SPACs are investment vehicles created to raise capital through an initial public offering (IPO) for the purpose of acquiring or merging with an existing company, offering a faster and often more flexible alternative to traditional IPOs. They have surged in popularity, providing unique opportunities and risks for investors looking to capitalize on emerging markets and innovative businesses. Explore the rest of this article to understand how SPACs work and whether they align with your investment strategy.

Table of Comparison

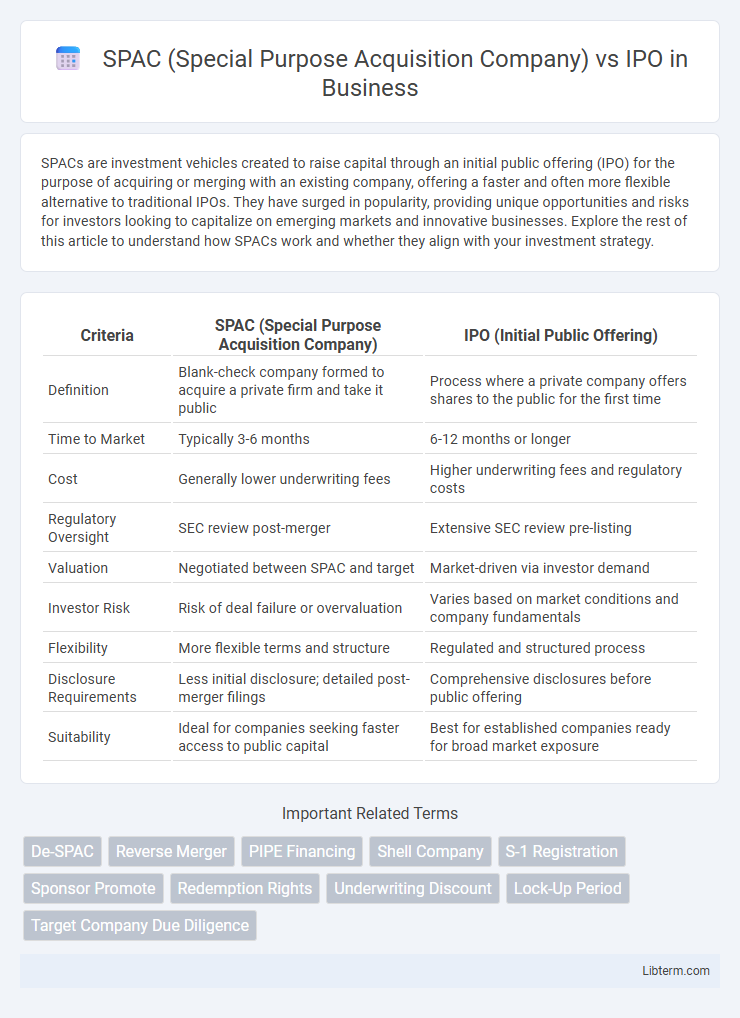

| Criteria | SPAC (Special Purpose Acquisition Company) | IPO (Initial Public Offering) |

|---|---|---|

| Definition | Blank-check company formed to acquire a private firm and take it public | Process where a private company offers shares to the public for the first time |

| Time to Market | Typically 3-6 months | 6-12 months or longer |

| Cost | Generally lower underwriting fees | Higher underwriting fees and regulatory costs |

| Regulatory Oversight | SEC review post-merger | Extensive SEC review pre-listing |

| Valuation | Negotiated between SPAC and target | Market-driven via investor demand |

| Investor Risk | Risk of deal failure or overvaluation | Varies based on market conditions and company fundamentals |

| Flexibility | More flexible terms and structure | Regulated and structured process |

| Disclosure Requirements | Less initial disclosure; detailed post-merger filings | Comprehensive disclosures before public offering |

| Suitability | Ideal for companies seeking faster access to public capital | Best for established companies ready for broad market exposure |

Introduction to SPACs and IPOs

SPACs (Special Purpose Acquisition Companies) are shell companies created solely to raise capital through an initial public offering for the purpose of acquiring or merging with an existing private company, providing a faster route to public markets compared to traditional IPOs. IPOs (Initial Public Offerings) involve a private company offering its shares directly to the public for the first time, often requiring extensive regulatory approvals, rigorous financial disclosures, and market-driven pricing mechanisms. Investors choose SPACs for potentially quicker public listings and deal transparency, while IPOs are preferred for well-established companies seeking broader market validation and long-term investor base.

