Insurtech and proptech are transforming the insurance and real estate industries through innovative technology solutions that enhance efficiency and customer experience. By leveraging data analytics, AI, and digital platforms, these sectors enable personalized services and streamline operations, reducing costs and improving accessibility. Discover how these cutting-edge technologies can impact Your investments and reshape the future of property and insurance in the rest of this article.

Table of Comparison

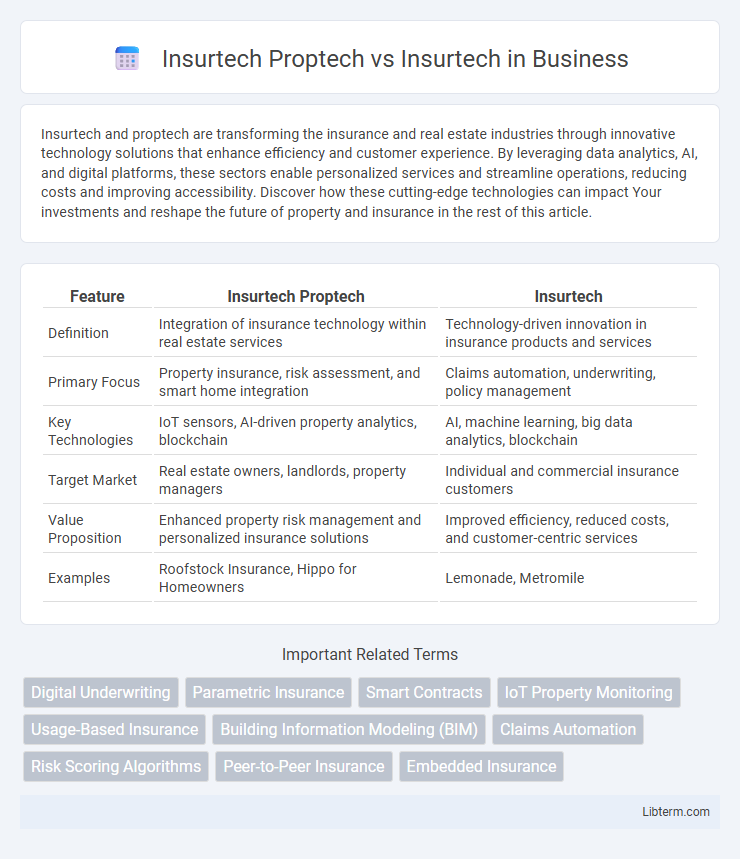

| Feature | Insurtech Proptech | Insurtech |

|---|---|---|

| Definition | Integration of insurance technology within real estate services | Technology-driven innovation in insurance products and services |

| Primary Focus | Property insurance, risk assessment, and smart home integration | Claims automation, underwriting, policy management |

| Key Technologies | IoT sensors, AI-driven property analytics, blockchain | AI, machine learning, big data analytics, blockchain |

| Target Market | Real estate owners, landlords, property managers | Individual and commercial insurance customers |

| Value Proposition | Enhanced property risk management and personalized insurance solutions | Improved efficiency, reduced costs, and customer-centric services |

| Examples | Roofstock Insurance, Hippo for Homeowners | Lemonade, Metromile |

Understanding Insurtech: A New Age for Insurance

Insurtech represents a transformative wave in the insurance industry, leveraging advanced technologies such as AI, big data, and blockchain to enhance underwriting, claims processing, and customer experience. Unlike Proptech, which specifically targets real estate technology innovations, Insurtech broadly redefines risk assessment and policy management across various insurance sectors. This new age for insurance emphasizes digitization, automation, and personalized services, driving efficiency and innovation in policy delivery and risk mitigation strategies.

What is Proptech? Exploring Property Technology

Proptech, short for property technology, leverages digital innovations to transform real estate markets through advanced tools like AI, IoT, and blockchain that enhance property management, transactions, and customer experiences. Unlike insurtech, which focuses on disrupting insurance processes via automation, data analytics, and risk assessment, proptech specifically targets improvements in property development, sales, leasing, and facility management. The growing integration of proptech solutions accelerates smart building systems, virtual reality property tours, and data-driven real estate investment strategies.

