Employee Stock Ownership Plans (ESOPs) provide a powerful tool for companies to align employee interests with corporate success through stock ownership. These plans can enhance employee motivation and retention by giving workers a stake in the company's future growth and profitability. Discover how ESOPs can impact your financial goals and company culture by exploring the rest of this article.

Table of Comparison

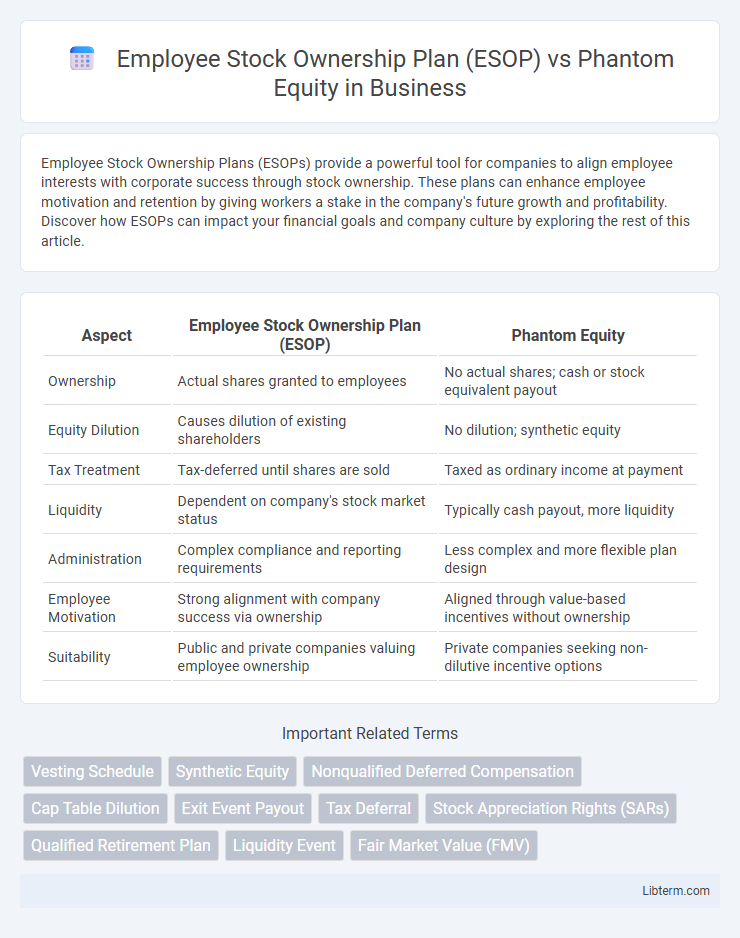

| Aspect | Employee Stock Ownership Plan (ESOP) | Phantom Equity |

|---|---|---|

| Ownership | Actual shares granted to employees | No actual shares; cash or stock equivalent payout |

| Equity Dilution | Causes dilution of existing shareholders | No dilution; synthetic equity |

| Tax Treatment | Tax-deferred until shares are sold | Taxed as ordinary income at payment |

| Liquidity | Dependent on company's stock market status | Typically cash payout, more liquidity |

| Administration | Complex compliance and reporting requirements | Less complex and more flexible plan design |

| Employee Motivation | Strong alignment with company success via ownership | Aligned through value-based incentives without ownership |

| Suitability | Public and private companies valuing employee ownership | Private companies seeking non-dilutive incentive options |

Introduction to Employee Stock Ownership Plan (ESOP) and Phantom Equity

Employee Stock Ownership Plans (ESOPs) are employee benefit plans that provide workers with ownership interest in the company through actual stock shares, fostering long-term investment and alignment with corporate performance. Phantom Equity offers a contractual right to receive cash or stock equivalent to company shares' value without granting actual ownership, enabling companies to incentivize employees without diluting equity. Both ESOPs and Phantom Equity serve as strategic tools for employee motivation and retention but differ fundamentally in terms of ownership transfer and financial implications.

Key Differences Between ESOP and Phantom Equity

Employee Stock Ownership Plans (ESOPs) grant actual shares of company stock to employees, creating legal ownership and potential voting rights, whereas Phantom Equity provides cash or stock bonuses tied to company valuation without transferring real shares. ESOPs involve regulatory complexities and tax advantages under the Employee Retirement Income Security Act (ERISA), while Phantom Equity offers more flexible, less regulated incentive structures to align employee interests with company performance. The liquidity event for ESOP participants often requires stock repurchase by the company, contrasting with Phantom Equity's cash settlement triggered by predefined conditions such as a sale or IPO.

