A proxy fight occurs when shareholders attempt to gain control of a company by persuading other investors to vote in favor of their proposed changes during a shareholder meeting. This strategic move often involves soliciting proxy votes to influence board composition or corporate policies. Explore how winning a proxy fight can impact your investment and corporate governance by reading the rest of the article.

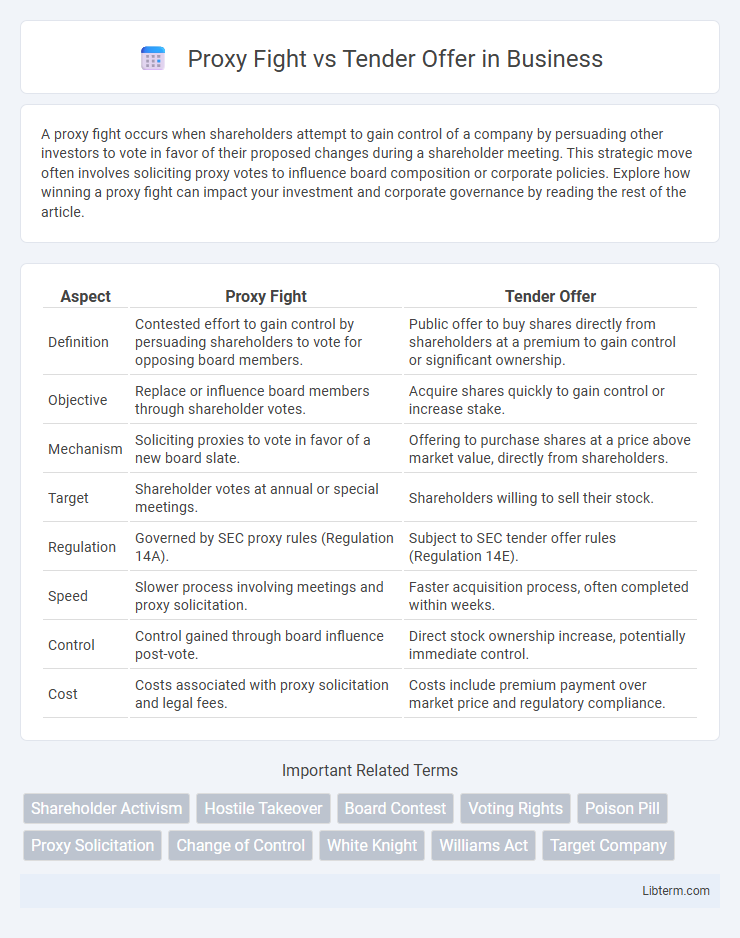

Table of Comparison

| Aspect | Proxy Fight | Tender Offer |

|---|---|---|

| Definition | Contested effort to gain control by persuading shareholders to vote for opposing board members. | Public offer to buy shares directly from shareholders at a premium to gain control or significant ownership. |

| Objective | Replace or influence board members through shareholder votes. | Acquire shares quickly to gain control or increase stake. |

| Mechanism | Soliciting proxies to vote in favor of a new board slate. | Offering to purchase shares at a price above market value, directly from shareholders. |

| Target | Shareholder votes at annual or special meetings. | Shareholders willing to sell their stock. |

| Regulation | Governed by SEC proxy rules (Regulation 14A). | Subject to SEC tender offer rules (Regulation 14E). |

| Speed | Slower process involving meetings and proxy solicitation. | Faster acquisition process, often completed within weeks. |

| Control | Control gained through board influence post-vote. | Direct stock ownership increase, potentially immediate control. |

| Cost | Costs associated with proxy solicitation and legal fees. | Costs include premium payment over market price and regulatory compliance. |

Understanding Proxy Fights: Definition and Process

Proxy fights involve a corporate shareholder dispute where opposing parties seek to gain control of a company by persuading shareholders to vote for their proposed board of directors during a shareholder meeting. The process requires nomination of alternative board candidates, solicitation of proxy votes, and strategic communication to convince shareholders of the benefits of their leadership. Unlike tender offers, proxy fights center on influencing voting rights rather than direct purchase of shares.

