Currency swaps are financial agreements where two parties exchange principal and interest payments in different currencies, helping manage currency risk and secure favorable borrowing rates. These swaps enable businesses and investors to hedge against exchange rate fluctuations while optimizing their financing costs. Explore the rest of the article to understand how currency swaps can benefit your international financial strategies.

Table of Comparison

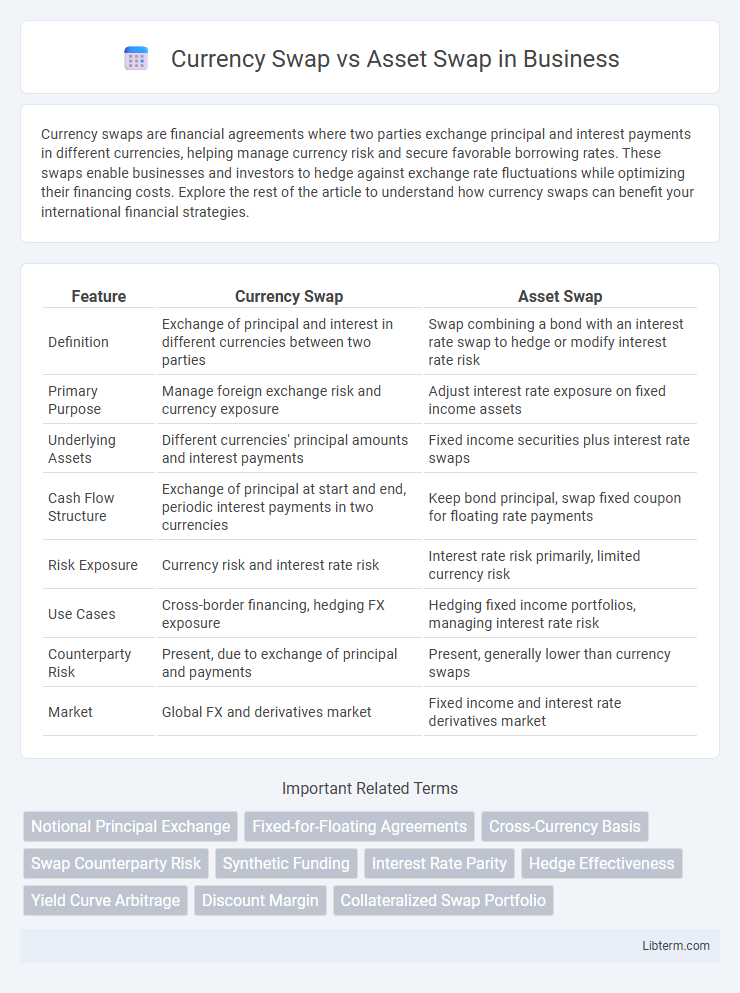

| Feature | Currency Swap | Asset Swap |

|---|---|---|

| Definition | Exchange of principal and interest in different currencies between two parties | Swap combining a bond with an interest rate swap to hedge or modify interest rate risk |

| Primary Purpose | Manage foreign exchange risk and currency exposure | Adjust interest rate exposure on fixed income assets |

| Underlying Assets | Different currencies' principal amounts and interest payments | Fixed income securities plus interest rate swaps |

| Cash Flow Structure | Exchange of principal at start and end, periodic interest payments in two currencies | Keep bond principal, swap fixed coupon for floating rate payments |

| Risk Exposure | Currency risk and interest rate risk | Interest rate risk primarily, limited currency risk |

| Use Cases | Cross-border financing, hedging FX exposure | Hedging fixed income portfolios, managing interest rate risk |

| Counterparty Risk | Present, due to exchange of principal and payments | Present, generally lower than currency swaps |

| Market | Global FX and derivatives market | Fixed income and interest rate derivatives market |

Introduction to Currency Swaps and Asset Swaps

Currency swaps involve exchanging principal and interest payments in different currencies to hedge exchange rate risk or access foreign capital markets, typically used by multinational corporations and governments. Asset swaps convert fixed-rate bonds into floating-rate instruments by combining a bond with an interest rate swap, allowing investors to manage interest rate exposure and enhance yield. Both instruments serve as vital tools in financial risk management and portfolio diversification strategies.

