Mergers combine two companies into one entity to enhance market presence, streamline operations, and increase profitability. This strategic move can lead to synergies that improve efficiency and competitiveness in your industry. Discover how mergers impact business growth and what to consider before pursuing one in the full article.

Table of Comparison

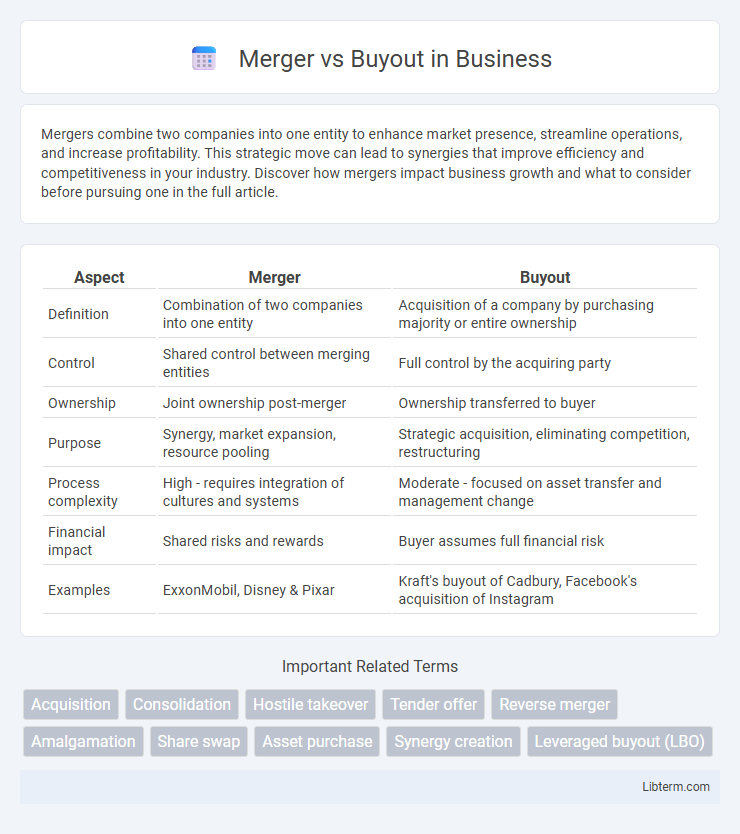

| Aspect | Merger | Buyout |

|---|---|---|

| Definition | Combination of two companies into one entity | Acquisition of a company by purchasing majority or entire ownership |

| Control | Shared control between merging entities | Full control by the acquiring party |

| Ownership | Joint ownership post-merger | Ownership transferred to buyer |

| Purpose | Synergy, market expansion, resource pooling | Strategic acquisition, eliminating competition, restructuring |

| Process complexity | High - requires integration of cultures and systems | Moderate - focused on asset transfer and management change |

| Financial impact | Shared risks and rewards | Buyer assumes full financial risk |

| Examples | ExxonMobil, Disney & Pixar | Kraft's buyout of Cadbury, Facebook's acquisition of Instagram |

Understanding Mergers and Buyouts

Mergers involve the combination of two companies to form a single new entity, often aiming to enhance market share, reduce operational costs, or achieve synergies. Buyouts occur when one company acquires a controlling interest in another, frequently through leveraged buyouts (LBOs) where debt is used to finance the purchase, enabling the buyer to assume full control. Understanding the differences in structure, financial implications, and strategic goals is essential for assessing which method best suits growth, consolidation, or investment strategies.

Key Differences Between Mergers and Buyouts

Mergers involve the combination of two companies into a single new entity, typically with shared ownership and management, while buyouts occur when one company acquires controlling interest or full ownership of another, often resulting in the acquired firm's integration or dissolution. In mergers, value creation focuses on synergy and collaboration, whereas buyouts prioritize control, restructuring, and optimizing operational efficiency. Key differences include the nature of ownership transfer, management control, and strategic intent, with mergers aiming for mutual growth and buyouts targeting financial returns and market dominance.

Strategic Reasons for Mergers

Mergers often occur to achieve strategic growth by combining complementary strengths and expanding market share, enabling companies to enhance competitive positioning. They facilitate access to new technologies, diversify product lines, and enter new geographic markets more efficiently than organic growth. Strategic mergers also aim to realize synergies in operations, reduce costs, and improve innovation capability through shared resources.

Common Motivations Behind Buyouts

Buyouts are commonly motivated by the desire for greater control, enabling buyers to streamline decision-making and implement strategic changes rapidly. Private equity firms often pursue buyouts to unlock value through operational improvements and financial restructuring. These transactions provide opportunities to acquire undervalued assets, optimize management, and drive long-term growth.

Legal and Regulatory Implications

Merger and buyout transactions face distinct legal and regulatory implications shaped by antitrust laws, securities regulations, and disclose requirements mandated by authorities such as the SEC and FTC. Mergers typically require detailed scrutiny to ensure compliance with competition law, often necessitating pre-merger notifications and approvals to prevent monopolistic consequences. Buyouts, especially leveraged ones, trigger regulatory oversight related to financing structures, shareholder rights, and potential changes in corporate governance under state corporate laws and federal securities standards.

Financial Impact: Mergers vs Buyouts

Mergers typically create financial synergies by combining assets, revenues, and cost structures, which can lead to increased shareholder value through economies of scale and operational efficiency. Buyouts, particularly leveraged buyouts (LBOs), involve significant debt financing that restructures the target company's financial profile, impacting cash flow management and often leading to aggressive cost-cutting and asset divestitures. The financial impact of mergers centers on integration benefits and market expansion, whereas buyouts focus on financial engineering and optimizing capital structure for higher returns.

Risks and Challenges in Each Approach

Mergers involve blending two companies into a single entity, which poses risks such as cultural clashes, integration difficulties, and potential loss of key personnel, affecting operational continuity. Buyouts, often led by private equity, carry challenges like high debt levels, pressure to improve performance rapidly, and possible resistance from existing management or stakeholders. Both approaches demand thorough due diligence to mitigate financial, legal, and strategic uncertainties impacting long-term success.

Successful Case Studies: Mergers

Successful merger case studies illustrate the strategic alignment between companies to create synergistic growth, such as the Disney-Pixar merger which enhanced creative collaboration and market dominance in animation. The ExxonMobil merger combined Exxon and Mobil's resources to become the largest publicly traded oil and gas company, optimizing operational efficiency and global reach. These mergers demonstrate how combining complementary strengths results in increased shareholder value and competitive advantages in their respective industries.

Notable Buyout Examples

Notable buyout examples include the 2007 leveraged buyout of TXU Corporation by Kohlberg Kravis Roberts and TPG Capital valued at approximately $45 billion, marking one of the largest in history. Another significant buyout is the 2013 acquisition of Dell Inc. by its founder Michael Dell and Silver Lake Partners, transforming the company from a public to a private entity in a $24.4 billion deal. These buyouts highlight strategies where firms acquire controlling stakes in companies, often using substantial debt financing, distinct from mergers that involve combining two companies into one.

Choosing the Right Strategy for Your Business

Selecting between a merger and a buyout depends on your business goals, financial health, and growth strategy. A merger typically involves combining two companies to leverage synergies and expand market reach, while a buyout focuses on acquiring control by purchasing a majority stake or entire company. Analyzing factors such as valuation, integration complexity, and long-term objectives ensures choosing the optimal strategy for sustainable business growth.

Merger Infographic

libterm.com

libterm.com