What is a SPAC?

A Special Purpose Acquisition Company (SPAC) is a publicly traded shell company created to raise capital through an initial public offering (IPO) with the intention of acquiring or merging with an existing private company. Unlike a traditional IPO, where a private company offers its shares directly to the public, a SPAC allows the private company to go public through a reverse merger with the SPAC, providing a faster and often less complex route to market. SPACs have gained popularity as an alternative to traditional IPOs due to their potential for greater price certainty and reduced regulatory scrutiny during the going-public process.

What is an IPO?

An IPO (Initial Public Offering) is the process by which a private company offers its shares to the public for the first time, enabling access to capital markets and increasing liquidity. This traditional method involves underwriting by investment banks, regulatory scrutiny, and detailed financial disclosures to attract investors. IPOs provide companies with a direct path to public ownership, often resulting in higher market valuation and increased brand visibility.

Key Differences Between SPACs and IPOs

SPACs (Special Purpose Acquisition Companies) offer a faster route to public markets by merging with a private company, bypassing the lengthy traditional IPO process that involves extensive regulatory scrutiny and market volatility. Unlike IPOs, which require significant upfront disclosures and roadshows to attract investors, SPACs provide greater certainty in valuation through negotiated deals with target companies. SPAC transactions often result in quicker capital access and less market risk, whereas IPOs depend heavily on market conditions and investor sentiment at the time of offering.

Advantages of Going Public via SPAC

Going public via a SPAC allows companies to access capital markets faster and with greater certainty on valuation compared to traditional IPOs, often reducing time from months to weeks. SPAC transactions provide greater negotiation leverage, enabling firms to secure better deal terms and retain control over the business's strategic direction. Additionally, SPACs offer access to experienced sponsors and investors, enhancing credibility and facilitating smoother market entry for emerging businesses.

Advantages of Traditional IPOs

Traditional IPOs provide established companies with direct access to public capital markets, enabling transparent valuation through rigorous regulatory disclosures and investor scrutiny. They often result in stronger investor confidence and brand credibility due to the comprehensive financial reporting and due diligence processes mandated by securities regulators. This method can attract long-term institutional investors willing to support sustained growth, unlike SPACs, which may face volatility stemming from speculative investor behavior.

Risks and Challenges of SPACs

SPACs (Special Purpose Acquisition Companies) pose significant risks, including potential overvaluation and limited due diligence compared to traditional IPOs, which may result in unforeseen financial losses for investors. The sponsorship structure of SPACs often creates conflicts of interest, as sponsors profit regardless of the acquisition outcome, increasing investor risk. Regulatory scrutiny and market volatility further complicate SPAC transactions, challenging transparency and long-term stability in comparison to conventional IPO processes.

Risks and Challenges of IPOs

IPOs present significant risks such as market volatility, regulatory scrutiny, and the potential for undervaluation during pricing, which can negatively impact capital raised and shareholder value. Companies face extensive disclosure requirements and high underwriting fees, increasing operational burdens prior to going public. The lengthy and complex process of an IPO can expose firms to market fluctuations, reducing predictability in timing and financial outcomes.

Market Trends: SPACs vs IPOs

SPACs have surged in popularity, raising over $80 billion in 2021, driven by faster and more flexible routes to public markets compared to traditional IPOs, which averaged about $175 billion that year globally. Market trends reveal a shift as SPACs offer private companies reduced regulatory scrutiny and more predictable valuations, attracting sectors like technology and healthcare seeking expedited capital access. Despite cooling interest in 2023 due to increased regulatory oversight and market volatility, SPACs remain a dynamic alternative to IPOs, influencing public market strategies and investor appetite.

Which Is Better: SPAC or IPO?

SPACs offer a faster and often less expensive route to public markets compared to traditional IPOs, allowing companies to bypass extensive regulatory scrutiny and market volatility. IPOs provide greater price discovery and transparency due to their rigorous regulatory process and underwriter involvement, which can lead to more stable long-term valuations. The choice depends on a company's need for speed, certainty of valuation, and willingness to comply with disclosure requirements; SPACs benefit high-growth firms seeking rapid capital, while IPOs suit established companies prioritizing market credibility.

SPAC (Special Purpose Acquisition Company) Infographic

libterm.com

libterm.com