A management fee is a charge levied by investment managers or asset management firms to oversee and operate your investments, typically expressed as a percentage of assets under management. This fee covers services such as portfolio management, research, and administrative expenses, impacting overall investment returns. Discover how understanding management fees can optimize your financial decisions by reading the full article.

Table of Comparison

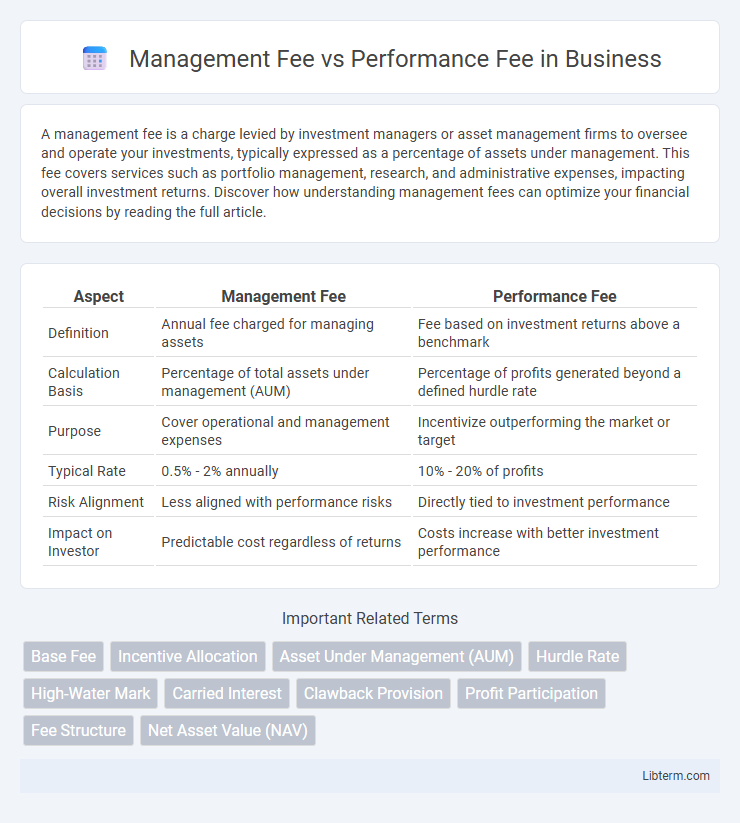

| Aspect | Management Fee | Performance Fee |

|---|---|---|

| Definition | Annual fee charged for managing assets | Fee based on investment returns above a benchmark |

| Calculation Basis | Percentage of total assets under management (AUM) | Percentage of profits generated beyond a defined hurdle rate |

| Purpose | Cover operational and management expenses | Incentivize outperforming the market or target |

| Typical Rate | 0.5% - 2% annually | 10% - 20% of profits |

| Risk Alignment | Less aligned with performance risks | Directly tied to investment performance |

| Impact on Investor | Predictable cost regardless of returns | Costs increase with better investment performance |

Understanding Management Fees

Management fees are fixed charges typically calculated as a percentage of assets under management (AUM), paid regularly to cover operational costs and ensure consistent service delivery. These fees usually range from 1% to 2% annually and remain constant regardless of investment performance. Understanding management fees is crucial for investors as they directly impact net returns and reflect the baseline cost of maintaining professional portfolio management.

What Are Performance Fees?

Performance fees are compensation structures where investment managers earn a percentage of the profits generated above a predetermined benchmark or hurdle rate. These fees align the interests of managers and investors by incentivizing managers to achieve higher returns, typically calculated as a share of the net gains. Performance fees are commonly used in hedge funds, private equity, and alternative investments to reward superior fund performance.

Key Differences Between Management and Performance Fees

Management fees are fixed charges, typically calculated as a percentage of assets under management (AUM), designed to cover operational costs regardless of fund performance. Performance fees are variable and based on the fund's returns exceeding a predetermined benchmark or hurdle rate, aligning manager incentives with investor gains. The key difference lies in risk-sharing: management fees provide steady income to managers, while performance fees reward successful investment outcomes.

Pros and Cons of Management Fees

Management fees provide stable income for fund managers, ensuring consistent operational support and financial planning regardless of fund performance. However, these fees may reduce overall returns for investors, especially during periods of poor performance, since they are charged regardless of profits. The predictability of management fees benefits fund administrators but can create misalignment between manager incentives and investor interests.

Advantages and Disadvantages of Performance Fees

Performance fees align the interests of fund managers and investors by rewarding managers only when they generate positive returns, motivating superior fund performance. These fees can lead to higher compensation for managers during profitable periods but may also encourage risk-taking behavior to achieve short-term gains. Conversely, performance fees can disadvantage investors by increasing overall costs and creating potential conflicts of interest if managers prioritize performance over long-term stability.

How Fee Structures Impact Investors

Management fees, typically a fixed percentage of assets under management, provide consistent revenue for fund managers but reduce investors' returns regardless of performance. Performance fees, charged as a percentage of the fund's profits, align manager incentives with investor gains but may encourage riskier investment strategies. Understanding these fee structures is crucial for investors to assess the potential impact on net returns and risk exposure over time.

Typical Fee Percentages in the Market

Management fees in investment funds typically range from 0.5% to 2% annually of assets under management, providing consistent revenue for fund managers regardless of fund performance. Performance fees generally amount to 20% of profits earned above a predefined benchmark or hurdle rate, aligning manager incentives with investor returns. Hedge funds and private equity firms often combine a 2% management fee with a 20% performance fee, known as the "2 and 20" structure, although mutual funds usually charge only management fees without performance fees.

Aligning Interests: Managers vs Investors

Management fees provide a steady income to fund managers regardless of investment outcomes, ensuring operational stability but potentially misaligning with investor returns. Performance fees directly link manager compensation to investment success, incentivizing higher returns but possibly encouraging riskier strategies. Aligning interests effectively requires structuring fees that balance consistent management with motivation for superior performance, fostering trust and mutual benefit between managers and investors.

Industry Trends in Fund Fee Models

Management fees typically range between 1% and 2% of assets under management, providing stable revenue streams for fund managers, while performance fees, often set at 20% of profits, align manager incentives with investor returns. Industry trends reveal a gradual shift towards fee structures emphasizing performance fees to attract investors seeking value-driven compensation models amid increased fee transparency and competition. Emerging models include tiered or hurdle-based performance fees, reflecting efforts to balance manager reward with investor protection in a competitive fund landscape.

Choosing the Best Fee Structure for Your Investment

Evaluating Management Fee versus Performance Fee is essential when selecting the optimal fee structure for your investment portfolio. Management Fees offer predictable, fixed costs regardless of fund performance, while Performance Fees align manager incentives with investment returns, applying only when specific benchmarks or profits are achieved. Balancing cost predictability and potential for enhanced manager motivation helps investors tailor fee arrangements to their risk tolerance and investment goals.

Management Fee Infographic

libterm.com

libterm.com