Tax payable represents the amount of taxes a company or individual owes to the government based on their taxable income or transactions during a specific period. Accurately calculating and managing tax payable ensures compliance with tax laws and avoids penalties or interest charges. Explore the full article to better understand how tax payable impacts your financial responsibilities.

Table of Comparison

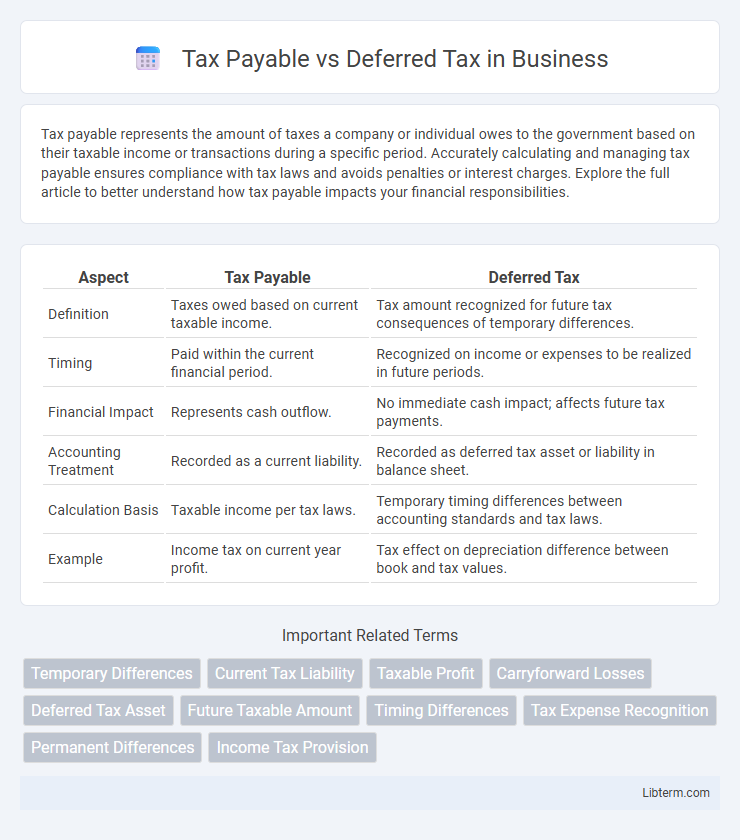

| Aspect | Tax Payable | Deferred Tax |

|---|---|---|

| Definition | Taxes owed based on current taxable income. | Tax amount recognized for future tax consequences of temporary differences. |

| Timing | Paid within the current financial period. | Recognized on income or expenses to be realized in future periods. |

| Financial Impact | Represents cash outflow. | No immediate cash impact; affects future tax payments. |

| Accounting Treatment | Recorded as a current liability. | Recorded as deferred tax asset or liability in balance sheet. |

| Calculation Basis | Taxable income per tax laws. | Temporary timing differences between accounting standards and tax laws. |

| Example | Income tax on current year profit. | Tax effect on depreciation difference between book and tax values. |

Introduction to Tax Payable and Deferred Tax

Tax Payable represents the current tax liability a company owes to tax authorities based on taxable income for the reporting period. Deferred Tax arises from temporary differences between accounting income and taxable income, leading to future tax obligations or benefits. Understanding these distinct tax concepts is crucial for accurate financial reporting and tax planning strategies.

Understanding Tax Payable

Tax payable represents the actual amount of income tax a company owes to tax authorities for the current fiscal period based on taxable income reported on its tax return. It is a current liability recorded on the balance sheet and entails an immediate obligation requiring settlement within the accounting period. Understanding tax payable is essential for accurate cash flow management and compliance with tax regulations.

What is Deferred Tax?

Deferred tax represents tax liabilities or assets resulting from temporary differences between accounting income and taxable income, which will reverse in future periods. It arises when income or expenses are recognized in different periods for financial reporting and tax purposes, leading to future tax consequences. Deferred tax ensures accurate matching of tax expenses with accounting profits in compliance with accounting standards like IAS 12.

Key Differences Between Tax Payable and Deferred Tax

Tax payable represents the actual amount of income tax a company owes to tax authorities for the current period based on taxable income reported on the tax return. Deferred tax arises from temporary differences between accounting income and taxable income, resulting in future tax liabilities or assets recognized on the balance sheet. The key difference lies in timing: tax payable is a current obligation, while deferred tax reflects future tax consequences of present transactions or events.

Causes of Deferred Tax Assets and Liabilities

Deferred tax assets arise primarily from deductible temporary differences such as warranty expenses, tax loss carryforwards, and provisions that are recognized in accounting but not yet deductible for tax purposes. Deferred tax liabilities result from taxable temporary differences including accelerated depreciation for tax purposes compared to accounting, revenue recognition differences, and installment sale methods that delay tax payments. These timing differences between accounting income and taxable income create future tax consequences reflected as deferred tax assets or liabilities on the balance sheet.

Tax Payable in Financial Statements

Tax payable represents the actual amount of income tax a company owes to tax authorities within a specific period, recorded as a current liability on the balance sheet. It reflects the tax expense recognized in the income statement, adjusted for any prepayments or credits, and is settled in the short term. Accurately reporting tax payable ensures transparency in financial statements, enabling stakeholders to assess the company's immediate tax obligations.

Accounting for Deferred Tax

Deferred tax accounting involves recognizing temporary differences between the carrying amount of assets and liabilities in financial statements and their tax bases, leading to deferred tax assets or liabilities. These differences arise from timing discrepancies in revenue recognition, expense deductions, or asset depreciation under accounting standards versus tax regulations. Properly accounting for deferred tax ensures accurate matching of tax expenses to the relevant periods, enhancing financial statement reliability and compliance with IAS 12 or comparable tax accounting standards.

Impact on Cash Flow and Profitability

Tax payable directly affects cash flow as it represents the actual tax amount due to the government within the fiscal period, reducing available cash immediately. Deferred tax arises from timing differences between accounting income and taxable income, impacting reported profitability without an immediate cash outflow, thus potentially inflating or deflating profit margins temporarily. Understanding the distinction between tax payable and deferred tax is crucial for accurate cash flow management and assessing true operational profitability.

Regulatory and Compliance Considerations

Tax payable represents the current tax liability based on taxable income reported in financial statements, requiring timely regulatory compliance with local tax authorities through accurate filings and payments. Deferred tax arises from temporary differences between accounting income and taxable income, mandating adherence to accounting standards such as IFRS or GAAP for proper recognition and disclosure in financial reports. Companies must ensure compliance with evolving tax laws and rigorous audit requirements to avoid penalties related to both current and deferred tax obligations.

Practical Examples of Tax Payable vs Deferred Tax

Tax payable represents the actual amount a company owes to tax authorities for the current period, such as $50,000 owed on taxable income of $500,000, while deferred tax arises from temporary differences in accounting versus tax treatment, like recognizing $10,000 deferred tax liability due to accelerated depreciation. For example, if a company uses straight-line depreciation for accounting but accelerated depreciation for tax, it may report lower taxable income initially, resulting in lower tax payable but higher deferred tax liabilities. Deferred tax assets can occur when expenses are recognized earlier for tax purposes, creating future tax benefits, as seen in warranty expenses deductible in tax filings but accrued later in financial statements.

Tax Payable Infographic

libterm.com

libterm.com