A forward contract is a customized financial agreement between two parties to buy or sell an asset at a predetermined price on a specific future date. It helps businesses and investors hedge against price fluctuations, providing certainty in volatile markets. Explore the article to understand how you can effectively use forward contracts for risk management and investment strategies.

Table of Comparison

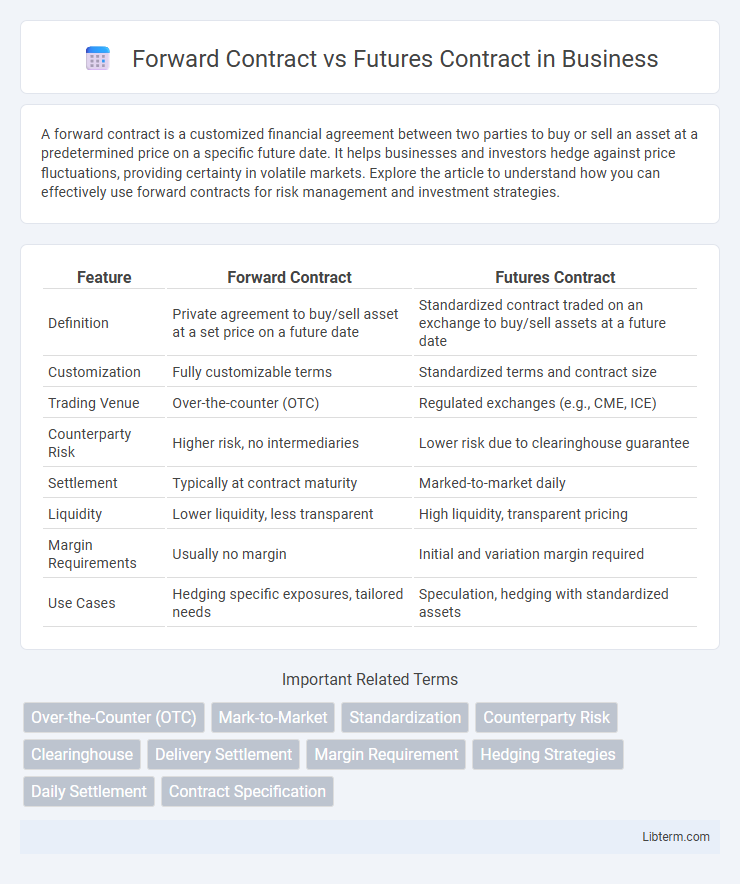

| Feature | Forward Contract | Futures Contract |

|---|---|---|

| Definition | Private agreement to buy/sell asset at a set price on a future date | Standardized contract traded on an exchange to buy/sell assets at a future date |

| Customization | Fully customizable terms | Standardized terms and contract size |

| Trading Venue | Over-the-counter (OTC) | Regulated exchanges (e.g., CME, ICE) |

| Counterparty Risk | Higher risk, no intermediaries | Lower risk due to clearinghouse guarantee |

| Settlement | Typically at contract maturity | Marked-to-market daily |

| Liquidity | Lower liquidity, less transparent | High liquidity, transparent pricing |

| Margin Requirements | Usually no margin | Initial and variation margin required |

| Use Cases | Hedging specific exposures, tailored needs | Speculation, hedging with standardized assets |

Introduction to Forward and Futures Contracts

Forward contracts are customized agreements between two parties to buy or sell an asset at a specified price on a future date, often used for hedging and are traded over-the-counter. Futures contracts are standardized agreements traded on regulated exchanges, obligating the buyer or seller to transact an asset at a predetermined price and date, offering greater liquidity and reduced counterparty risk. Both instruments serve to manage price risk but differ significantly in terms of standardization, trading venues, and regulatory oversight.

Definition and Key Features of Forward Contracts

A forward contract is a customized agreement between two parties to buy or sell an asset at a specified price on a future date, typically traded over-the-counter (OTC) and not standardized. Key features include flexibility in contract terms, lack of daily settlement or margin requirements, and counterparty risk due to the absence of a centralized clearinghouse. Forward contracts are often used for hedging specific risks in commodities, currencies, or financial instruments, offering tailored solutions compared to standardized futures contracts.

Definition and Key Features of Futures Contracts

A futures contract is a standardized legal agreement to buy or sell a specific quantity of an asset at a predetermined price on a set date in the future, traded on regulated exchanges. Key features of futures contracts include standardized contract sizes, daily settlement through a clearinghouse, marked-to-market pricing, and margin requirements to reduce counterparty risk. Unlike forward contracts, futures offer higher liquidity, price transparency, and reduced default risk due to their standardized and regulated nature.

Similarities Between Forward and Futures Contracts

Forward and futures contracts both serve as financial derivatives used to hedge against price fluctuations by locking in the price of an asset for future delivery. They share the characteristic of obligating the buyer and seller to transact a specific quantity of an underlying asset at an agreed-upon price on a future date. Both contracts are utilized in commodities trading, currency exchange, and interest rate hedging, providing essential risk management tools for investors and businesses.

Main Differences: Forwards vs Futures

Forward contracts are customized agreements traded over-the-counter (OTC) between two parties to buy or sell an asset at a specific price on a future date, offering flexibility but higher counterparty risk. Futures contracts are standardized agreements traded on exchanges with daily settlement and margin requirements, reducing credit risk through clearinghouses. The key differences include customization, trading venues, counterparty risk, and liquidity, with forwards suited for tailored hedges and futures preferred for standardized, transparent trading.

How Forward Contracts Work in Practice

Forward contracts are customized agreements between two parties to buy or sell an asset at a specified price on a future date, executed over-the-counter without standardization. These contracts allow businesses to hedge against price fluctuations by locking in prices, with settlement occurring at contract maturity. Unlike futures, forward contracts carry counterparty risk since they are not regulated or traded on exchanges.

How Futures Contracts Operate in Financial Markets

Futures contracts are standardized agreements traded on regulated exchanges, obligating parties to buy or sell an asset at a predetermined price on a specified future date, with daily settlement through a process called marking to market. These contracts require initial margin deposits and maintenance margins to manage credit risk, ensuring liquidity and minimizing default risk in financial markets. Unlike forward contracts, futures contracts offer greater transparency and ease of transfer due to their standardized terms and regulated clearinghouses.

Advantages and Disadvantages of Forward Contracts

Forward contracts offer customization in terms of contract size, delivery date, and underlying asset, providing flexibility for parties with specific hedging needs. Their main disadvantage is the lack of liquidity and counterparty risk due to being over-the-counter (OTC) instruments without centralized clearinghouses. These contracts also face higher credit risk and limited price transparency compared to standardized futures contracts traded on regulated exchanges.

Pros and Cons of Futures Contracts

Futures contracts offer standardized terms and are traded on regulated exchanges, providing high liquidity and reduced counterparty risk compared to forward contracts. The requirement for margin deposits ensures daily settlement of gains and losses, which can enhance risk management but may lead to margin calls during volatile markets. However, futures contracts lack flexibility in contract customization, potentially making them less suitable for hedgers with specific needs.

Choosing Between Forward and Futures Contracts: Key Considerations

Choosing between forward and futures contracts depends on factors such as customization, liquidity, and counterparty risk. Forward contracts offer tailored terms and flexibility but carry higher counterparty risk due to lack of centralized clearing. Futures contracts provide standardized terms, greater liquidity through exchanges, and lower credit risk via margin requirements, making them suitable for traders seeking standardized risk management instruments.

Forward Contract Infographic

libterm.com

libterm.com