Deferred Net Settlement (DNS) streamlines financial transactions by aggregating multiple payments over a set period and settling the net amount at once, reducing transaction costs and enhancing liquidity management. This method is widely used in clearinghouses and payment systems to improve efficiency and minimize risk. Explore the rest of the article to understand how deferred net settlement can optimize your payment processes.

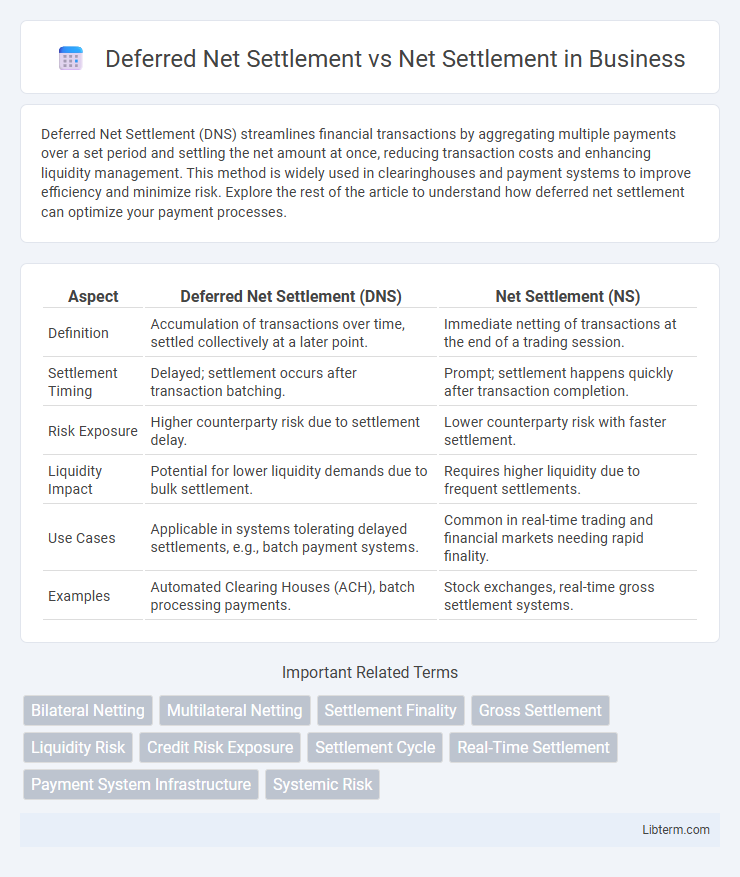

Table of Comparison

| Aspect | Deferred Net Settlement (DNS) | Net Settlement (NS) |

|---|---|---|

| Definition | Accumulation of transactions over time, settled collectively at a later point. | Immediate netting of transactions at the end of a trading session. |

| Settlement Timing | Delayed; settlement occurs after transaction batching. | Prompt; settlement happens quickly after transaction completion. |

| Risk Exposure | Higher counterparty risk due to settlement delay. | Lower counterparty risk with faster settlement. |

| Liquidity Impact | Potential for lower liquidity demands due to bulk settlement. | Requires higher liquidity due to frequent settlements. |

| Use Cases | Applicable in systems tolerating delayed settlements, e.g., batch payment systems. | Common in real-time trading and financial markets needing rapid finality. |

| Examples | Automated Clearing Houses (ACH), batch processing payments. | Stock exchanges, real-time gross settlement systems. |

Introduction to Payment Settlement Systems

Deferred Net Settlement (DNS) aggregates multiple payment instructions and settles them at specific intervals, reducing the number of transactions processed individually and improving liquidity management in payment systems. Net Settlement, by contrast, consolidates multiple transactions between parties to settle only the net amount owed, thereby minimizing settlement risk and operational costs. Both systems play crucial roles in payment settlement infrastructures, balancing the trade-offs between settlement speed, risk exposure, and system efficiency.

Defining Deferred Net Settlement (DNS)

Deferred Net Settlement (DNS) is a payment system where transactions between multiple parties are accumulated and settled at a later, specified time, reducing the number of individual transfers and enhancing liquidity management. DNS contrasts with Net Settlement, which typically involves immediate or near-immediate reconciliation and transfer of funds after transactions occur. By postponing the settlement process, Deferred Net Settlement minimizes settlement risk and operational costs, making it suitable for clearinghouses and interbank payment systems.