How ESOPs Work: Structure and Implementation

Employee Stock Ownership Plans (ESOPs) function by allocating company stock to employees through a trust, creating vested ownership over time based on tenure or performance criteria. The company contributes shares or cash to the trust, which holds and manages these shares until employees become eligible to receive them, typically upon retirement, resignation, or termination. ESOP implementation involves establishing the trust, conducting a valuation of company shares, and designing vesting schedules to align employee incentives with long-term business growth.

Understanding Phantom Equity: Key Features and Mechanisms

Phantom Equity is a type of employee compensation that provides cash bonuses linked to the company's stock value without granting actual ownership or voting rights, offering a non-dilutive alternative to traditional stock options. Key features include cash payouts based on the appreciation of company shares, deferred vesting schedules, and alignment of employee incentives with company performance. Mechanisms involve tracking a hypothetical number of shares, calculating payouts upon triggering events such as liquidity events or retirement, and enabling companies to reward employees without issuing real equity.

Tax Implications: ESOP vs Phantom Equity

Employee Stock Ownership Plans (ESOPs) offer tax advantages such as tax-deductible contributions and tax-deferred growth for employees, with distributions typically taxed as ordinary income upon withdrawal. Phantom equity, however, does not involve actual stock transfer, so recipients are taxed at ordinary income rates when the cash or stock equivalent is paid out, without the benefit of deferral or capital gains treatment. Employers benefit from ESOP contributions being deductible, while phantom equity payouts are also deductible as compensation expenses, making tax treatment a key consideration in plan selection.

Benefits of ESOPs for Employers and Employees

Employee Stock Ownership Plans (ESOPs) offer employers significant tax advantages, enhance employee motivation, and improve retention by granting workers actual ownership stakes, aligning their interests with company performance. Employees benefit from real equity appreciation, dividend participation, and potential wealth accumulation upon retirement or company sale, fostering long-term financial security. Unlike Phantom Equity, which provides cash bonuses tied to company valuation without ownership rights, ESOPs cultivate a culture of shared success and accountability through genuine stock ownership.

Advantages and Disadvantages of Phantom Equity

Phantom Equity offers employees the financial benefits of stock ownership without diluting actual company shares, providing a flexible compensation tool especially useful for private companies. It avoids complex legal transfers and tax complications associated with Employee Stock Ownership Plans (ESOPs), but lacks voting rights and direct equity ownership, which may reduce employee engagement. The main disadvantages include potential cash flow challenges for the company when payouts are triggered and limited appeal to employees seeking long-term equity growth.

Suitability: Which Companies Should Consider ESOP or Phantom Equity?

Employee Stock Ownership Plans (ESOPs) are suitable for companies seeking to foster employee ownership and long-term commitment, particularly established firms with stable cash flow able to handle the administrative costs and regulatory requirements. Phantom equity is ideal for startups and private businesses wanting to offer equity-like incentives without diluting ownership or issuing shares, providing flexibility and simpler implementation. Firms evaluating these options should consider their growth stage, capital structure, and employee motivation goals to determine the most strategic choice.

Legal and Regulatory Considerations for Each Option

Employee Stock Ownership Plans (ESOPs) are subject to stringent ERISA regulations, requiring compliance with fiduciary duties, valuation standards, and reporting obligations under the Department of Labor and IRS guidelines. Phantom Equity plans, not involving actual stock issuance, avoid many SEC registration and ERISA constraints but must adhere to contract law and applicable tax regulations, ensuring clear terms to prevent legal disputes. Companies must evaluate regulatory frameworks, tax implications, and shareholder rights to determine the most compliant and strategic equity compensation structure.

Choosing the Right Equity Solution for Your Business

Choosing the right equity solution for your business depends on factors such as ownership goals, tax implications, and employee incentives. Employee Stock Ownership Plans (ESOPs) offer actual shares, enabling employees to build real equity and benefit from company growth, but require regulatory compliance and can be complex to administer. Phantom Equity provides stock-value appreciation without diluting ownership, offering flexibility and simpler implementation while delivering comparable employee motivation through cash or stock bonuses tied to company valuation.

Employee Stock Ownership Plan (ESOP) Infographic

libterm.com

libterm.com