Restitution is a legal remedy aimed at restoring a party to the position they were in before a loss or injury occurred, often involving the return of property or compensation for damages. It plays a crucial role in civil litigation and contract disputes by ensuring that wrongful gains are reversed and fairness is maintained. Explore the rest of the article to understand how restitution could impact your legal strategy and rights.

Table of Comparison

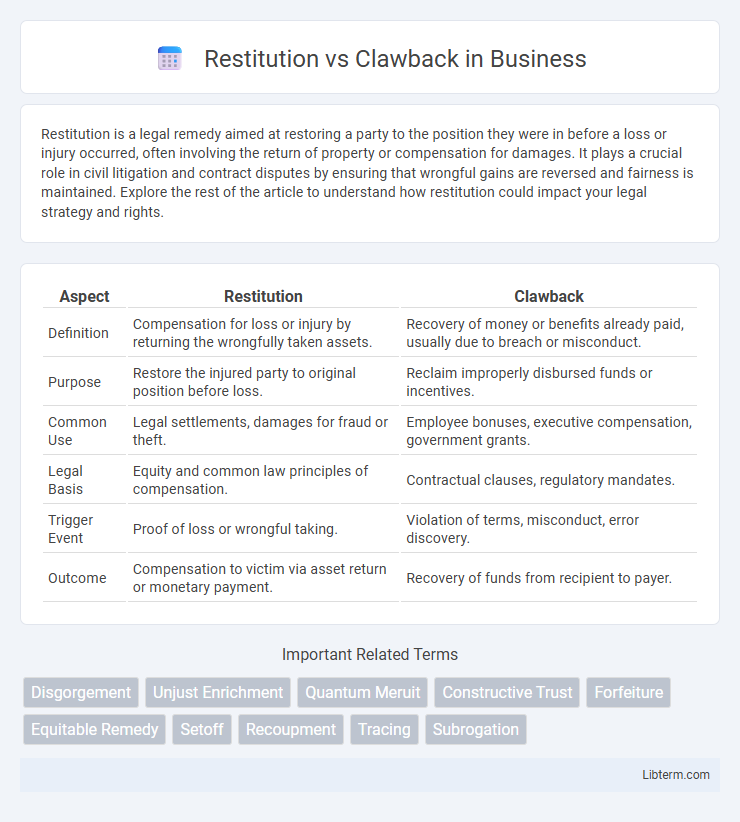

| Aspect | Restitution | Clawback |

|---|---|---|

| Definition | Compensation for loss or injury by returning the wrongfully taken assets. | Recovery of money or benefits already paid, usually due to breach or misconduct. |

| Purpose | Restore the injured party to original position before loss. | Reclaim improperly disbursed funds or incentives. |

| Common Use | Legal settlements, damages for fraud or theft. | Employee bonuses, executive compensation, government grants. |

| Legal Basis | Equity and common law principles of compensation. | Contractual clauses, regulatory mandates. |

| Trigger Event | Proof of loss or wrongful taking. | Violation of terms, misconduct, error discovery. |

| Outcome | Compensation to victim via asset return or monetary payment. | Recovery of funds from recipient to payer. |

Introduction to Restitution and Clawback

Restitution involves restoring a party to their original position by returning losses or property acquired unjustly, emphasizing fairness and compensation. Clawback refers to the contractual or legal recovery of previously disbursed funds, often triggered by misconduct or breach of terms. Both concepts play critical roles in financial, legal, and corporate governance contexts by ensuring accountability and redress.

Defining Restitution: Meaning and Context

Restitution refers to the act of restoring or compensating for loss, damage, or injury, aiming to make the injured party whole again by returning them to their original position. It is commonly applied in legal contexts where a party is required to return unjust gains or compensate for harm caused by breach of contract, fraud, or wrongdoing. Restitution emphasizes fairness and equity, ensuring that wrongdoers do not benefit from their actions and victims receive appropriate remedy.

Understanding Clawback: Concept and Applications

Clawback refers to the contractual provision or legal mechanism allowing the recovery of funds or benefits already disbursed, often triggered by fraud, misconduct, or failure to meet specified conditions. Common in executive compensation, bankruptcy settlements, and government contracts, clawbacks ensure accountability by returning bonuses, incentives, or payments when performance metrics are unmet or financial misstatements occur. This mechanism safeguards organizational interests by deterring unethical behavior and promoting compliance through financial repercussions.

Key Differences Between Restitution and Clawback

Restitution primarily involves compensating a victim by restoring them to their original position before a loss or harm occurred, often used in criminal and civil law to address wrongful acts. Clawback refers to the recovery of money or benefits that were previously disbursed, frequently applied in corporate governance and executive compensation contexts to reclaim bonuses or incentives linked to misconduct or financial restatements. The key difference lies in restitution focusing on victim compensation, while clawback centers on recouping funds from the recipient due to contractual breaches or policy violations.

Legal Frameworks Governing Restitution and Clawback

Legal frameworks governing restitution and clawback vary significantly depending on jurisdiction, focusing on the recovery of ill-gotten gains or improperly obtained assets. Restitution laws primarily aim to compensate victims for losses caused by wrongful acts, often guided by principles within civil law and equitable remedies. Clawback provisions frequently arise in corporate and financial regulations, enabling entities to reclaim bonuses or profits in cases of misconduct or financial restatements, supported by statutes such as the Sarbanes-Oxley Act in the United States.

Common Scenarios: When Is Restitution Used?

Restitution is commonly used in scenarios involving criminal cases where a defendant must compensate a victim for financial losses or damages caused by their unlawful actions, such as theft, fraud, or property damage. It also applies in civil cases requiring the return of specific property or monetary reimbursement to rectify unjust enrichment. Courts frequently order restitution during plea agreements or sentencing to restore victims' losses and uphold equitable justice.

Typical Cases: When Are Clawbacks Enforced?

Clawbacks are typically enforced in cases involving executive compensation, such as bonuses or stock options awarded based on financial results later found to be inaccurate due to misconduct or accounting errors. They also apply in bankruptcy proceedings where funds distributed to creditors or insiders must be recovered to ensure equitable asset distribution. Regulatory violations, including securities fraud or violations of corporate governance rules, frequently trigger clawback provisions to recoup unlawful profits or incentives.

Restitution vs Clawback in Employment Contracts

Restitution in employment contracts involves restoring the injured party to the position they were in before a breach, often through compensation for losses incurred. Clawback provisions allow employers to reclaim bonuses or benefits from employees if certain conditions, such as misconduct or financial restatements, are met post-payment. Understanding the differences is crucial for managing risk and ensuring clear terms regarding compensation recovery and restoration.

Financial and Tax Implications

Restitution involves repaying funds to victims or parties wrongfully deprived, often outside tax code scope, whereas clawback provisions mandate reclaiming bonuses or incentives typically treated as taxable income adjustments. Financially, restitution may impact net earnings through expense recognition, while clawbacks adjust reported compensation, influencing payroll taxes and withholding requirements. Tax implications hinge on timing and characterization; restitution payments might not produce immediate tax consequences, but clawbacks generally require employers to amend tax filings and reclaim associated withholdings to maintain compliance.

Choosing the Right Remedy: Restitution or Clawback

Choosing the right remedy between restitution and clawback depends on the nature of the wrongful gain and the legal context. Restitution aims to restore the injured party to their original position by returning benefits unjustly obtained, often used in contract breaches or unjust enrichment cases. Clawback provisions are typically employed in corporate governance and financial regulation to recover bonuses or incentives paid out based on false or misleading information.

Restitution Infographic

libterm.com

libterm.com