Emissions allowances regulate the amount of greenhouse gases a company can emit, serving as key tools in environmental policy and carbon markets. Businesses must manage their allowances carefully to avoid penalties and capitalize on trading opportunities within emissions trading systems. Explore the rest of this article to understand how emissions allowances impact your industry and strategies for compliance.

Table of Comparison

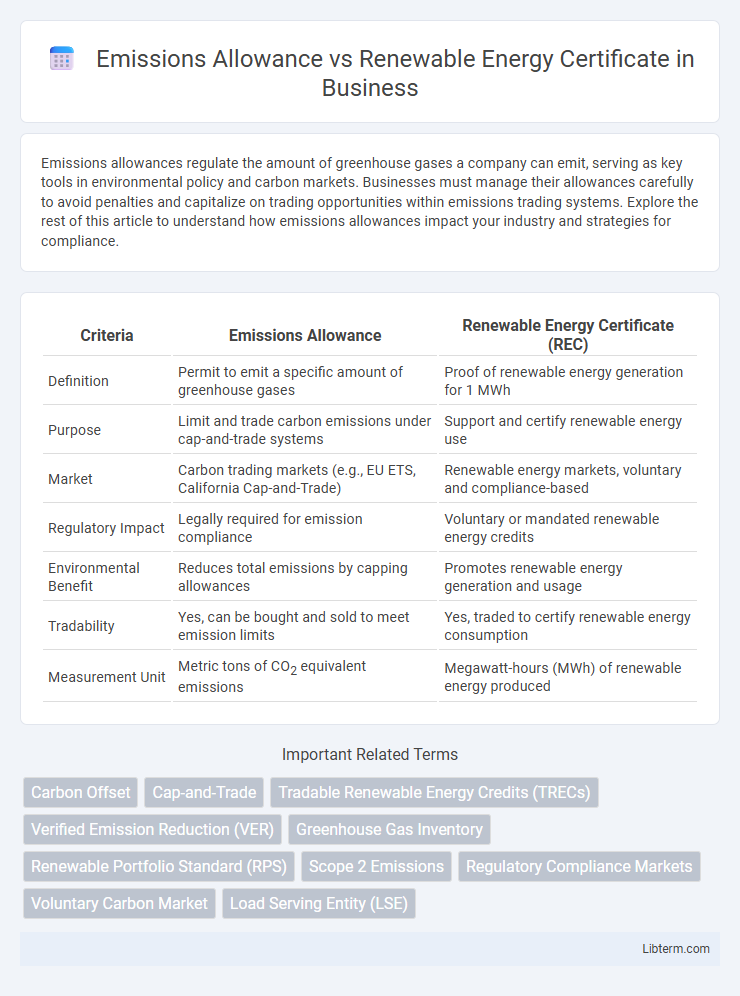

| Criteria | Emissions Allowance | Renewable Energy Certificate (REC) |

|---|---|---|

| Definition | Permit to emit a specific amount of greenhouse gases | Proof of renewable energy generation for 1 MWh |

| Purpose | Limit and trade carbon emissions under cap-and-trade systems | Support and certify renewable energy use |

| Market | Carbon trading markets (e.g., EU ETS, California Cap-and-Trade) | Renewable energy markets, voluntary and compliance-based |

| Regulatory Impact | Legally required for emission compliance | Voluntary or mandated renewable energy credits |

| Environmental Benefit | Reduces total emissions by capping allowances | Promotes renewable energy generation and usage |

| Tradability | Yes, can be bought and sold to meet emission limits | Yes, traded to certify renewable energy consumption |

| Measurement Unit | Metric tons of CO2 equivalent emissions | Megawatt-hours (MWh) of renewable energy produced |

Introduction to Emissions Allowances and Renewable Energy Certificates

Emissions Allowances represent government-issued permits that limit the amount of greenhouse gases a company can emit, integral to cap-and-trade systems designed to reduce overall carbon emissions. Renewable Energy Certificates (RECs) certify that one megawatt-hour (MWh) of electricity has been generated from renewable energy sources, supporting clean energy markets and tracking renewable energy usage. Both instruments function as market-based approaches to environmental regulation, enabling companies to meet emission reduction targets or demonstrate renewable energy consumption.

Defining Emissions Allowances: Purpose and Mechanism

Emissions allowances serve as regulatory permits that authorize the holder to emit a specified quantity of greenhouse gases, typically measured in metric tons of CO2 equivalent, under a cap-and-trade system designed to limit overall emissions. These allowances create a market-driven incentive by setting a cap on total emissions and allowing companies to buy, sell, or trade allowances, encouraging cost-effective reductions across industries. The mechanism ensures compliance with environmental regulations by requiring emitters to hold enough allowances to cover their emissions or face penalties, driving investments in cleaner technologies.