Key Definitions: Currency Swap vs Asset Swap

Currency swaps involve exchanging principal and interest payments in one currency for those in another currency, enabling parties to hedge foreign exchange risk or obtain cheaper debt financing. Asset swaps combine a bond with an interest rate swap, allowing the bondholder to convert fixed-rate payments into floating-rate payments or vice versa, enhancing flexibility in interest rate exposure. While currency swaps primarily address currency risk and cash flow management, asset swaps focus on adjusting interest rate risk profiles of existing debt instruments.

How Currency Swaps Work

Currency swaps involve the exchange of principal and interest payments in one currency for those in another currency, allowing two parties to access foreign currencies at more favorable terms than via direct borrowing. The process begins with an initial exchange of equivalent principal amounts at the prevailing spot rate, followed by periodic interest payments based on agreed rates for each currency. At maturity, the principal amounts are re-exchanged at the original spot rate, eliminating exchange rate risk for the parties involved.

How Asset Swaps Operate

Asset swaps operate by combining a fixed-income security with an interest rate swap to transform the bond's cash flows into floating-rate payments, allowing investors to manage interest rate risk effectively. They involve exchanging the fixed coupon payments of the underlying bond for floating-rate payments, typically linked to LIBOR or SOFR benchmarks. This structure enables investors to hedge interest rate exposure while maintaining the bond's credit risk profile.

Main Structural Differences

Currency swaps involve exchanging principal and interest payments in different currencies between parties, mitigating foreign exchange risk and managing exposure to currency fluctuations. Asset swaps combine a fixed-income security with an interest rate swap, converting fixed-rate coupon payments into floating rates without changing the currency of the underlying asset. The primary structural difference lies in currency risk management in currency swaps versus interest rate risk management in asset swaps.

Purposes and Use Cases

Currency swaps primarily facilitate the exchange of principal and interest payments in different currencies, enabling firms to hedge foreign exchange risk and access cheaper funding in foreign markets. Asset swaps transform fixed-rate bonds into floating-rate instruments by swapping fixed coupon payments for variable interest rates, allowing investors to manage interest rate exposure or capitalize on changing market conditions. Corporations and financial institutions use currency swaps for cross-border financing and balance sheet management, while asset swaps are favored by portfolio managers seeking customized cash flow structures or interest rate risk management.

Risk Factors: Currency vs Asset Swaps

Currency swaps primarily expose counterparties to foreign exchange risk due to fluctuating exchange rates between the swapped currencies, while asset swaps involve credit risk linked to the underlying asset's issuer and interest rate risk based on changes in benchmark rates. In currency swaps, mismatched valuation dates or sudden currency depreciation can significantly impact cash flows and valuations, whereas asset swaps are more sensitive to credit spreads widening and shifts in market interest rates affecting bond prices. Both swap types require careful risk management strategies to mitigate exposure, with currency swaps demanding hedges against forex volatility and asset swaps necessitating monitoring of issuer creditworthiness and interest rate movements.

Benefits and Drawbacks

Currency swaps provide firms with the advantage of hedging foreign exchange risk and accessing capital in different currencies at potentially lower interest rates, but they involve complexity, counterparty risk, and regulatory considerations. Asset swaps enhance yield by allowing investors to combine fixed-income securities with interest rate swaps, improving cash flow management and flexibility, though they expose parties to interest rate and credit risks. Both instruments offer tailored risk management solutions but require careful evaluation of market conditions and counterparty reliability.

Real-World Examples

Currency swaps involve exchanging principal and interest payments in different currencies, commonly used by multinational corporations like Toyota to hedge exposure between yen and dollar-denominated debt. Asset swaps transform a fixed-income asset into a synthetic floating-rate instrument, as seen in portfolios managed by investment firms like BlackRock to enhance returns or manage interest rate risks. Real-world applications of currency swaps demonstrate global funding optimization, while asset swaps provide flexibility in fixed-income investment strategies.

Choosing Between Currency Swap and Asset Swap

Choosing between a currency swap and an asset swap depends on the specific financial objectives and risk management needs of an institution. Currency swaps are optimal for hedging foreign exchange risk and managing currency exposure across different cash flows, while asset swaps prioritize modifying interest rate risk and enhancing yield by swapping fixed-rate assets for floating-rate liabilities or vice versa. Evaluating the underlying exposure, maturity, and cash flow structures helps determine whether a currency swap or asset swap aligns better with portfolio goals and financial strategies.

Currency Swap Infographic

libterm.com

libterm.com