Equipment financing offers businesses the opportunity to acquire essential machinery and technology without large upfront costs, preserving cash flow and enabling growth. Flexible terms and competitive rates tailor repayment options to your specific financial situation, making it easier to manage expenses. Discover how equipment financing can empower your business by exploring the rest of this article.

Table of Comparison

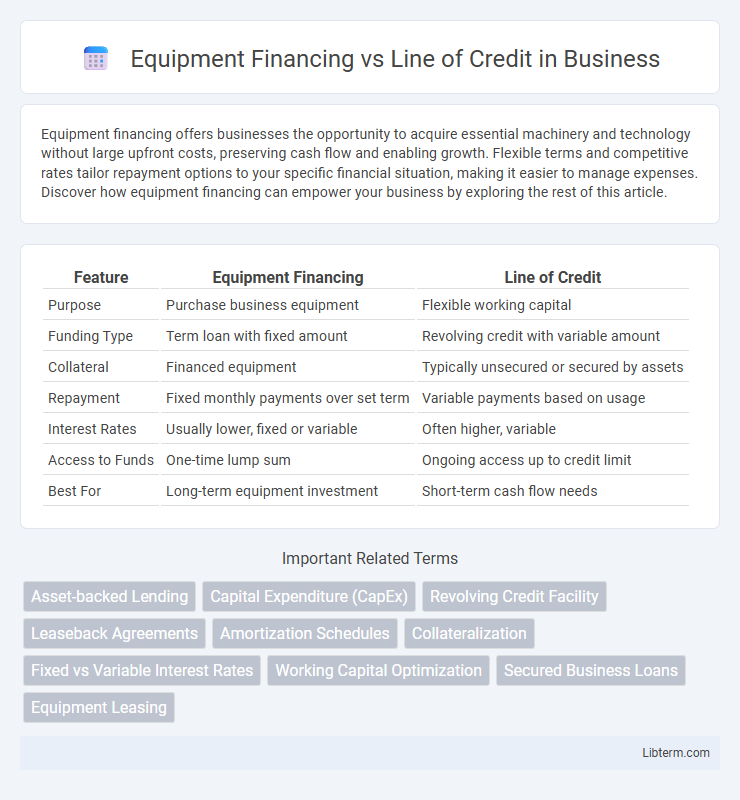

| Feature | Equipment Financing | Line of Credit |

|---|---|---|

| Purpose | Purchase business equipment | Flexible working capital |

| Funding Type | Term loan with fixed amount | Revolving credit with variable amount |

| Collateral | Financed equipment | Typically unsecured or secured by assets |

| Repayment | Fixed monthly payments over set term | Variable payments based on usage |

| Interest Rates | Usually lower, fixed or variable | Often higher, variable |

| Access to Funds | One-time lump sum | Ongoing access up to credit limit |

| Best For | Long-term equipment investment | Short-term cash flow needs |

Introduction to Equipment Financing and Lines of Credit

Equipment financing provides businesses with capital specifically designated for purchasing or leasing machinery, vehicles, or technology required for operations, typically secured by the equipment itself. Lines of credit offer flexible access to funds up to a predetermined limit, supporting cash flow management and short-term expenses without the need for collateral. Both financial tools serve distinct purposes: equipment financing targets asset acquisition, while lines of credit facilitate ongoing working capital needs.

Understanding Equipment Financing

Equipment financing provides businesses with capital specifically to purchase or lease machinery, allowing asset acquisition without large upfront costs. This funding option often features fixed interest rates and structured repayment schedules tied directly to the equipment's value and useful life. Understanding equipment financing helps companies optimize cash flow management by aligning loan terms with the lifespan and operational benefits of the purchased assets.

What is a Line of Credit?

A line of credit is a flexible financing option that allows businesses to access a predetermined amount of funds when needed, paying interest only on the amount used. Unlike equipment financing, which is specifically secured for purchasing machinery or tools, a line of credit provides broader access to capital for various operational expenses. This revolving credit structure supports cash flow management and short-term funding needs without asset-specific collateral.

Key Differences Between Equipment Financing and Lines of Credit

Equipment financing provides a lump sum loan specifically for purchasing machinery or equipment, typically with the equipment itself serving as collateral, while a line of credit offers flexible access to funds up to a preset limit for varied business expenses. Repayment terms for equipment financing are usually fixed, involving regular payments over a set period, whereas lines of credit require interest only on the amount borrowed and involve revolving credit usage. Equipment financing is ideal for long-term investments in physical assets, whereas lines of credit support short-term working capital needs or cash flow fluctuations.

Pros and Cons of Equipment Financing

Equipment financing offers the advantage of spreading the cost of essential machinery over time, preserving cash flow and enabling businesses to upgrade to the latest technology. However, it often requires collateral and may involve higher interest rates compared to other financing options, impacting overall cost-effectiveness. Unlike a line of credit, equipment financing typically restricts funds to specific purchases, limiting financial flexibility but providing a structured repayment schedule tied directly to the acquired asset.

Advantages and Disadvantages of Lines of Credit

Lines of credit offer flexible access to funds, enabling businesses to borrow only what they need and repay multiple times without reapplying, which supports cash flow management and operational expenses. However, interest is typically variable, potentially increasing costs unpredictably, and some lenders may impose maintenance fees or strict credit requirements, limiting accessibility for startups or companies with poor credit scores. Unlike equipment financing, which is tied to specific asset purchases with fixed terms, lines of credit provide broader financial freedom but may pose higher risk of debt misuse or fluctuating repayments.

Eligibility Requirements for Each Option

Equipment financing requires borrowers to demonstrate a strong credit score, stable business revenue, and sometimes collateral in the form of the equipment being financed, making it accessible primarily to businesses with proven financial stability. In contrast, lines of credit often have more flexible eligibility criteria, focusing on overall creditworthiness and cash flow, with some lenders offering unsecured lines to businesses with lower credit scores or less established financial histories. Understanding these distinctions helps businesses choose the best financing option based on their credit profile, revenue consistency, and asset availability.

Cost Comparison: Fees, Rates, and Repayment Terms

Equipment financing typically involves fixed interest rates and structured repayment terms, often including down payments and origination fees that can increase upfront costs. Lines of credit usually offer variable interest rates with flexible repayment schedules and lower initial fees, but the overall cost can fluctuate based on usage and credit utilization. Borrowers should evaluate the total cost of ownership, considering factors like interest rate stability, fee structures, and repayment flexibility to determine the most economical option.

When to Choose Equipment Financing vs Line of Credit

Equipment financing is ideal when purchasing specific assets, such as machinery or vehicles, where the equipment itself serves as collateral, offering fixed repayment terms that simplify budgeting. Lines of credit provide flexible access to funds for ongoing operational expenses or short-term cash flow needs, allowing businesses to borrow only what they need and pay interest solely on the drawn amount. Choose equipment financing for long-term investments in tangible assets and a predictable repayment schedule; opt for a line of credit when managing variable expenses or working capital fluctuations.

Conclusion: Making the Right Choice for Your Business

Choosing between equipment financing and a line of credit depends on your business's cash flow, creditworthiness, and long-term equipment needs. Equipment financing offers fixed payments and ownership benefits, ideal for specific asset purchases, while a line of credit provides flexible access to funds for various expenses. Evaluate your financial goals and repayment capacity to select the option that aligns with your operational strategy and growth plans.

Equipment Financing Infographic

libterm.com

libterm.com