Effective planning enhances productivity by clearly defining goals, allocating resources efficiently, and anticipating potential challenges. It provides a roadmap that keeps projects on track and ensures timely completion. Discover actionable strategies to master your planning skills by reading the rest of the article.

Table of Comparison

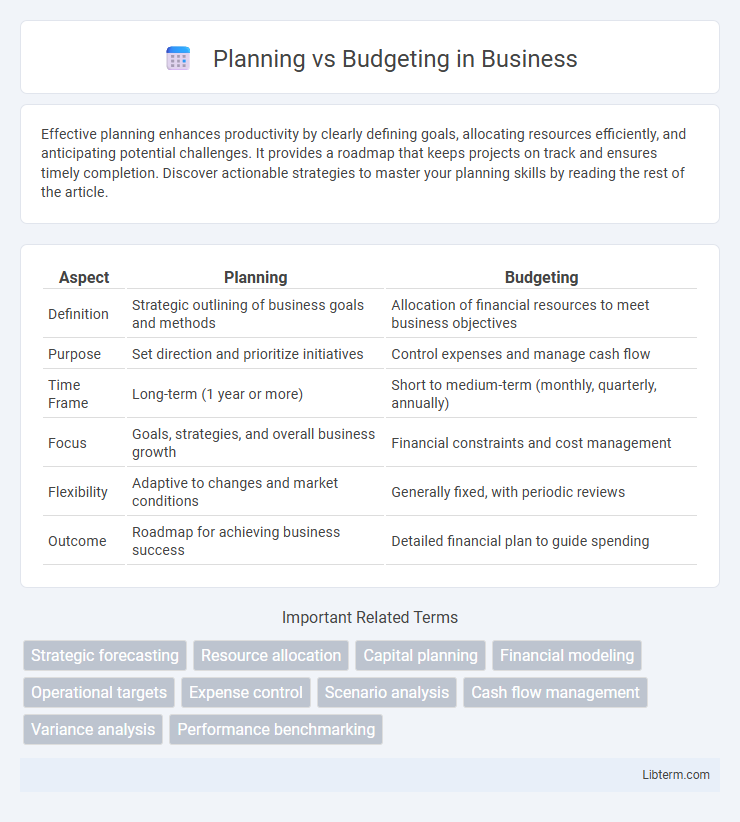

| Aspect | Planning | Budgeting |

|---|---|---|

| Definition | Strategic outlining of business goals and methods | Allocation of financial resources to meet business objectives |

| Purpose | Set direction and prioritize initiatives | Control expenses and manage cash flow |

| Time Frame | Long-term (1 year or more) | Short to medium-term (monthly, quarterly, annually) |

| Focus | Goals, strategies, and overall business growth | Financial constraints and cost management |

| Flexibility | Adaptive to changes and market conditions | Generally fixed, with periodic reviews |

| Outcome | Roadmap for achieving business success | Detailed financial plan to guide spending |

Understanding the Difference: Planning vs Budgeting

Planning involves setting strategic goals and outlining the actions needed to achieve them, emphasizing long-term vision and resource allocation. Budgeting focuses on quantifying financial resources, detailing income and expenses to ensure operational control within a specified time frame. Understanding the difference between planning and budgeting is crucial for effective management, as planning guides overall direction while budgeting allocates funds to support that plan.

The Role of Planning in Business Success

Planning drives business success by setting clear objectives and outlining strategic actions to achieve goals, which enhances resource allocation efficiency and risk management. Effective planning enables companies to anticipate market changes, optimize operations, and maintain a competitive edge. It creates a roadmap that aligns team efforts, facilitates adaptability, and supports long-term growth beyond the constraints of static budgeting processes.

Budgeting: Definition and Key Objectives

Budgeting is the systematic process of creating a financial plan that allocates resources to achieve specific goals within a defined period, typically focused on controlling costs and ensuring financial stability. The key objectives of budgeting include forecasting revenues and expenses, setting spending limits, and providing a framework for performance evaluation and decision-making. Effective budgeting enhances organizational efficiency by aligning resource allocation with strategic priorities and identifying potential financial risks.

How Planning Guides Organizational Direction

Planning guides organizational direction by establishing long-term goals and defining strategic priorities that align resources with key business objectives. It provides a framework for decision-making, helping leaders anticipate market trends, allocate assets effectively, and respond proactively to changes. Unlike budgeting, which focuses on short-term financial constraints, planning ensures sustained growth and competitive advantage through visionary foresight.

The Purpose of Budgeting in Financial Management

Budgeting serves as a critical financial management tool designed to allocate resources efficiently and control expenditures within an organization. Its primary purpose is to create a detailed financial plan that guides decision-making, ensures fiscal discipline, and aligns spending with strategic objectives. Effective budgeting facilitates performance evaluation by comparing actual financial outcomes against projected figures, enabling timely adjustments to maintain financial health.

Key Components of Effective Planning

Effective planning involves setting clear objectives, conducting thorough environmental analysis, and defining actionable strategies to achieve organizational goals. It requires establishing measurable targets, allocating resources efficiently, and developing contingency plans to address potential risks. Continuous monitoring and performance evaluation ensure alignment with strategic priorities and allow for adaptive adjustments throughout the planning cycle.

Essential Elements of a Flexible Budget

A flexible budget adapts to changing activity levels by incorporating variable and fixed costs, allowing organizations to adjust financial plans dynamically. Essential elements include accurate cost behavior analysis, clear identification of cost drivers, and real-time performance monitoring to ensure budget adjustments align with actual operational conditions. This approach enhances resource allocation efficiency and improves financial control across different scenarios.

Synergy Between Planning and Budgeting

The synergy between planning and budgeting enhances organizational efficiency by aligning strategic goals with financial resources, ensuring that every budget allocation supports key initiatives and operational priorities. Effective integration of planning and budgeting processes facilitates proactive decision-making, enabling companies to anticipate challenges and adjust expenditures in real time. This alignment drives sustainable growth by optimizing resource deployment and promoting accountability across departments.

Common Pitfalls in Planning and Budgeting Processes

Common pitfalls in planning and budgeting processes include unrealistic assumptions that lead to overly optimistic projections, insufficient stakeholder engagement resulting in misaligned goals, and lack of flexibility to adapt to changing market conditions. Failure to integrate accurate historical data and neglecting continuous monitoring can cause budget overruns and missed strategic targets. These issues often compromise organizational financial health and hinder effective resource allocation.

Best Practices for Aligning Planning and Budgeting

Effective alignment of planning and budgeting hinges on integrating strategic goals with financial forecasts to ensure resource allocation supports organizational priorities. Best practices include establishing clear communication channels between planning and finance teams, using rolling forecasts to adapt to market changes, and leveraging technology tools for real-time data synchronization. This approach enhances decision-making agility and drives performance by linking operational plans directly to budget constraints.

Planning Infographic

libterm.com

libterm.com