contract management, ongoing monitoring |

| Examples | Entering new markets, product launches, mergers | Outsourcing services, supplier failures, third-party security |

Understanding Strategic Risk: Definition and Importance

Strategic risk involves potential losses arising from adverse business decisions, improper implementation, or changes in the external business environment that affect an organization's long-term objectives. Understanding strategic risk is crucial for organizations to align their risk management frameworks with corporate strategy, ensuring resilience against market volatility and competitive pressures. Effective strategic risk management helps maintain sustainable growth by proactively identifying threats related to innovation, market shifts, and regulatory changes.

What is Third-Party Risk? An Overview

Third-party risk refers to the potential threats and vulnerabilities an organization faces when outsourcing services or partnering with external vendors, suppliers, or contractors. These risks encompass financial loss, reputational damage, operational disruption, and compliance violations resulting from the third party's actions or failures. Managing third-party risk involves rigorous due diligence, continuous monitoring, and comprehensive risk assessment to ensure alignment with the organization's strategic goals and regulatory requirements.

Key Differences Between Strategic and Third-Party Risks

Strategic risk involves potential losses from failed business strategies, market shifts, or competitive pressures impacting an organization's long-term goals. Third-party risk arises from dependencies on external vendors, suppliers, or partners, including risks related to their performance, compliance, or security breaches. The key difference lies in strategic risk being internally focused on organizational decision-making and direction, whereas third-party risk centers on external relationships and their potential disruptions.

Common Sources of Strategic Risks

Common sources of strategic risks include market competition, regulatory changes, technological disruptions, and shifts in consumer preferences, which can undermine an organization's long-term objectives. Third-party risks often stem from supplier reliability, vendor compliance issues, and cybersecurity vulnerabilities linked to external partners. Understanding these sources enables businesses to develop robust risk mitigation strategies that safeguard their strategic goals and operational integrity.

Typical Causes of Third-Party Risks

Typical causes of third-party risks include vendor misalignment, cyber vulnerabilities in supplier systems, and inadequate compliance with regulatory standards. Strategic risk often emerges from poor partner selection or failure to monitor third-party performance, impacting business objectives and operational continuity. Identifying these risks early enhances risk mitigation strategies and ensures stronger supply chain resilience.

Impact of Strategic Risk on Business Objectives

Strategic risk directly affects a company's ability to achieve its long-term business objectives by undermining strategic initiatives and market positioning, leading to potential loss of competitive advantage and reduced profitability. This type of risk arises from decisions related to business models, mergers and acquisitions, and shifts in market dynamics, causing misalignment with stakeholder expectations and operational capabilities. Unlike third-party risk, which centers on external vendor failures, strategic risk impacts the core direction and sustainability of the business itself.

How Third-Party Risk Affects Operational Resilience

Third-party risk significantly impacts operational resilience by introducing vulnerabilities through external suppliers, vendors, and partners, potentially disrupting critical business functions. Dependence on third parties can expose organizations to cyberattacks, compliance failures, and supply chain interruptions, weakening their ability to respond and recover from adverse events. Effective third-party risk management enhances operational resilience by ensuring continuous monitoring, risk assessment, and mitigation strategies are in place to protect essential operations.

Strategies for Managing Strategic Risks

Managing strategic risks requires a comprehensive approach centered on thorough market analysis, scenario planning, and continuous monitoring of competitive dynamics. Implementing robust governance frameworks and aligning risk management with corporate objectives enables organizations to anticipate and mitigate potential disruptions effectively. Leveraging advanced analytics and fostering cross-functional collaboration further enhance the ability to adapt strategies in a rapidly changing business environment.

Best Practices for Third-Party Risk Management

Effective third-party risk management hinges on a structured framework that includes thorough vendor due diligence, continuous monitoring, and clear contractual obligations addressing compliance, security, and performance standards. Implementing automated risk assessment tools and standardized reporting processes enhances transparency and enables proactive mitigation of potential disruptions. Aligning third-party risk strategies with overall strategic risk management ensures resilience and supports organizational objectives in complex supply chain environments.

Integrating Strategic and Third-Party Risk Assessments

Integrating strategic risk and third-party risk assessments enhances organizational resilience by aligning external vendor risks with internal business objectives. Combining these assessments allows for a comprehensive evaluation of potential impacts on long-term goals and supply chain vulnerabilities. Effective integration leverages data analytics and risk management frameworks to prioritize mitigation efforts across both strategic initiatives and third-party dependencies.

Strategic Risk Infographic

libterm.com

libterm.com