Depletion refers to the gradual reduction of natural resources, commodities, or energy reserves due to continuous extraction or consumption. This process impacts environmental sustainability and economic stability by diminishing the availability of essential materials. Discover how depletion affects your environment and economy by reading the rest of the article.

Table of Comparison

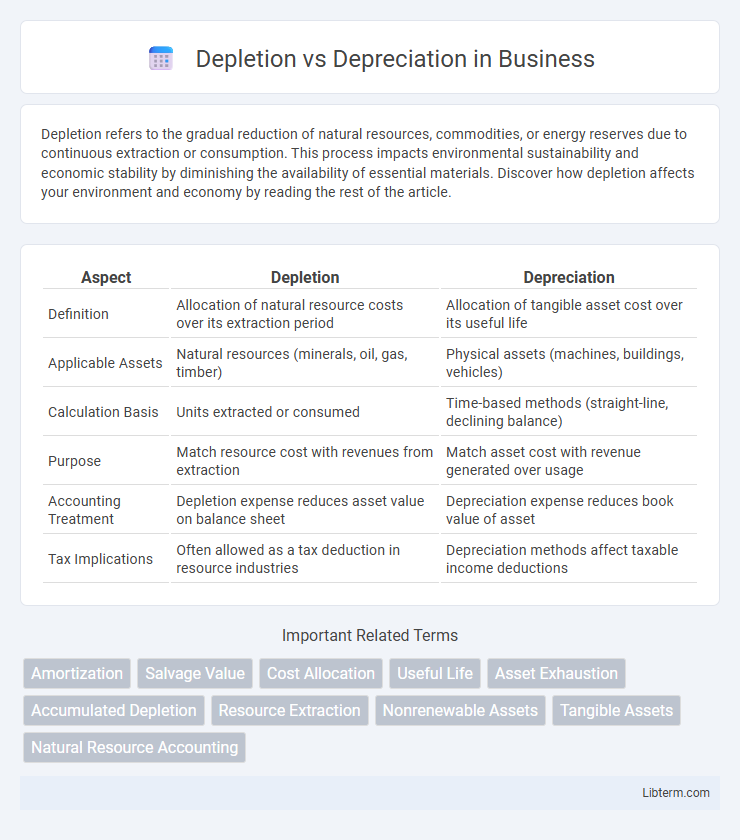

| Aspect | Depletion | Depreciation |

|---|---|---|

| Definition | Allocation of natural resource costs over its extraction period | Allocation of tangible asset cost over its useful life |

| Applicable Assets | Natural resources (minerals, oil, gas, timber) | Physical assets (machines, buildings, vehicles) |

| Calculation Basis | Units extracted or consumed | Time-based methods (straight-line, declining balance) |

| Purpose | Match resource cost with revenues from extraction | Match asset cost with revenue generated over usage |

| Accounting Treatment | Depletion expense reduces asset value on balance sheet | Depreciation expense reduces book value of asset |

| Tax Implications | Often allowed as a tax deduction in resource industries | Depreciation methods affect taxable income deductions |

Understanding Depletion and Depreciation

Depletion refers to the allocation of the cost of natural resources, such as minerals, oil, and timber, over the period they are extracted or consumed. Depreciation involves the systematic allocation of the cost of tangible fixed assets, like machinery, buildings, and vehicles, over their useful life. Both methods help businesses match expenses with revenues, but depletion specifically applies to resource extraction, while depreciation applies to wear-and-tear of physical assets.

Key Differences Between Depletion and Depreciation

Depletion refers to the allocation of the cost of natural resources, such as minerals, oil, and timber, over their extraction period, while depreciation involves spreading the cost of tangible fixed assets like machinery and buildings over their useful lifespan. Depletion is calculated based on units extracted or produced, making it variable with production levels, whereas depreciation is typically computed using time-based methods like straight-line or declining balance. Key differences also include their accounting treatment under tax regulations and the nature of assets involved--natural resources for depletion versus physical plant assets for depreciation.

Types of Assets Subject to Depletion and Depreciation

Depletion applies primarily to natural resources such as oil, minerals, timber, and coal, where the asset's value decreases as the resource is extracted. Depreciation concerns tangible fixed assets like machinery, buildings, vehicles, and equipment, reflecting the wear and tear or obsolescence over time. Both methods allocate the cost of the asset over its useful life but are tailored to specific asset categories for accurate financial reporting.

Accounting Methods for Depletion

Accounting methods for depletion primarily include the cost depletion and percentage depletion methods. Cost depletion allocates the cost of natural resources based on the units extracted relative to the total estimated recoverable units, providing a precise matching of expense to resource use. Percentage depletion allows a fixed percentage of gross income from resource extraction, often used for tax purposes, and may exceed the asset's original cost.

Accounting Methods for Depreciation

Accounting methods for depreciation include straight-line, declining balance, and units of production, each allocating cost differently over an asset's useful life. The straight-line method spreads the cost evenly, while declining balance accelerates expense recognition in earlier years. Units of production ties expense to asset usage, providing a flexible approach aligned with operational activity.

Impact on Financial Statements

Depletion directly reduces the mineral resource asset's book value on the balance sheet and is recorded as an expense on the income statement, impacting net income. Depreciation systematically allocates the cost of tangible fixed assets like machinery over their useful life, similarly reducing asset value and affecting profit margins. Both depletion and depreciation influence cash flow indirectly by affecting taxable income and reported earnings.

Tax Implications of Depletion and Depreciation

Tax implications of depletion allow businesses to deduct the reduction of natural resource reserves, typically calculated using cost or percentage methods, thereby reducing taxable income for industries like mining and oil extraction. Depreciation tax rules enable companies to allocate the cost of tangible fixed assets over their useful lives, utilizing methods such as straight-line or accelerated depreciation to optimize tax benefits. Both depletion and depreciation deductions lower taxable income but apply to different asset types, with specific IRS guidelines governing their calculation and reporting.

Factors Influencing Depletion and Depreciation Rates

Depletion rates are primarily influenced by the quantity and quality of natural resources, extraction methods, and market demand fluctuations, while depreciation rates depend on the asset's useful life, usage intensity, and technological obsolescence. Geological conditions and regulatory changes affect depletion costs, whereas wear and tear, maintenance frequency, and economic factors shape depreciation schedules. Accurate estimation of these factors ensures precise accounting and resource valuation in industries like mining and manufacturing.

Common Errors in Calculation and Reporting

Common errors in calculating depletion include incorrect estimation of the total resource quantity, leading to inaccurate depletion expense allocation, and failure to update the resource base after extraction adjustments. Depreciation mistakes often involve using the wrong depreciation method, such as straight-line instead of declining balance, and neglecting to account for asset improvements or changes in useful life. Misreporting depletion and depreciation expenses on financial statements can distort asset values and profit margins, resulting in compliance issues and misinformed decision-making.

Best Practices for Managing Asset Depletion and Depreciation

Effective management of asset depletion and depreciation involves accurate tracking of resource usage and implementing systematic cost allocation methods that reflect an asset's consumption over time. Best practices include routinely assessing asset lifespan, regularly updating depletion rates based on production output, and applying consistent depreciation methods such as straight-line or declining balance in compliance with accounting standards like GAAP or IFRS. Leveraging specialized software and maintaining detailed records ensures precise financial reporting, enhances asset valuation accuracy, and supports informed decision-making for capital expenditures.

Depletion Infographic

libterm.com

libterm.com