What Are Renewable Energy Certificates (RECs)?

Renewable Energy Certificates (RECs) represent proof that one megawatt-hour (MWh) of electricity was generated from a renewable energy resource, such as wind or solar power. They serve as market-based instruments that allow businesses and individuals to claim the environmental benefits of renewable energy generation without directly consuming the renewable electricity. RECs play a crucial role in supporting green energy markets by enabling compliance with regulatory mandates and corporate sustainability goals, differentiating them from emissions allowances which focus on limiting greenhouse gas outputs.

Regulatory Framework: Cap-and-Trade vs Renewable Standards

Emissions allowances function within cap-and-trade regulatory frameworks that set a carbon emissions limit, allowing entities to buy or sell allowances to comply with caps, incentivizing emission reductions. Renewable Energy Certificates (RECs) support regulatory renewable portfolio standards (RPS) by certifying that one megawatt-hour of electricity was generated from renewable sources, ensuring utilities meet specific renewable energy targets. These frameworks complement each other by addressing greenhouse gas emissions through market mechanisms while promoting cleaner energy production via compliance with regulatory standards.

Key Differences Between Emissions Allowances and RECs

Emissions Allowances represent permits that cap the total greenhouse gas emissions a company can release, functioning within regulated cap-and-trade systems to enforce compliance with environmental limits. Renewable Energy Certificates (RECs) certify the generation of one megawatt-hour (MWh) of electricity from renewable sources, helping companies meet voluntary or mandated renewable energy goals without directly limiting emissions. The key difference lies in emissions allowances controlling overall pollution through market-based caps, while RECs incentivize and verify renewable energy production to promote cleaner energy consumption.

Market Dynamics and Trading for Emissions Allowances and RECs

Emissions allowances and Renewable Energy Certificates (RECs) function within distinct market frameworks where emissions allowances trade in cap-and-trade systems, imposing a limit on total greenhouse gas emissions and enabling companies to buy or sell permits based on their emission levels. RECs represent proof that one megawatt-hour of electricity was generated from renewable sources, driving demand in voluntary and compliance renewable energy markets by allowing entities to claim renewable energy consumption. Market dynamics for emissions allowances are often influenced by regulatory caps, penalty mechanisms, and economic activity, while REC trading is shaped by renewable portfolio standards, corporate sustainability goals, and geographical renewable energy production variability.

Environmental Impact Comparison: Allowances vs RECs

Emissions allowances regulate the amount of greenhouse gases a company can emit, providing a direct cap that incentivizes emission reductions but can still permit pollution within the capped limit. Renewable Energy Certificates (RECs) represent proof that energy has been generated from renewable sources, supporting the expansion of clean energy without capping emissions directly. RECs often drive investment in sustainable energy infrastructure, while emissions allowances focus on limiting overall carbon output, making RECs more effective in promoting long-term environmental benefits through renewable energy development.

Benefits and Challenges of Using Emissions Allowances

Emissions allowances provide companies with flexibility to meet regulatory requirements by capping total greenhouse gas emissions, enabling market-based trading to incentivize reductions cost-effectively. Key benefits include promoting innovation in emissions reduction technologies and offering economic efficiency through market dynamics. Challenges involve potential market volatility, risk of overallocation reducing environmental impact, and complexities in monitoring and enforcement to prevent fraud or misuse.

Advantages and Limitations of Renewable Energy Certificates

Renewable Energy Certificates (RECs) offer the advantage of promoting green energy production by allowing companies to claim renewable energy usage without directly generating it, thereby supporting market demand for clean energy projects. However, RECs face limitations such as potential double counting and the challenge of ensuring that purchasing certificates leads to additional renewable energy capacity rather than merely reallocating existing resources. Unlike emissions allowances that cap overall pollution levels, RECs primarily drive renewable energy adoption but lack direct mechanisms to reduce carbon emissions consistently.

Choosing the Right Instrument for Carbon Reduction Goals

Selecting between Emissions Allowances and Renewable Energy Certificates (RECs) depends on specific carbon reduction goals and regulatory frameworks. Emissions Allowances directly cap and trade greenhouse gas emissions, providing flexible compliance options for regulated entities, whereas RECs represent proof of renewable energy generation and support market-based incentives for clean energy adoption. Aligning the choice with organizational targets involves evaluating cost-effectiveness, regulatory requirements, and impact on renewable energy investment.

Emissions Allowance Infographic

libterm.com

libterm.com