The exercise period is crucial for achieving consistent fitness gains and preventing injury by allowing adequate time for muscle recovery and adaptation. Structuring your workouts with appropriate intervals enhances endurance, strength, and overall performance. Discover how optimizing your exercise period can elevate your training results in the rest of this article.

Table of Comparison

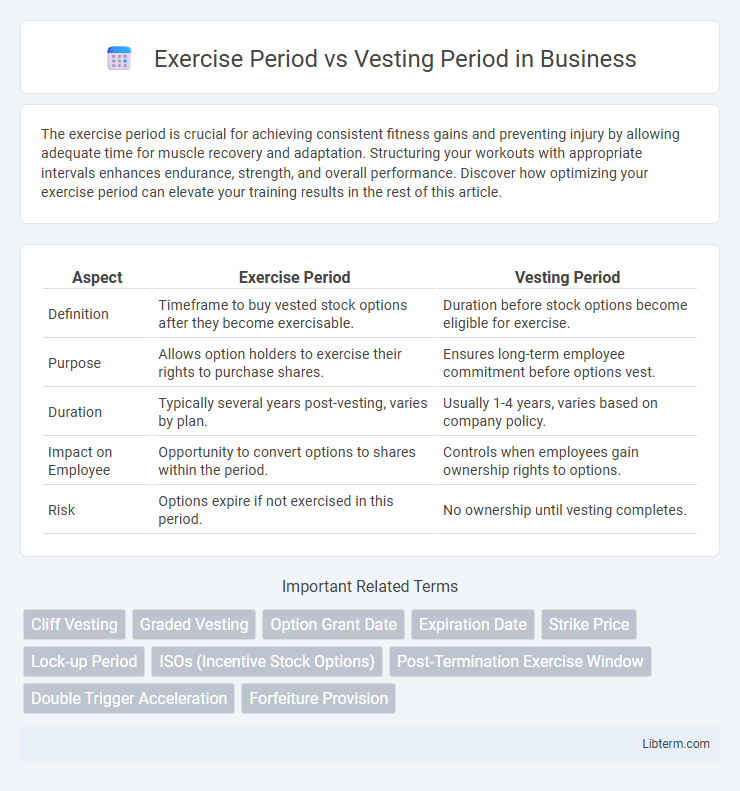

| Aspect | Exercise Period | Vesting Period |

|---|---|---|

| Definition | Timeframe to buy vested stock options after they become exercisable. | Duration before stock options become eligible for exercise. |

| Purpose | Allows option holders to exercise their rights to purchase shares. | Ensures long-term employee commitment before options vest. |

| Duration | Typically several years post-vesting, varies by plan. | Usually 1-4 years, varies based on company policy. |

| Impact on Employee | Opportunity to convert options to shares within the period. | Controls when employees gain ownership rights to options. |

| Risk | Options expire if not exercised in this period. | No ownership until vesting completes. |

Introduction to Exercise Period and Vesting Period

The exercise period is the timeframe during which an employee can purchase stock options after they have vested. The vesting period is the duration an employee must wait before earning the right to exercise their stock options. Understanding the distinction between these periods is crucial for maximizing the benefits of employee stock option plans.

Defining Exercise Period in Equity Compensation

The exercise period in equity compensation refers to the timeframe during which an employee can purchase vested stock options after they become eligible. This period typically begins once the options vest and ends on the expiration date, often ranging from several months to ten years. Understanding the exercise period is crucial for maximizing the financial benefits of stock options before they expire.

Understanding Vesting Period in Stock Options

The vesting period in stock options is the timeframe an employee must wait before gaining full ownership of granted shares, often spanning several years to encourage retention. During this period, employees cannot exercise their options, meaning they cannot purchase the underlying stock until the vesting conditions are met. Understanding the vesting schedule is crucial for maximizing financial benefits and aligning stock options with long-term career goals.

Key Differences Between Exercise Period and Vesting Period

The exercise period is the timeframe during which an employee can purchase stock options after they have vested, usually lasting several years. The vesting period refers to the duration an employee must wait before gaining ownership rights to stock options or other benefits, often spanning multiple years. Key differences include the vesting period determining eligibility to exercise options, while the exercise period limits the window to actually buy the shares after vesting.

Importance of Vesting Period for Employees

The vesting period is crucial for employees as it determines when they gain full ownership of their stock options or retirement benefits, incentivizing long-term commitment and loyalty to the company. Unlike the exercise period, which is the timeframe to purchase vested options, the vesting period secures an employee's right to these benefits over time, often linked to continued employment. Understanding the vesting schedule helps employees plan financially and maximize the value of their equity compensation.

How the Exercise Period Works After Vesting

The exercise period begins once the vesting period ends, allowing option holders to purchase shares at the predetermined strike price within a specified timeframe. During this exercise window, employees must decide to exercise their stock options before expiry, typically ranging from months to years depending on the plan terms. Failure to act within the exercise period results in the loss of vested options, emphasizing the importance of understanding plan-specific timelines for converting equity into actual ownership.

Common Timeframes for Vesting and Exercise Periods

Common vesting periods for stock options typically range from three to five years, often with a one-year cliff followed by monthly or quarterly vesting. Exercise periods generally last from 90 days to 10 years after the vesting date, depending on the company's stock option plan and termination clauses. Understanding these timeframes is crucial for maximizing the benefits of equity compensation and avoiding option expiration.

Legal and Tax Implications of Exercise vs Vesting Periods

The exercise period refers to the timeframe during which employees can purchase stock options after they have vested, while the vesting period is the duration an employee must wait to earn the right to exercise those options. Legally, unvested options cannot be exercised, ensuring compliance with equity compensation regulations, whereas exercised options create immediate tax events subject to income or capital gains taxes based on the holding period. Tax implications vary significantly: exercising early can trigger ordinary income tax on the bargain element, whereas holding shares post-exercise may result in preferential long-term capital gains tax if specific holding period requirements are met.

Strategies for Managing Stock Options Timelines

Exercise period refers to the timeframe during which an employee can purchase vested stock options, while the vesting period is the duration required to earn those options. Effective strategies for managing stock options timelines include monitoring expiration dates to avoid losing options and aligning exercise decisions with personal financial goals and tax implications. Prioritizing early exercises during favorable market conditions and understanding company-specific rules can maximize potential gains and minimize risks.

Frequently Asked Questions on Exercise and Vesting Periods

The exercise period refers to the time frame during which an employee can purchase their stock options after they have vested, while the vesting period is the duration an employee must wait to earn the right to exercise those options. Frequently asked questions often address how long the exercise period lasts after employment ends and what happens if options are not exercised within this timeframe. Common concerns also include the implications for tax liability depending on when options are exercised relative to the vesting schedule.

Exercise Period Infographic

libterm.com

libterm.com