Investment banks play a crucial role in facilitating capital raising, mergers, and acquisitions for corporations and governments. They provide expert advisory services and underwrite securities, ensuring successful financial transactions. Explore the full article to understand how investment banks can impact your financial strategies and growth opportunities.

Table of Comparison

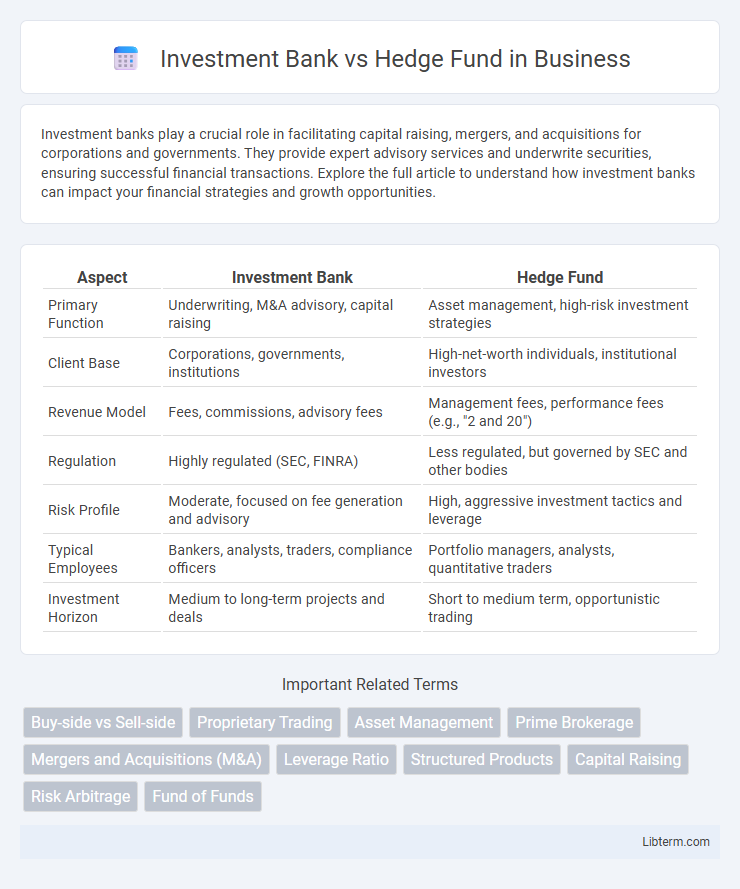

| Aspect | Investment Bank | Hedge Fund |

|---|---|---|

| Primary Function | Underwriting, M&A advisory, capital raising | Asset management, high-risk investment strategies |

| Client Base | Corporations, governments, institutions | High-net-worth individuals, institutional investors |

| Revenue Model | Fees, commissions, advisory fees | Management fees, performance fees (e.g., "2 and 20") |

| Regulation | Highly regulated (SEC, FINRA) | Less regulated, but governed by SEC and other bodies |

| Risk Profile | Moderate, focused on fee generation and advisory | High, aggressive investment tactics and leverage |

| Typical Employees | Bankers, analysts, traders, compliance officers | Portfolio managers, analysts, quantitative traders |

| Investment Horizon | Medium to long-term projects and deals | Short to medium term, opportunistic trading |

Introduction to Investment Banks and Hedge Funds

Investment banks specialize in services such as underwriting, mergers and acquisitions advisory, and market making, facilitating capital flow between investors and corporations. Hedge funds manage pooled capital using diverse strategies including long-short equity, arbitrage, and derivatives to maximize returns for accredited investors. Both institutions operate in financial markets but differ in structure, regulatory environment, and investment goals.

Core Functions and Objectives

Investment banks specialize in underwriting securities, facilitating mergers and acquisitions, and providing advisory services to corporations and governments, aiming to generate fee-based income through capital market activities. Hedge funds focus on managing pooled capital from accredited investors or institutions, utilizing diverse strategies such as long-short equity, arbitrage, and global macro to achieve high returns on investment. While investment banks serve as intermediaries in financial markets, hedge funds primarily seek to maximize portfolio performance through active asset management and risk-taking.

