Stock dividends increase the number of shares you own without distributing cash, providing a way for companies to reward shareholders while conserving cash flow. This approach can dilute earnings per share but often signals confidence in the company's future growth prospects. Explore the rest of the article to understand how stock dividends might impact your investment strategy.

Table of Comparison

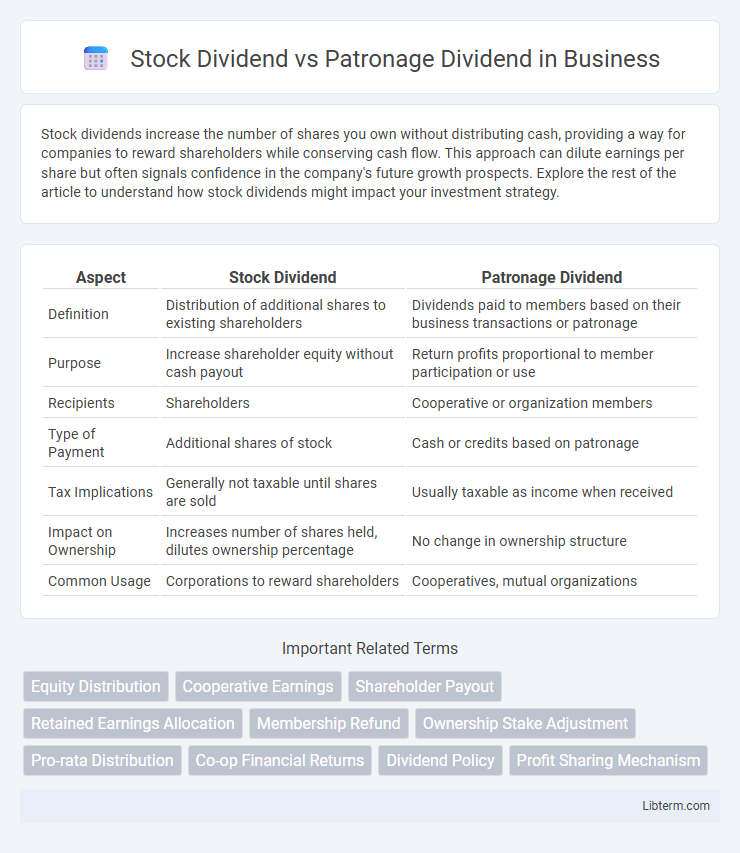

| Aspect | Stock Dividend | Patronage Dividend |

|---|---|---|

| Definition | Distribution of additional shares to existing shareholders | Dividends paid to members based on their business transactions or patronage |

| Purpose | Increase shareholder equity without cash payout | Return profits proportional to member participation or use |

| Recipients | Shareholders | Cooperative or organization members |

| Type of Payment | Additional shares of stock | Cash or credits based on patronage |

| Tax Implications | Generally not taxable until shares are sold | Usually taxable as income when received |

| Impact on Ownership | Increases number of shares held, dilutes ownership percentage | No change in ownership structure |

| Common Usage | Corporations to reward shareholders | Cooperatives, mutual organizations |

Introduction to Stock Dividends and Patronage Dividends

Stock dividends distribute additional shares of a company's stock to existing shareholders, increasing the number of shares they own without affecting cash flow. Patronage dividends are payments made by cooperatives to members based on their use of cooperative services, reflecting the cooperative's profitability and member participation. Both types of dividends reward stakeholders but differ in form, source, and distribution criteria.

Defining Stock Dividends

Stock dividends refer to payments made to shareholders in the form of additional shares rather than cash, effectively increasing the number of shares owned without altering the overall equity value. These dividends adjust the share structure by distributing a proportional amount of new shares based on existing holdings, thereby diluting the share price while retaining the company's cash reserves. In contrast, patronage dividends distribute profits to cooperative members based on their individual transactions or contributions, emphasizing member participation rather than share ownership.

Understanding Patronage Dividends

Patronage dividends are payments made to members of a cooperative based on their use of the cooperative's services, reflecting a share of the profits proportional to their patronage. Unlike stock dividends, which are distributions to shareholders based on stock ownership, patronage dividends emphasize rewarding cooperative members' participation and contribution. This system aligns members' interests with the cooperative's success and promotes member loyalty and engagement.

Key Differences Between Stock and Patronage Dividends

Stock dividends distribute additional shares to shareholders, increasing equity without impacting cash flow, while patronage dividends return earnings to cooperative members based on their level of participation, often in cash or allocated credits. Stock dividends primarily benefit investors by enhancing share value and ownership, whereas patronage dividends reward members for using cooperative services, emphasizing member engagement over investment returns. The key difference lies in the purpose: stock dividends serve equity growth for investors, and patronage dividends reinforce cooperative principles by sharing profits proportionally among active members.

Purpose and Objectives of Each Dividend Type

Stock dividends aim to reward shareholders by issuing additional shares, increasing their equity stake without depleting cash reserves, thus enhancing shareholder value and encouraging long-term investment. Patronage dividends distribute cooperative earnings back to members based on their level of participation, promoting member loyalty and equitable profit sharing aligned with cooperative principles. The primary objective of stock dividends is capital growth for investors, while patronage dividends focus on member benefits and reinforcing cooperative engagement.

Eligibility Requirements for Receiving Dividends

Stock dividends are typically distributed to shareholders who own shares on the record date, requiring proof of stock ownership in a corporation. Patronage dividends are paid to members of cooperatives based on their level of participation or usage, demanding active involvement or patronage within the cooperative during the specified period. Eligibility for stock dividends depends on shareholding status, while patronage dividends hinge on member activity and cooperative bylaws.

Tax Implications of Stock vs Patronage Dividends

Stock dividends are generally taxed as ordinary income or capital gains depending on the holding period and specific IRS rules, whereas patronage dividends are often treated as a return of capital or a reduction in the cost basis of the member's stock, potentially deferring tax liability. The IRS classifies patronage dividends as taxable income only when distributed in cash, but if paid in additional stock or other property, taxation may be deferred until disposition. Understanding these distinctions is crucial for cooperative members and investors to optimize tax outcomes and comply with federal tax regulations.

Impact on Shareholders and Members

Stock dividends increase shareholders' equity by issuing additional shares, diluting the ownership percentage but enhancing long-term investment value and liquidity. Patronage dividends distribute earnings based on members' transactions, directly rewarding member participation and promoting cooperative engagement without affecting ownership stakes. Both dividend types influence financial returns, yet stock dividends impact market value while patronage dividends reinforce member loyalty and usage.

Advantages and Disadvantages of Each Dividend Form

Stock dividends increase shareholders' equity without reducing cash flow, providing investors with more shares and potential capital gains; however, they may dilute earnings per share and lead to market undervaluation. Patronage dividends return profits based on member or customer participation, strengthening cooperative loyalty and reflecting democratic control, but can reduce reinvestment capital and create variability in payout amounts. Choosing between stock and patronage dividends depends on balancing cash flow needs, shareholder expectations, and organizational goals.

Choosing the Right Dividend for Your Organization

Selecting the appropriate dividend type depends on your organization's structure and financial goals; stock dividends increase shareholder equity by issuing additional shares, benefiting companies focusing on growth and stock value appreciation. Patronage dividends distribute profits based on member transactions, ideal for cooperatives emphasizing member engagement and equitable profit sharing. Evaluating your entity's long-term objectives and member or shareholder expectations ensures optimal alignment between dividend strategy and organizational success.

Stock Dividend Infographic

libterm.com

libterm.com