First-party risk refers to the potential financial losses a business or individual may face due to events directly affecting their own operations or assets, such as natural disasters, theft, or equipment breakdowns. Understanding and managing these risks is crucial to safeguarding your financial stability and ensuring continuity. Discover more about how to identify and mitigate first-party risks effectively in the rest of this article.

Table of Comparison

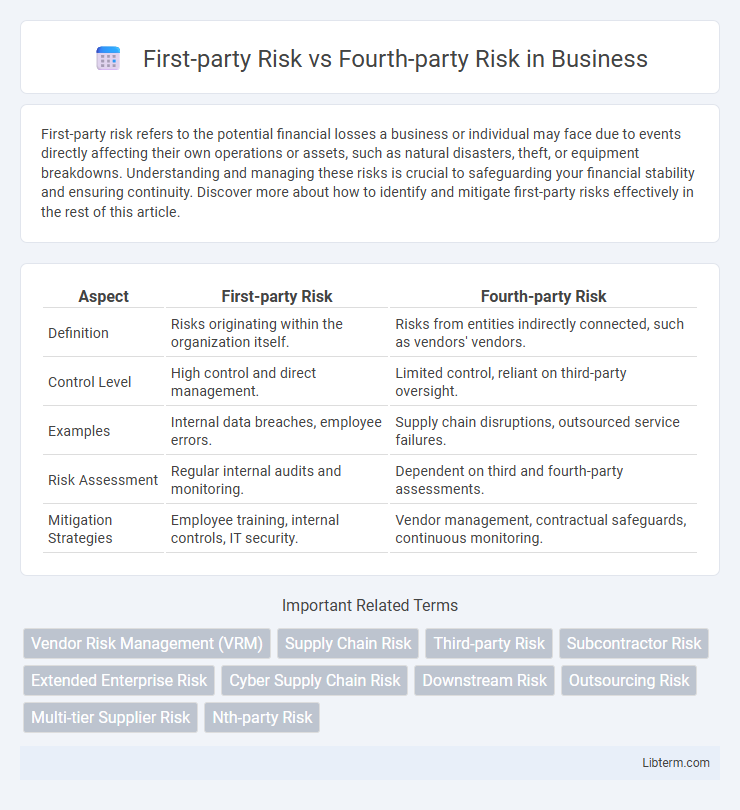

| Aspect | First-party Risk | Fourth-party Risk |

|---|---|---|

| Definition | Risks originating within the organization itself. | Risks from entities indirectly connected, such as vendors' vendors. |

| Control Level | High control and direct management. | Limited control, reliant on third-party oversight. |

| Examples | Internal data breaches, employee errors. | Supply chain disruptions, outsourced service failures. |

| Risk Assessment | Regular internal audits and monitoring. | Dependent on third and fourth-party assessments. |

| Mitigation Strategies | Employee training, internal controls, IT security. | Vendor management, contractual safeguards, continuous monitoring. |

Understanding Risk: First-party vs Fourth-party

First-party risk refers to the potential threats and vulnerabilities an organization faces directly from its own operations, assets, and internal processes. Fourth-party risk involves the indirect risks arising from the subcontractors or service providers that support an organization's third-party vendors. Understanding these distinctions is crucial for comprehensive risk management, as first-party risk focuses on internal controls while fourth-party risk requires assessing the extended vendor ecosystem beyond direct suppliers.

Definition of First-party Risk

First-party risk refers to the potential threats and vulnerabilities that directly impact an organization's own assets, operations, or reputation. It includes risks such as internal system failures, employee errors, and direct cyberattacks targeting the company's infrastructure. Understanding first-party risk is essential for developing robust internal controls and risk management strategies to protect organizational integrity.

Definition of Fourth-party Risk

Fourth-party risk refers to the potential vulnerabilities and threats that arise from the subcontractors or service providers engaged by an organization's direct third-party vendors. Unlike first-party risk, which involves internal risks within the organization itself, and third-party risk, related to direct vendors, fourth-party risk extends to the indirect relationships and dependencies, impacting cybersecurity, compliance, and operational continuity. Managing fourth-party risk requires comprehensive visibility into the extended supply chain, ensuring third-party vendors have robust controls over their own suppliers and partners.

Key Differences Between First-party and Fourth-party Risk

First-party risk involves direct risks an organization faces from its own operations or assets, such as internal cybersecurity threats or operational failures. Fourth-party risk arises from the extended supply chain, referring to the risks associated with subcontractors or service providers used by an organization's third-party vendors. Key differences include the scope of control, with first-party risk being within the organization's direct management, whereas fourth-party risk requires assessing and mitigating risks beyond immediate vendors, often involving less visibility and higher complexity.

Common Sources of First-party Risk

Common sources of first-party risk include internal system failures, employee errors, and cybersecurity breaches directly impacting the organization. These risks often arise from inadequate internal controls, outdated technology infrastructure, or insufficient employee training. Understanding these vulnerabilities helps companies implement targeted strategies to minimize operational disruptions and financial losses.

Common Sources of Fourth-party Risk

Common sources of fourth-party risk include subcontractors, software vendors, cloud service providers, and data center operators that your direct suppliers rely on to deliver services or products. These fourth parties may introduce vulnerabilities such as data breaches, compliance failures, or operational disruptions that indirectly impact your organization's security posture. Identifying and managing these risks is critical due to the extended supply chain's complexity and limited visibility into fourth-party security controls.

Impact of First-party Risk on Organizations

First-party risk directly affects an organization's internal operations by exposing it to potential losses from events such as data breaches, system failures, or employee misconduct. These risks can disrupt business continuity, damage reputation, and lead to significant financial penalties or regulatory sanctions. Effective risk management strategies are essential to mitigate first-party risk and ensure organizational resilience and compliance.

Impact of Fourth-party Risk on Organizations

Fourth-party risk significantly amplifies organizational vulnerabilities by extending the threat landscape beyond direct suppliers to their subcontractors and service providers, increasing exposure to cybersecurity breaches, compliance failures, and operational disruptions. Unmanaged fourth-party risks can lead to cascading supply chain failures, regulatory penalties, and reputational damage, as organizations often lack visibility and control over these indirect relationships. Effective risk management requires comprehensive third- and fourth-party risk assessments, continuous monitoring, and integration of supply chain data to mitigate potential cascading impacts on business continuity and regulatory compliance.

Strategies for Managing First-party and Fourth-party Risk

Implement robust due diligence and continuous monitoring systems to identify vulnerabilities in first-party risk and ensure reliable internal controls. For fourth-party risk, establish stringent vendor management protocols, including regular assessments and contractual obligations that enforce cybersecurity standards across the extended supply chain. Integrating automated risk management software enhances visibility and response capabilities for both first-party and fourth-party risks.

Future Trends in First-party and Fourth-party Risk Management

Future trends in first-party and fourth-party risk management emphasize increased adoption of AI-driven analytics to predict and mitigate risks proactively. Organizations are integrating blockchain technology to enhance transparency and traceability in supply chains, reducing fourth-party risk exposure. Enhanced regulatory frameworks and real-time monitoring tools are driving more comprehensive risk assessment and resilience strategies across all tiers of business relationships.

First-party Risk Infographic

libterm.com

libterm.com