Defining Insurtech Proptech: Where Insurance Meets Property Innovation

Insurtech Proptech represents the convergence of insurance technology and property technology, creating innovative solutions that enhance risk assessment, claims processing, and property management. By integrating IoT devices, AI-driven analytics, and blockchain, Insurtech Proptech improves underwriting accuracy and facilitates seamless property transactions. This hybrid technology sector streamlines insurance coverage tailored specifically for real estate assets, promoting efficiency and transparency in both industries.

Key Differences Between Insurtech Proptech and Traditional Insurtech

Insurtech Proptech integrates insurance technology specifically within the real estate sector, leveraging data analytics and IoT to optimize property insurance and risk assessment, while traditional Insurtech broadly improves insurance operations across various industries through automation and AI-driven underwriting. Key differences include Insurtech Proptech's focus on property-related insurance products, real-time property monitoring, and enhanced fraud detection tailored to real estate, whereas traditional Insurtech emphasizes digital claims processing, customer engagement, and general risk management. The specialized nature of Insurtech Proptech enables more precise coverage options and pricing models based on location-specific data, contrasting with the wider but less granular applications of conventional Insurtech solutions.

Benefits of Insurtech Proptech for Property Owners and Tenants

Insurtech Proptech integrates advanced insurance technology with property management, offering property owners streamlined risk assessment and automated claims processing. Tenants benefit from faster claim resolutions and transparent coverage options tailored to rental properties. This synergy enhances operational efficiency and delivers personalized protection, reducing financial uncertainties for both parties.

How Insurtech is Revolutionizing the Insurance Industry

Insurtech is revolutionizing the insurance industry by leveraging advanced technologies like artificial intelligence, blockchain, and big data analytics to streamline underwriting, enhance claims processing, and improve customer experience. Unlike Proptech, which focuses on transforming real estate through digital solutions, Insurtech specifically targets insurance processes to offer personalized policies, faster risk assessment, and automated fraud detection. The integration of IoT devices and telematics within Insurtech enables real-time data collection, driving more accurate pricing models and proactive risk management.

Key Technologies Powering Insurtech Proptech

Key technologies powering Insurtech Proptech include blockchain for secure property transactions, artificial intelligence (AI) for predictive risk analysis in real estate insurance, and Internet of Things (IoT) devices enabling real-time property monitoring. Machine learning algorithms enhance underwriting accuracy by analyzing vast datasets from property management systems, while smart contracts automate claims processing and lease agreements. Geospatial analytics further optimize property valuation and risk assessment, differentiating Insurtech Proptech from traditional Insurtech by integrating property-specific data with insurance technology.

Market Trends: Growth of Insurtech Proptech vs Insurtech

Insurtech Proptech is experiencing rapid growth by integrating insurance solutions with real estate technology, driven by increasing demand for streamlined property transactions and risk management. The Insurtech market is expanding broadly, fueled by advances in AI, big data, and customer-centric digital platforms, but Insurtech Proptech leverages niche opportunities within real estate, often outpacing general Insurtech sectors in adoption rates. Market forecasts predict Insurtech Proptech will grow at a higher CAGR compared to traditional Insurtech, capitalizing on urbanization, smart home innovations, and regulatory shifts favoring property-related insurance products.

Challenges Facing Insurtech Proptech and Insurtech Adoption

Insurtech Proptech faces challenges such as regulatory complexities, integration of advanced technologies like AI and IoT, and addressing diverse consumer needs within real estate markets. Insurtech adoption encounters obstacles including legacy system compatibility, data privacy concerns, and the need for customer trust in automated insurance processes. Overcoming these challenges requires strategic partnerships, robust cybersecurity measures, and continuous innovation to drive widespread acceptance and seamless implementation.

Future Outlook: The Convergence of Insurtech and Proptech

The convergence of Insurtech and Proptech is reshaping the future landscape of insurance and real estate by integrating advanced technologies like AI, IoT, and blockchain to create more efficient, data-driven risk assessment and property management solutions. Insurtech leverages real-time property data from Proptech innovations to enhance underwriting accuracy and streamline claims processing, leading to personalized insurance products tailored to individual property profiles. This synergy is expected to drive greater market transparency, reduce operational costs, and foster innovation in both sectors, positioning Insurtech-Proptech collaboration as a key growth area in the digital transformation of insurance and real estate industries.

Insurtech Proptech Infographic

libterm.com

libterm.com