What Is a Tender Offer? Key Features Explained

A tender offer is a public, open bid by an acquiring company to purchase shares from existing shareholders at a specified price, usually at a premium above market value, to gain control of the target company. Key features include a fixed offer price, a set time frame for shareholders to respond, and the possibility of bypassing the target company's board of directors. This approach contrasts with a proxy fight, which involves soliciting shareholder votes to replace management or influence corporate policies rather than directly purchasing shares.

Proxy Fight vs Tender Offer: Core Differences

Proxy fights and tender offers are two distinct strategies used in corporate takeovers, differing fundamentally in approach and execution. Proxy fights involve persuading shareholders to vote for new management or board members during an annual or special meeting, whereas tender offers directly seek to purchase shares from shareholders at a specified price, often above market value. Proxy fights emphasize gaining control through shareholder votes, while tender offers prioritize swift acquisition of a significant equity stake via direct share purchases.

Legal Framework Governing Proxy Fights and Tender Offers

Proxy fights and tender offers are governed by distinct legal frameworks designed to protect shareholders and ensure market transparency. Proxy fights fall primarily under the Securities Exchange Act of 1934 and related SEC proxy rules, which regulate solicitation processes and disclosure requirements to prevent manipulation and misinformation. Tender offers are subject to Section 14(d) and 14(e) of the Securities Exchange Act and Regulation 14D, imposing strict timing, disclosure, and fiduciary duty rules to safeguard shareholders' interests during buyout attempts.

Motivations Behind Proxy Fights and Tender Offers

Proxy fights are motivated by shareholders or activist investors seeking to gain control of a company's board to influence management decisions or strategic direction. Tender offers are driven by acquirers aiming for swift ownership acquisition by directly purchasing shares from existing shareholders at a premium price. Both strategies reflect differing approaches to corporate control changes, with proxy fights emphasizing governance influence and tender offers focusing on share accumulation.

Key Players in Proxy Fights and Tender Offers

Key players in proxy fights include dissident shareholders, company management, and proxy advisory firms, all vying to influence shareholder votes on corporate governance matters. In tender offers, the main participants are the acquiring company making a direct purchase proposal, target shareholders deciding whether to sell, and regulatory bodies overseeing compliance with securities laws. Both scenarios involve strategic communication and negotiation aimed at shifting control or ownership in a corporation.

Advantages and Disadvantages of Proxy Fights

Proxy fights enable shareholders to influence corporate decisions by voting to replace management without the need for direct share acquisition, offering a cost-effective way to gain control. However, proxy battles can be costly, time-consuming, and uncertain due to potential legal challenges and the need to secure sufficient shareholder support. Unlike tender offers, proxy fights do not involve immediate ownership changes but rely on persuading shareholders to vote, which may limit the aggressor's control and strategic flexibility.

Pros and Cons of Tender Offers

Tender offers provide shareholders direct opportunities to sell shares at a premium, often accelerating control acquisition compared to proxy fights. They can create immediate liquidity and pressure target companies but may face regulatory scrutiny and high costs. Tender offers might also alienate management and long-term shareholders, risking reputational damage and potential legal challenges.

Impact on Shareholders: Proxy Fight vs Tender Offer

A proxy fight directly involves shareholders as they vote on proposed changes, potentially shifting corporate control without immediate cash transactions. Tender offers provide shareholders with a premium price to sell their shares, offering immediate financial gain but often resulting in a change of ownership. Both mechanisms significantly influence shareholder power and value, with proxy fights emphasizing governance control and tender offers prioritizing liquidity and exit opportunities.

Strategic Considerations for Companies Facing Both

Companies facing both proxy fights and tender offers must evaluate shareholder sentiment and the likelihood of success in influencing board composition versus acquiring shares directly. Proxy fights demand thorough preparation for engaging shareholders and legal compliance, while tender offers require careful pricing strategies and regulatory disclosures to achieve desired ownership levels. Strategic decisions hinge on balancing costs, timing, market response, and potential for long-term control changes.

Proxy Fight Infographic

libterm.com

libterm.com