Enterprise Value (EV) represents a company's total valuation by combining market capitalization, debt, and cash equivalents, providing a comprehensive measure beyond just stock price. This metric is crucial for investors and analysts assessing takeover prices, financial health, and comparative valuations across industries. Explore the rest of the article to understand how Enterprise Value can impact your investment decisions and corporate strategy.

Table of Comparison

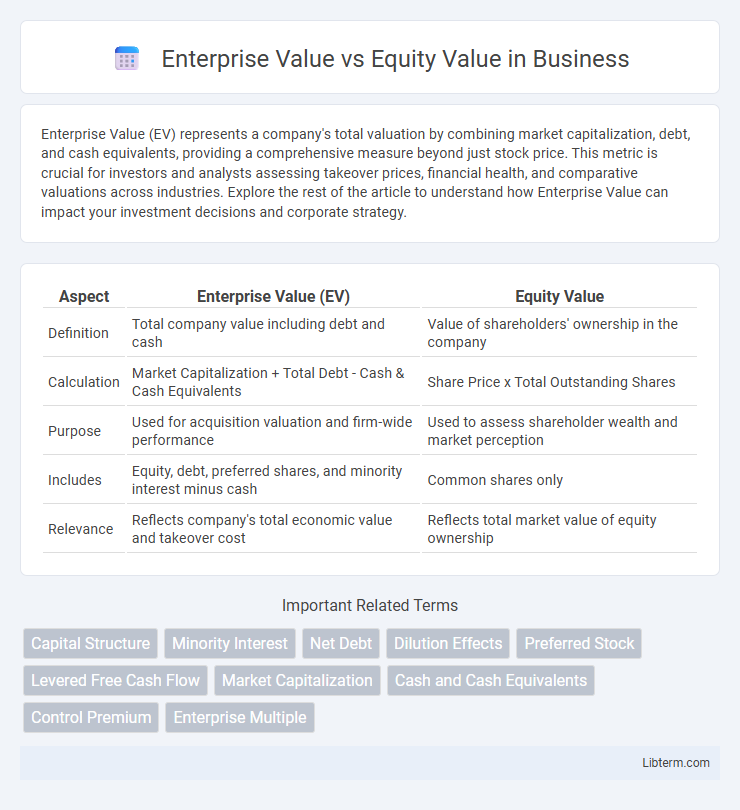

| Aspect | Enterprise Value (EV) | Equity Value |

|---|---|---|

| Definition | Total company value including debt and cash | Value of shareholders' ownership in the company |

| Calculation | Market Capitalization + Total Debt - Cash & Cash Equivalents | Share Price x Total Outstanding Shares |

| Purpose | Used for acquisition valuation and firm-wide performance | Used to assess shareholder wealth and market perception |

| Includes | Equity, debt, preferred shares, and minority interest minus cash | Common shares only |

| Relevance | Reflects company's total economic value and takeover cost | Reflects total market value of equity ownership |

Introduction to Enterprise Value and Equity Value

Enterprise Value (EV) represents the total value of a company, including its market capitalization, debt, and excluding cash, reflecting the cost to acquire the entire business. Equity Value, also known as market capitalization, indicates the value attributed solely to shareholders by multiplying the current stock price by outstanding shares. Understanding the distinction between EV and Equity Value is crucial for accurate company valuation and investment analysis.

Definitions: Enterprise Value vs Equity Value

Enterprise Value (EV) represents the total value of a company, including market capitalization, debt, minority interest, and preferred shares, minus cash and cash equivalents, reflecting the company's full economic worth. Equity Value, also known as market capitalization, measures the value of a company's shares outstanding, representing the ownership interest held by shareholders. While Enterprise Value captures the entire capital structure and is used in valuation metrics like EV/EBITDA, Equity Value focuses solely on shareholder value and is commonly used in stock market analysis.

Key Components of Enterprise Value

Enterprise Value (EV) represents the total value of a company, including market capitalization, debt, preferred stock, and minority interest, minus cash and cash equivalents. Key components of EV encompass equity value, net debt (total debt minus cash), and other non-operating liabilities or assets that affect the firm's valuation. This comprehensive measure reflects the true economic value, aiding investors in assessing takeover price or comparing companies with different capital structures.

Key Components of Equity Value

Equity Value represents the market value of a company's shareholders' ownership, calculated as the total outstanding shares multiplied by the current share price, reflecting common equity and preferred equity. Key components also include the value of stock options, warrants, and restricted stock units that dilute ownership, impacting the diluted equity value. Unlike Enterprise Value, which incorporates debt and cash, Equity Value focuses strictly on ownership interests held by equity investors.

Calculation Methods for Enterprise Value

Enterprise Value (EV) is calculated by adding market capitalization, total debt, and minority interest, then subtracting cash and cash equivalents to reflect a company's total value. This calculation method provides a comprehensive valuation that includes both equity and debt holders, offering a more accurate measure for potential investors or acquirers. Understanding the precise components in the EV formula is crucial for comparing companies with different capital structures.

Calculation Methods for Equity Value

Equity Value is calculated by multiplying the current share price by the total number of outstanding shares, reflecting the market capitalization of a company. Adjustments such as stock options, warrants, and convertible securities are added to the basic equity value to compute the fully diluted equity value. This method captures the ownership value available to shareholders after accounting for potential dilution from convertible instruments.

Major Differences Between Enterprise Value and Equity Value

Enterprise Value represents the total value of a company, including market capitalization, debt, minority interest, and preferred shares, minus cash and cash equivalents, reflecting the complete acquisition cost. Equity Value, also known as market capitalization, measures the value available to shareholders by multiplying the current stock price by outstanding shares. The major difference lies in Enterprise Value capturing the company's total economic worth, while Equity Value focuses solely on shareholder ownership, making EV a better metric for comparing companies with different capital structures.

Importance in Valuation and M&A

Enterprise Value (EV) represents the total value of a company, including debt and equity, providing a comprehensive metric for comparing firms regardless of capital structure, which is crucial in mergers and acquisitions (M&A) for accurate purchase price assessment. Equity Value reflects the value attributable to shareholders after accounting for debt, essential for understanding the net worth from an investor's perspective during M&A negotiations. Both metrics are vital for valuation, as EV guides the overall transaction value while Equity Value determines shareholder returns and informs deal structuring.

Common Misconceptions and Pitfalls

Enterprise Value represents the total value of a company's core operations including debt and excluding cash, often mistaken as the company's market capitalization alone. Equity Value is the market value of shareholders' ownership, commonly confused with Enterprise Value, leading to errors in valuation and investment decisions. Ignoring the impact of debt, cash, and minority interest in these calculations creates pitfalls that distort proper financial analysis and deal comparisons.

Choosing the Right Metric for Your Analysis

Enterprise Value (EV) represents the total value of a company, including debt, equity, and cash, making it ideal for assessing the overall acquisition price. Equity Value reflects the market capitalization and is best used when focusing on shareholder value or per-share metrics. Selecting the right metric depends on the analysis goal: use EV for evaluating capital structure and enterprise-wide performance, while Equity Value suits shareholder-focused assessments and stock price comparisons.

Enterprise Value Infographic

libterm.com

libterm.com