Neutral cash conversion reflects a balance between a company's cash inflows and outflows, ensuring it neither ties up excess capital in operations nor strains liquidity. This efficiency in managing working capital supports stable business performance and risk mitigation. Discover how optimizing your cash conversion cycle can improve financial health by reading the full article.

Table of Comparison

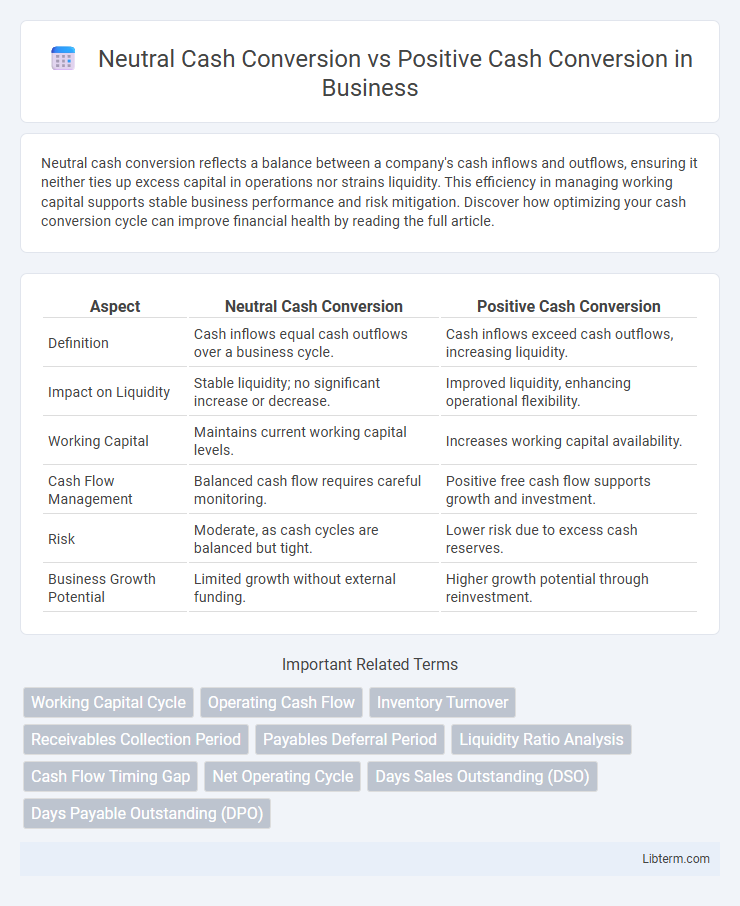

| Aspect | Neutral Cash Conversion | Positive Cash Conversion |

|---|---|---|

| Definition | Cash inflows equal cash outflows over a business cycle. | Cash inflows exceed cash outflows, increasing liquidity. |

| Impact on Liquidity | Stable liquidity; no significant increase or decrease. | Improved liquidity, enhancing operational flexibility. |

| Working Capital | Maintains current working capital levels. | Increases working capital availability. |

| Cash Flow Management | Balanced cash flow requires careful monitoring. | Positive free cash flow supports growth and investment. |

| Risk | Moderate, as cash cycles are balanced but tight. | Lower risk due to excess cash reserves. |

| Business Growth Potential | Limited growth without external funding. | Higher growth potential through reinvestment. |

Understanding Cash Conversion Cycles

Neutral cash conversion cycle occurs when a company's cash inflows from sales closely match its outflows for operations, resulting in a balanced working capital situation. Positive cash conversion cycle indicates that a company takes longer to collect receivables than it takes to pay its suppliers, potentially causing cash flow challenges. Understanding cash conversion cycles is crucial for managing liquidity, optimizing inventory, and improving overall financial efficiency.

What Is Neutral Cash Conversion?