Organizational Structure and Roles

Investment banks operate with a hierarchical organizational structure divided into front office, middle office, and back office functions, where front office roles include investment banking, sales, and trading focused on client-driven revenue generation. Hedge funds feature a leaner structure centered on portfolio managers, analysts, and traders who collectively make investment decisions and manage assets with a high degree of autonomy. The distinct roles in investment banks emphasize client advisory, underwriting, and market-making, whereas hedge fund roles prioritize active portfolio management and speculative investment strategies.

Clientele and Target Markets

Investment banks primarily serve corporations, governments, and institutional clients by offering services such as underwriting, mergers and acquisitions, and capital raising in global financial markets. Hedge funds target high-net-worth individuals and institutional investors seeking aggressive returns through diverse strategies including long-short equity, arbitrage, and derivatives trading. Both operate in sophisticated markets but differ in client risk tolerance and investment objectives, with investment banks focusing on advisory and capital formation, while hedge funds emphasize active portfolio management and alpha generation.

Revenue Generation Models

Investment banks generate revenue primarily through underwriting fees, advisory services for mergers and acquisitions, and trading commissions, leveraging large-scale capital markets activities. Hedge funds earn income mainly via management fees, typically around 2% of assets under management, combined with performance fees of approximately 20% on profits, aligning their interests with investors' returns. The divergent revenue models reflect the investment bank's focus on facilitating transactions and market liquidity, while hedge funds concentrate on active portfolio management and generating alpha.

Regulatory Environment and Compliance

Investment banks operate under stringent regulatory frameworks such as the Dodd-Frank Act and Basel III, requiring rigorous capital adequacy, reporting, and consumer protection measures. Hedge funds face lighter regulation but must adhere to SEC rules, including registration under the Investment Advisers Act of 1940 and periodic disclosures to safeguard against fraud and market manipulation. Compliance in investment banks emphasizes systemic risk management, while hedge funds prioritize investor transparency and anti-money laundering controls within a more flexible regulatory scope.

Risk Management Approaches

Investment banks employ rigorous risk management frameworks focusing on credit risk, market risk, and operational risk, using tools such as Value at Risk (VaR), stress testing, and scenario analysis to protect client assets and maintain regulatory compliance. Hedge funds prioritize dynamic risk strategies tailored to their specific investment styles, utilizing leverage control, diversification, and quantitative models to manage portfolio volatility and downside risk. Both institutions integrate advanced analytics and real-time monitoring systems but differ in risk appetite, with hedge funds often assuming higher risk for greater returns while investment banks emphasize risk mitigation to safeguard financial stability.

Career Opportunities and Work Culture

Investment banks offer structured career paths with roles in mergers and acquisitions, trading, and underwriting, emphasizing long hours and a high-pressure environment. Hedge funds provide dynamic opportunities focused on portfolio management, research, and proprietary trading, often rewarding performance with substantial bonuses. Work culture at investment banks tends to be hierarchical and formal, whereas hedge funds favor a more entrepreneurial and flexible atmosphere.

Performance Metrics and Evaluation

Investment banks primarily measure performance using deal volume, advisory fees, and underwriting success, emphasizing client acquisition and transaction value. Hedge funds focus on metrics like alpha, Sharpe ratio, and net asset value (NAV) growth to evaluate risk-adjusted returns and absolute performance. Both institutions rely on rigorous quantitative analysis but prioritize distinct financial indicators aligned with their operational objectives.

Key Differences and Which to Choose

Investment banks specialize in underwriting, mergers and acquisitions, and trading securities, serving corporations and governments with structured financial services, whereas hedge funds focus on pooled investment portfolios using diverse, often high-risk strategies aiming for high returns for accredited investors. Key differences include regulatory frameworks, risk tolerance, client base, and compensation models, with investment banks relying on fees and commissions and hedge funds on performance-based incentives. Choosing between them depends on your financial goals: select investment banks for advisory and capital-raising needs, and hedge funds for active portfolio management seeking aggressive growth.

Investment Bank Infographic

libterm.com

libterm.com