Understanding Net Settlement

Net Settlement is a financial process where multiple transactions between parties are aggregated, and only the net amount owed is exchanged, reducing the number of individual payments and improving efficiency. Deferred Net Settlement accumulates transactions over a specified period before calculating the net amount, often used in clearinghouses to manage risk and liquidity. Understanding Net Settlement involves recognizing its role in minimizing payment volumes, enhancing transaction speed, and lowering operational costs in financial markets.

Key Differences Between DNS and Net Settlement

Deferred Net Settlement (DNS) processes payments at predetermined intervals, aggregating transactions to enhance liquidity management, whereas Net Settlement settles obligations immediately after each transaction clearing. DNS minimizes settlement risk by consolidating multiple obligations into a single net position, reducing the frequency and volume of payments compared to real-time Net Settlement systems. Net Settlement, however, offers faster finality and reduces credit risk by settling transactions promptly without waiting for batching intervals.

Operational Process of Deferred Net Settlement

Deferred Net Settlement operates by aggregating multiple transactions over a defined period before settling the net amount between parties, reducing the number of individual payments and enhancing efficiency. The operational process involves collecting transaction data, calculating net positions for each participant at the end of the settlement period, and executing a single payment obligation, minimizing settlement risk and liquidity requirements. This system contrasts with immediate Net Settlement, where payments are processed continuously and individually, offering faster fund transfers but higher operational complexity and costs.

Real-Time Applications of Net Settlement

Net settlement processes aggregate multiple transactions into a single net amount, optimizing liquidity and reducing settlement risk, whereas deferred net settlement calculates net positions after a batching period. Real-time applications of net settlement, such as instant payment systems and real-time gross settlement (RTGS) platforms, enable immediate transaction finality and enhanced liquidity management by continuously updating net positions throughout the day. These real-time systems provide financial institutions with improved cash flow efficiency and risk mitigation compared to deferred settlement methods.

Risk Management in DNS vs Net Settlement

Deferred Net Settlement (DNS) enhances risk management by aggregating transactions over a defined period before settling net amounts, reducing the frequency and volume of settlements and minimizing liquidity risk for participants. Net Settlement processes individual transaction payments instantly but may increase exposure to settlement risk due to the lack of aggregation and reliance on timely fund availability. DNS's batch processing model provides more time for participants to manage liquidity and credit risks, whereas Net Settlement demands real-time risk mitigation strategies to prevent payment defaults.

Regulatory Considerations and Compliance

Deferred Net Settlement involves settling payment obligations at a specified later time, requiring adherence to regulatory frameworks designed to manage credit risk and ensure liquidity, such as those enforced by the Federal Reserve and the European Central Bank. Net Settlement processes settle transactions collectively at the end of a defined period, necessitating compliance with standards from bodies like the Payment Card Industry Security Standards Council (PCI SSC) to minimize systemic risk and enhance transparency. Both settlement methods must align with Anti-Money Laundering (AML) regulations and Know Your Customer (KYC) requirements to prevent fraud and ensure secure financial operations.

Advantages and Disadvantages of Each System

Deferred Net Settlement (DNS) consolidates multiple transactions over a specific period before settling the net amount, reducing liquidity requirements and lowering transaction costs. However, DNS involves settlement risk due to the accumulation of obligations, which can lead to systemic risk if a participant defaults. Net Settlement, settling transactions individually in real-time, minimizes settlement risk and enhances immediate fund availability but increases liquidity demands and operational costs.

Choosing the Right Settlement Method for Financial Institutions

Deferred Net Settlement aggregates multiple transactions over a specific period before processing a single net payment, reducing liquidity demands and operational costs for financial institutions. Net Settlement involves immediate or near-real-time balancing of transactions, enhancing cash flow visibility but requiring higher liquidity reserves. Financial institutions must assess transaction volume, liquidity availability, and risk tolerance to select the most efficient settlement method that optimizes capital use and operational efficiency.

Deferred Net Settlement Infographic

libterm.com

libterm.com