Neutral cash conversion occurs when a company's cash conversion cycle (CCC) is zero, indicating that the time taken to convert inventory and receivables into cash equals the time taken to pay suppliers. This balance means the business efficiently manages working capital without relying on external financing or delaying payments to suppliers. Companies with neutral CCC maintain liquidity by synchronizing cash inflows and outflows, minimizing the need for additional cash reserves.

Defining Positive Cash Conversion

Positive cash conversion occurs when a company efficiently collects cash from sales faster than it pays out cash for expenses, resulting in a cash conversion cycle (CCC) that is less than zero or positive in terms of cash flow. This financial metric indicates strong liquidity and operational efficiency, as the business generates cash before it needs to settle its payables. In contrast, neutral cash conversion means the CCC balances out, with cash inflows roughly matching cash outflows, signaling stable but less aggressive cash management.

Key Differences: Neutral vs Positive Cash Conversion

Neutral cash conversion occurs when a company's cash conversion cycle (CCC) is zero, indicating that the period between paying suppliers and collecting receivables breaks even without impacting cash flow. Positive cash conversion means the company collects cash from customers before paying its suppliers, resulting in a negative CCC and improved liquidity. Key differences include cash flow timing and working capital efficiency, with positive cash conversion providing enhanced cash management advantages over neutral cash conversion.

Financial Impact on Business Operations

Neutral cash conversion indicates a balance where a company's cash inflows from operations match outflows, maintaining stable liquidity without excess or shortage. Positive cash conversion reflects efficient operational management, generating more cash than expenses, which enhances working capital and supports growth initiatives. This increased liquidity improves a business's ability to invest, reduce debt, and withstand financial downturns, directly impacting operational resilience and expansion capacity.

Pros and Cons of Neutral Cash Conversion

Neutral cash conversion maintains a balance where operating cash flow matches net sales, offering consistent liquidity without overextending credit or inventory. This steady cycle reduces risk by avoiding excessive investments in working capital, but may limit growth opportunities since cash tied up in operations restricts reinvestment capacity. Companies with neutral cash conversion benefit from stability but might miss out on the financial leverage that positive cash conversion cycles can provide.

Advantages of Positive Cash Conversion

Positive cash conversion improves liquidity by generating cash faster than liabilities come due, allowing businesses to reinvest in growth opportunities without additional financing. It enhances operational efficiency by minimizing reliance on external funding and reducing interest costs associated with short-term borrowings. Companies with positive cash conversion enjoy stronger financial health, making them more attractive to investors and creditors due to predictable cash flow and reduced risk.

Real-World Examples: Neutral vs Positive Scenarios

Neutral cash conversion occurs when a company's operating cash flow closely matches its net income, maintaining stable working capital without significant cash buildup or depletion, exemplified by companies like IBM during steady business cycles. Positive cash conversion, where operating cash flow exceeds net income, reflects efficient collections and inventory management, as seen in tech giants like Apple that optimize receivables and payables to generate excess cash. These real-world examples highlight how neutral scenarios indicate balanced operations, while positive cash conversion underscores superior liquidity and operational efficiency.

Strategies to Move from Neutral to Positive Cash Conversion

Implementing efficient inventory management and accelerating receivables collection are crucial strategies to shift from neutral to positive cash conversion, enhancing liquidity and operational efficiency. Leveraging technology for real-time cash flow analysis allows businesses to identify bottlenecks and optimize payment cycles, ensuring faster cash inflows than outflows. Prioritizing supplier negotiations to extend payables, combined with disciplined working capital management, further supports a sustainable positive cash conversion cycle.

Choosing the Right Cash Conversion Approach for Your Business

Choosing the right cash conversion approach depends on your business's operational efficiency and financial strategy. Neutral Cash Conversion indicates a balanced cycle where cash inflows and outflows align closely, minimizing working capital needs and stabilizing liquidity. Positive Cash Conversion, on the other hand, accelerates cash inflows relative to outflows, enhancing cash reserves and supporting growth initiatives through improved cash flow management.

Neutral Cash Conversion Infographic

libterm.com

libterm.com