EPS measures a company's profitability on a per-share basis, reflecting net income available to shareholders, while EBITDA focuses on operational performance by excluding interest, taxes, depreciation, and amortization expenses. Understanding the differences between EPS and EBITDA can help you evaluate financial health and make more informed investment decisions. Explore the rest of the article to gain deeper insights into how these metrics impact your analysis.

Table of Comparison

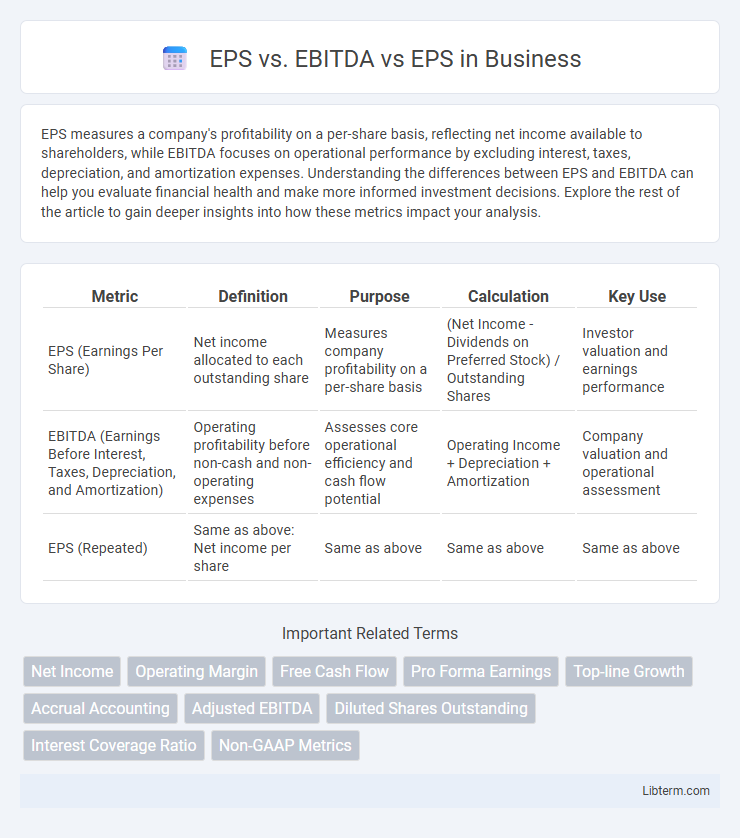

| Metric | Definition | Purpose | Calculation | Key Use |

|---|---|---|---|---|

| EPS (Earnings Per Share) | Net income allocated to each outstanding share | Measures company profitability on a per-share basis | (Net Income - Dividends on Preferred Stock) / Outstanding Shares | Investor valuation and earnings performance |

| EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) | Operating profitability before non-cash and non-operating expenses | Assesses core operational efficiency and cash flow potential | Operating Income + Depreciation + Amortization | Company valuation and operational assessment |

| EPS (Repeated) | Same as above: Net income per share | Same as above | Same as above | Same as above |

Introduction to EPS and EBITDA

Earnings Per Share (EPS) measures a company's profitability by dividing net income by outstanding shares, providing investors with a per-share profit metric. Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) evaluates operational performance by excluding non-operational expenses, offering insights into cash flow generation. Both EPS and EBITDA serve as critical indicators for assessing financial health but focus on different aspects of profitability and operational efficiency.

What is EPS (Earnings Per Share)?

EPS (Earnings Per Share) measures a company's profitability by dividing net income by the number of outstanding shares, indicating the earnings available to each share of common stock. Unlike EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), which focuses on operational profitability by excluding non-operating expenses, EPS reflects the actual profit attributed to shareholders after all expenses and taxes. Investors prioritize EPS to assess a company's financial health and compare profitability on a per-share basis across firms in the same industry.

What is EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)?

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is a financial metric that measures a company's operational profitability by excluding non-operating expenses and non-cash charges. It provides a clearer view of core business performance compared to EPS (Earnings Per Share), which reflects net income attributable to shareholders and includes all expenses. Investors use EBITDA to evaluate a firm's cash flow potential before accounting for capital structure and tax effects.

Key Differences Between EPS and EBITDA

Earnings Per Share (EPS) measures a company's net profit allocated to each outstanding share, reflecting profitability from shareholders' perspective. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) highlights operational performance by excluding non-operational expenses and non-cash charges, offering insights into cash flow potential. The key difference lies in EPS accounting for net income after all expenses, while EBITDA focuses solely on core operational efficiency without considering financing and accounting effects.

EPS: Calculation and Interpretation

Earnings Per Share (EPS) is calculated by dividing net income minus preferred dividends by the weighted average number of common shares outstanding, serving as a key indicator of a company's profitability on a per-share basis. EPS helps investors assess earnings performance relative to share value, differentiating it from EBITDA, which measures operational profitability before interest, taxes, depreciation, and amortization. Interpreting EPS involves analyzing trends over time and comparing against industry peers to gauge financial health and potential stock valuation.

EBITDA: Calculation and Use Cases

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is calculated by adding back interest, taxes, depreciation, and amortization expenses to net income, providing a clearer view of operational profitability. Unlike EPS (Earnings Per Share), which measures profitability on a per-share basis and reflects net income, EBITDA focuses on the core business performance by excluding non-operational costs and accounting decisions. This metric is widely used for comparing companies within the same industry, assessing cash flow potential, and evaluating operational efficiency without the influence of capital structure or tax environments.

Advantages of Using EPS

Earnings Per Share (EPS) directly measures the profitability available to each common shareholder, making it a clear indicator of company performance from an investor's perspective. Unlike EBITDA, which excludes interest, taxes, depreciation, and amortization, EPS reflects net income after all expenses, providing a more accurate assessment of a company's profitability. EPS also enables straightforward comparison across companies with different capital structures and tax situations, enhancing its usefulness in investment decision-making.

Advantages of Using EBITDA

EBITDA provides a clearer picture of a company's operating performance by excluding non-cash expenses like depreciation and amortization, unlike EPS which includes net income influenced by interest and taxes. This makes EBITDA particularly useful for comparing companies across industries with varying capital structures and tax rates. Investors and analysts favor EBITDA for its ability to highlight core profitability and cash flow potential without accounting distortions.

EPS vs. EBITDA: Which Metric Matters Most for Investors?

EPS (Earnings Per Share) measures a company's profitability on a per-share basis, reflecting net income available to shareholders, while EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) evaluates operational performance by excluding non-operational expenses and accounting decisions. Investors prioritize EPS for assessing actual earnings and dividend potential, but EBITDA offers insights into cash flow and operational efficiency, especially in capital-intensive industries. The choice between EPS and EBITDA depends on investment goals, with EPS favored for evaluating profitability and shareholder value, and EBITDA preferred for analyzing core business performance and debt servicing ability.

Conclusion: Choosing the Right Financial Metric

EPS measures net profit per share, highlighting shareholder profitability, while EBITDA reflects operational performance by excluding interest, taxes, depreciation, and amortization. Selecting the right metric depends on the analysis goal: EPS suits investors assessing earnings growth, EBITDA benefits those evaluating core business efficiency, and understanding both offers a comprehensive financial perspective. Balancing these metrics provides clearer insights into company value and operational health for informed decision-making.

EPS vs. EBITDA Infographic

libterm.com

libterm.com